The US government shutdown remains the main source of uncertainty in the currency market and may become the longest in history. The economic consequences will become especially apparent this week as federal civil servants, for the first time, will not receive their full wages. Meanwhile, federal agencies continue to operate in a limited capacity, with key macroeconomic data releases, including the jobs report, being postponed. This deprives the market of guidance and increases volatility, reducing demand for the dollar as a safe-haven asset.

For the EURUSD pair, the key factor becomes the combination of political pressure in the US and euro weakness amid uncertainty in the eurozone. At the same time, the euro is making continued attempts to regain lost ground.

This report examines how the shutdown and expectations surrounding Federal Reserve decisions may influence EURUSD performance from 27 to 31 October.

EURUSD forecast for this week: quick overview

- Market focus: the market remains under pressure from the US government shutdown as negotiations between Democrats and Republicans over government funding once again failed to reach a consensus

- Current trend: the EURUSD pair is trading around 1.1600, pressured by political uncertainty in both Europe and the US. Recovery attempts are limited by US economic data. The technical picture indicates continued strengthening of the euro towards 1.1700

- Outlook for 27 – 31 October: the baseline scenario suggests a rise towards 1.1700 with intermittent corrections. A breakout above 1.1700 will increase pressure on the euro, opening the way to 1.1850–1.1900

EURUSD fundamental analysis

The euro suffered last week. However, the potential for EURUSD growth remains, with continued ambiguity in US fiscal policy as a trigger.

The US government shutdown continues. It has paused the release of key macroeconomic statistics, including the jobs report, and has heightened market uncertainty. The likelihood of a Federal Reserve rate cut at the 29 October meeting is estimated at 97%, and the market is also partially pricing in another cut in December.

The euro is supported by moderately positive data from the eurozone, such as slowing inflation, rising Consumer Price Index, and stabilising industrial production. However, political instability in the eurozone continues to impact the euro.

