The EURUSD pair plunged to 1.1100 following the US-China agreement on reducing reciprocal tariffs. Today's spotlight is on the US inflation report. Find more details in our analysis for 13 May 2025.

EURUSD forecast: key trading points

- Market focus: today’s highlight is the US April inflation statistics, with the Consumer Price Index (CPI) scheduled for release

- Current trend: a downtrend prevails

- EURUSD forecast for 13 May 2025: 1.1200 and 1.1000

Fundamental analysis

The EURUSD pair continues to decline as the US dollar gains strength amid optimism over a de-escalation in the US-China trade dispute. The two countries agreed to a 90-day reduction in tariffs after talks in Geneva, signalling a meaningful thaw in trade tensions that had intensified last month.

Today, all eyes are on the US CPI data for April. The consensus forecasts suggest an increase of 0.3% month-on-month and 2.4% year-on-year. Any substantial deviation from these expectations could fuel heightened volatility in the EURUSD pair.

EURUSD technical analysis

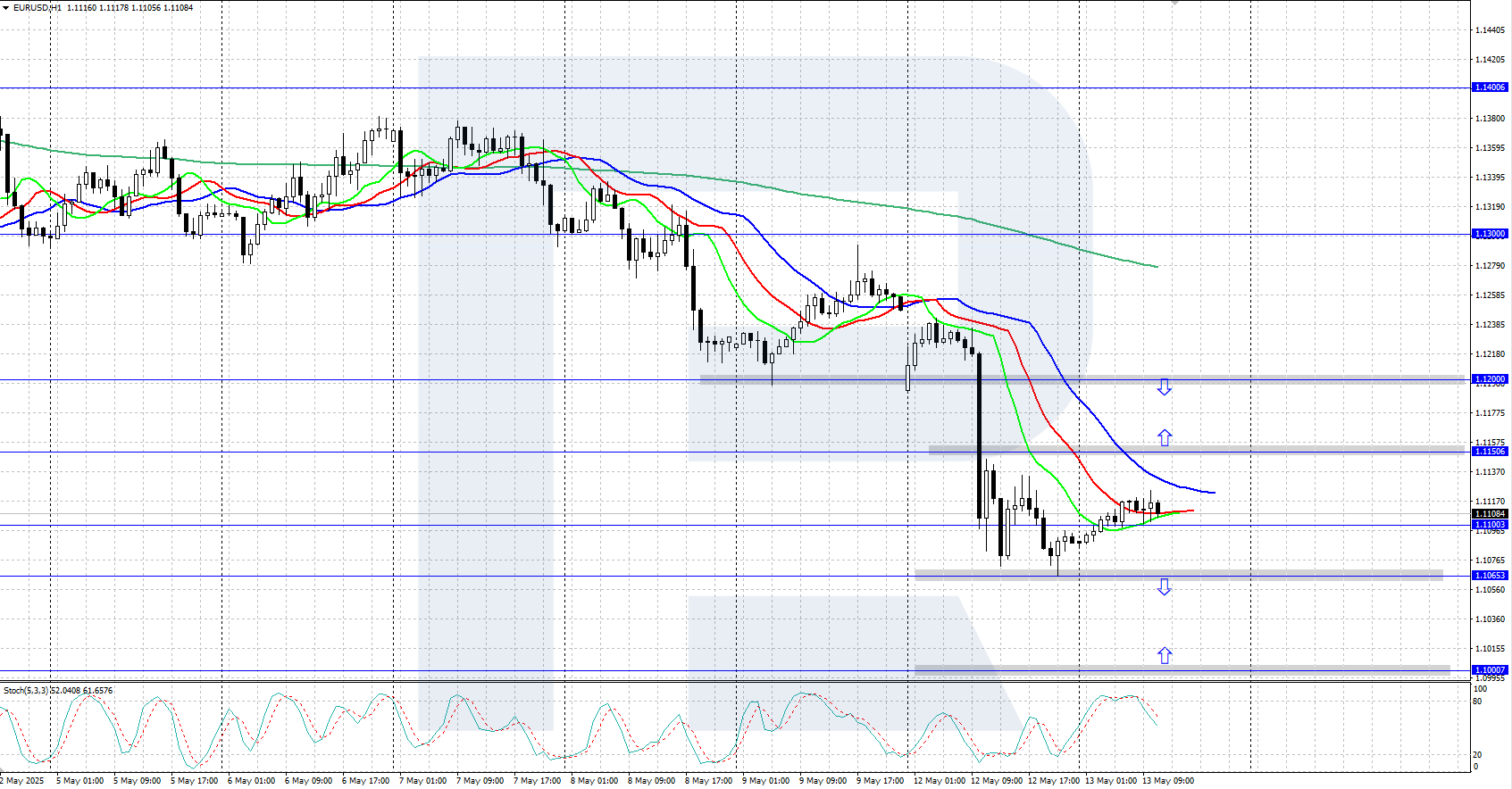

On the H4 chart, the EURUSD pair remains in a downtrend, falling to the 1.1100 area. The Alligator indicator confirms the bearish impulse, moving lower. The local support level is at 1.1065.

The short-term EURUSD forecast suggests a correction towards 1.1200 in the near term if bulls hold the price above 1.1065. Conversely, if bears push the price below 1.1065, a downward movement may continue towards the 1.1000 support level.

Summary

The EURUSD pair has dropped to the 1.1100 area amid improved US-China trade relations. Today, the market will focus on the US inflation statistics.