The EURUSD pair fell to 1.1615. The US government shutdown leaves little room for optimism. Find out more in our analysis for 8 October 2025.

EURUSD forecast: key trading points

- The EURUSD pair is falling rapidly under pressure from US news

- The market expects the Federal Reserve to cut interest rates by 25 basis points at the October meeting

- EURUSD forecast for 8 October 2025: 1.1580

Fundamental analysis

The EURUSD rate plunged to 1.1615 on Wednesday as the market grew increasingly concerned about the economic consequences of the ongoing US government shutdown. Federal agencies have now been closed for the second week, with no visible signs of a resolution between political parties. This uncertainty delays the release of key macroeconomic data and adds to pressure on policymakers to reach a compromise.

From a monetary policy perspective, market participants are almost fully pricing in a 25-basis-point Fed rate cut in October, with another expected in December. Investors are awaiting the release of the FOMC minutes and upcoming Fed speakers, including Jerome Powell, for further guidance on policy direction.

The US dollar showed the strongest gains against the New Zealand dollar after the RBNZ unexpectedly lowered its rate by 50 basis points, and it also strengthened against major currencies amid political uncertainty in France and Japan.

The EURUSD forecast is negative.

EURUSD technical analysis

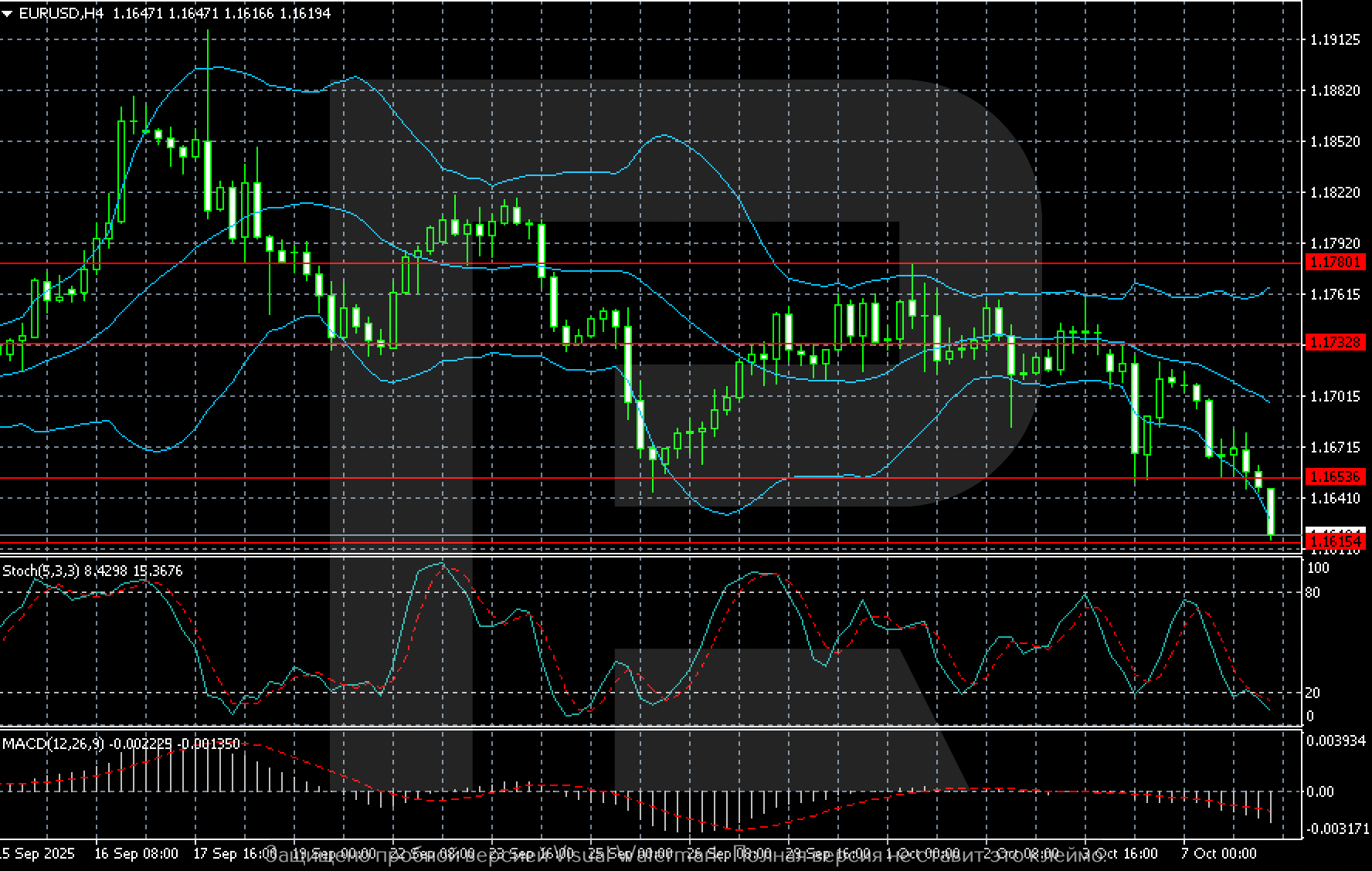

On the H4 chart, the EURUSD pair continues to decline, reaching a new local low near 1.1615. The movement has been bearish since the start of the week, with downward pressure on the euro intensifying after breaking below the 1.1653 support level.

The price firmly consolidated below the middle Bollinger Band, reflecting continued downward momentum. The widening of the indicator’s channels signals rising volatility and the strength of the current trend.

The Stochastic (5,3,3) is in oversold territory near 15, suggesting the possibility of a short-term technical rebound. However, MACD remains in negative territory, with its histogram still declining – confirming bearish dominance.

Key support levels are located at 1.1615 and 1.1580, while resistance levels lie at 1.1653 and 1.1732. Consolidation below 1.1650 maintains downside potential towards 1.1570–1.1500, while a return above 1.1650 could trigger a corrective rebound towards 1.1730–1.1780.

The overall technical picture remains bearish.

Summary

The EURUSD pair is sliding lower on Wednesday, although technical signals suggest the sell-off may pause soon. The EURUSD forecast for today, 8 October 2025, does not rule out a move towards 1.1580.

Open Account