Gold (XAUUSD) prices have entered a sideways trend and are hovering around the 4,000 USD mark. Find more details in our analysis for 7 November 2025.

XAUUSD forecast: key trading points

- Investors await the Fed’s decision

- Current trend: moving upwards

- XAUUSD forecast for 7 November 2025: 3,950 or 4,050

Fundamental analysis

The XAUUSD price forecast for today shows that gold prices declined to 4,381 USD, with quotes currently forming an upward wave and trading near the 4,000 USD per ounce level.

The XAUUSD outlook for 7 November 2025 takes into account the following potential triggers for reduced volatility:

- Strengthening of the USD and lower demand for gold as a safe-haven asset

- Expectations surrounding the Fed’s interest rate decision

- Easing geopolitical tensions worldwide

- The ongoing US government shutdown, which delays the release of key economic indicators

In summary, the fundamental conditions for gold remain relatively favourable, but current market sentiment reflects a balance between demand for safe-haven assets and growing competition from the dollar and risk assets.

XAUUSD technical analysis

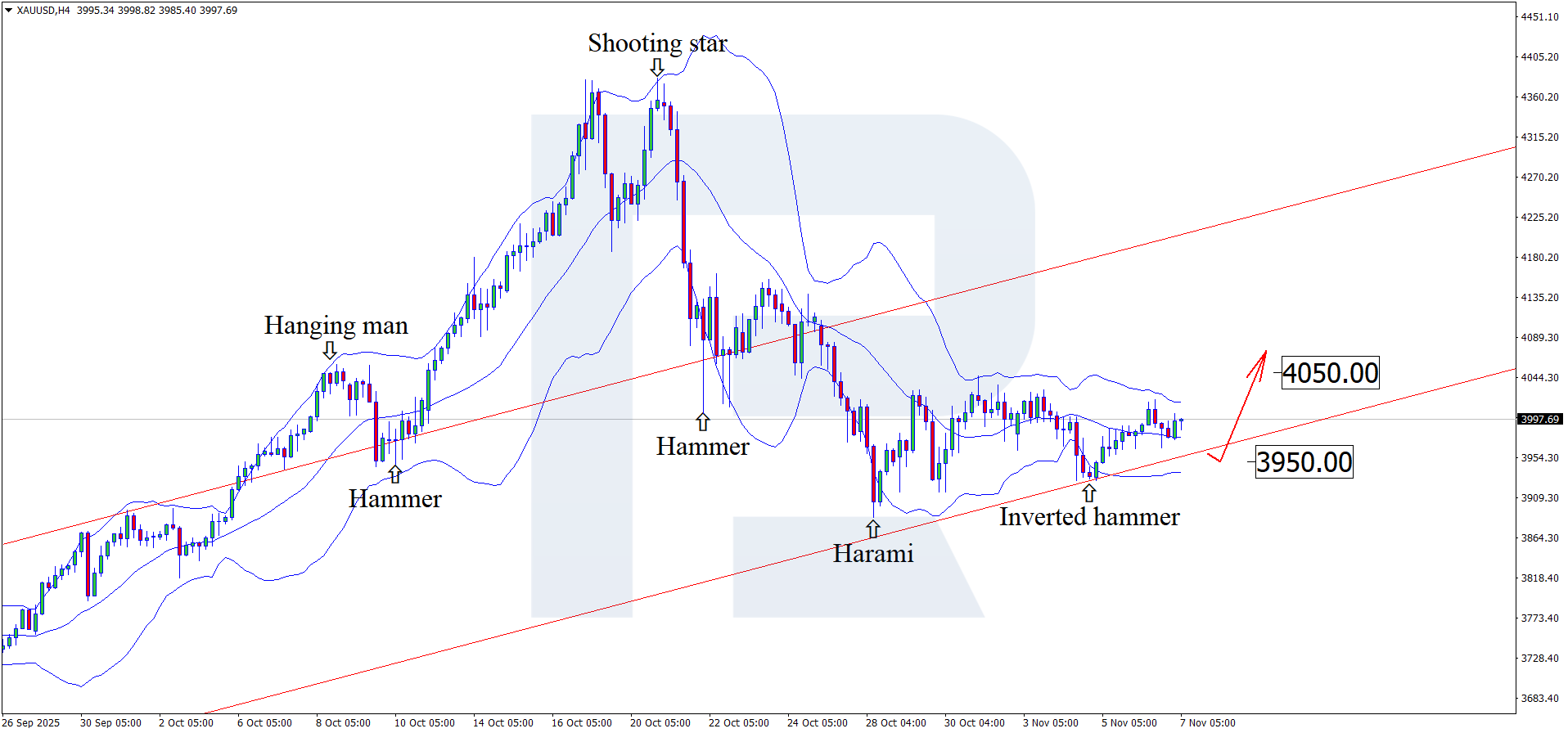

On the H4 chart, XAUUSD prices formed an Inverted Hammer reversal pattern near the lower Bollinger Band. Quotes are now forming an upward wave following the signal from the pattern. Given that XAUUSD remains within an upward channel, the upside target may be 4,050 USD.

At the same time, the XAUUSD technical analysis for today suggests an alternative scenario, where prices correct towards 3,950 USD before resuming the upward movement.

The potential for continued upward momentum remains, and XAUUSD quotes may head towards the next psychological level of 4,350 USD in the near term.

Summary

Amid the ongoing US government shutdown, gold (XAUUSD) is regaining ground. Technical analysis suggests a possible upward wave towards 4,050 USD.

Open Account