EURUSD technical analysis

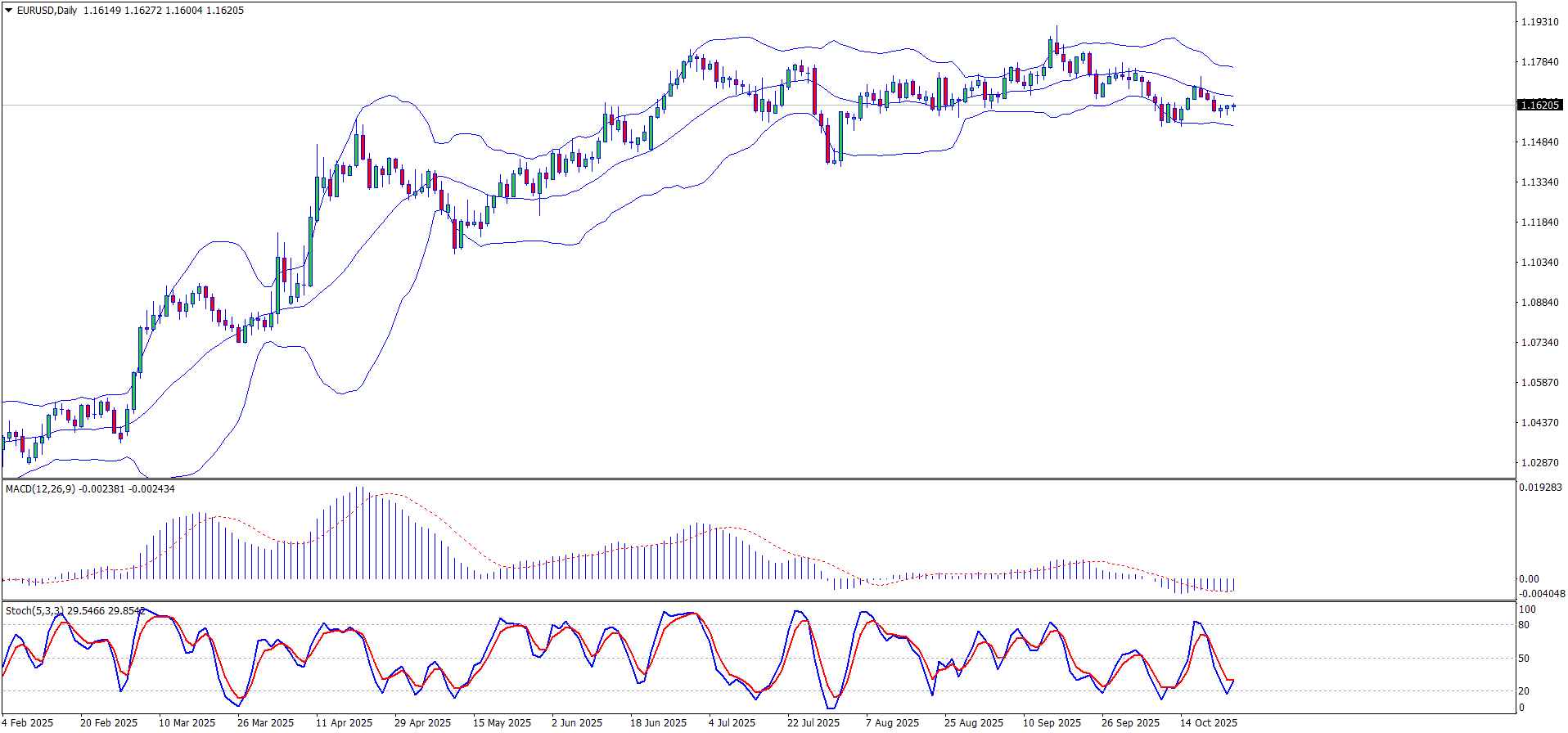

On the daily timeframe, the EURUSD pair is consolidating near 1.1610 after falling from 1.1700. The price action signals an attempt to recover after the decline, while the overall technical picture remains bullish.

The key resistance level lies at 1.1700, where the first significant pullback by buyers may occur. The next resistance level is at 1.1860. A consolidation above this level will trigger further growth.

The Stochastic Oscillator is moving towards oversold territory, signalling the likelihood of a new upward wave after the pullback, although without confirmation from volumes. MACD is also forming an upward wave towards the zero line, suggesting strengthening momentum.

The price is heading towards the middle Bollinger Band, which could serve as an additional signal for growth. Overall, the pair has a solid chance of continuing its uptrend.

EURUSD trading scenarios

The EURUSD pair is consolidating near 1.1600 after retreating from 1.1700. It remains under pressure from political uncertainty in the US and the eurozone. MACD is moving towards the zero line, the Stochastic Oscillator is in oversold territory, and the price is heading towards the middle Bollinger Band, all pointing to potential continued growth.

The US government shutdown increases uncertainty but maintains demand for the dollar as a safe-haven asset. Political instability in the eurozone also limits the euro’s potential.

Long positions are possible if the price holds above 1.1700.

Targets: 1.1800–1.1850

Stop-loss: below 1.1560

Short positions are relevant if the price breaks below 1.1555.

Targets: 1.1440 and 1.1388

Stop-loss: above 1.1600

Conclusion: the baseline scenario suggests consolidation in the 1.1700 area with potential for growth, pending the Fed decision.

Summary

Overall sentiment on the EURUSD pair is moderate. The main source of uncertainty is the US government shutdown. Congress once again failed to reach a compromise, and key macroeconomic data releases remain suspended, putting continued pressure on the USD and allowing the euro to recover.

From a technical perspective, the pair is consolidating around 1.1600, maintaining the potential to rise to 1.1800–1.1850, and in the event of a breakout, to 1.1915. However, fundamental factors appear to be restraining. In the baseline scenario for the week of 27–31 October, the pair will likely consolidate above 1.1700, maintaining upside potential.

Open Account