Ahead of the Federal Reserve’s rate decision, the EURUSD pair may form a correction and test the 1.1825 level before resuming its rise. Discover more in our analysis for 17 September 2025.

EURUSD forecast: key trading points

- The Fed's interest rate decision

- The rate is expected to be cut to 4.00 – 4.25%

- EURUSD forecast for 17 September 2025: 1.1920 and 1.1825

Fundamental analysis

The outlook for 17 September 2025 looks unfavourable for the USD as markets await today’s Fed policy decision. Analysts and financial markets broadly expect the Federal Reserve to lower the federal funds rate to 4.00–4.25%. This would be the first rate cut of 2025 after a long pause.

Drivers for the cut include labour market weakness and sluggish job creation, alongside moderate but still above-target inflation. Despite periodic upticks in price growth, the Federal Reserve appears willing to ease monetary policy, especially if wage growth and domestic pressures subside.

In addition to the rate move itself, markets will closely watch:

- The Fed’s updated forecasts signalling possible next steps for interest rates

- Press conference comments by Jerome Powell (or other FOMC members) – tone, emphasis on inflation risks, and economic outlook

- Supporting economic data – employment, retail sales, inflation figures cited as justification or warning signs

The EURUSD outlook depends on Fed officials’ tone and the pending interest rate decision. A cautious message would reinforce expectations of continued easing. But if inflation concerns or hawkish warnings dominate, volatility could spike, and the rate may remain unchanged with a tighter credit policy.

EURUSD technical analysis

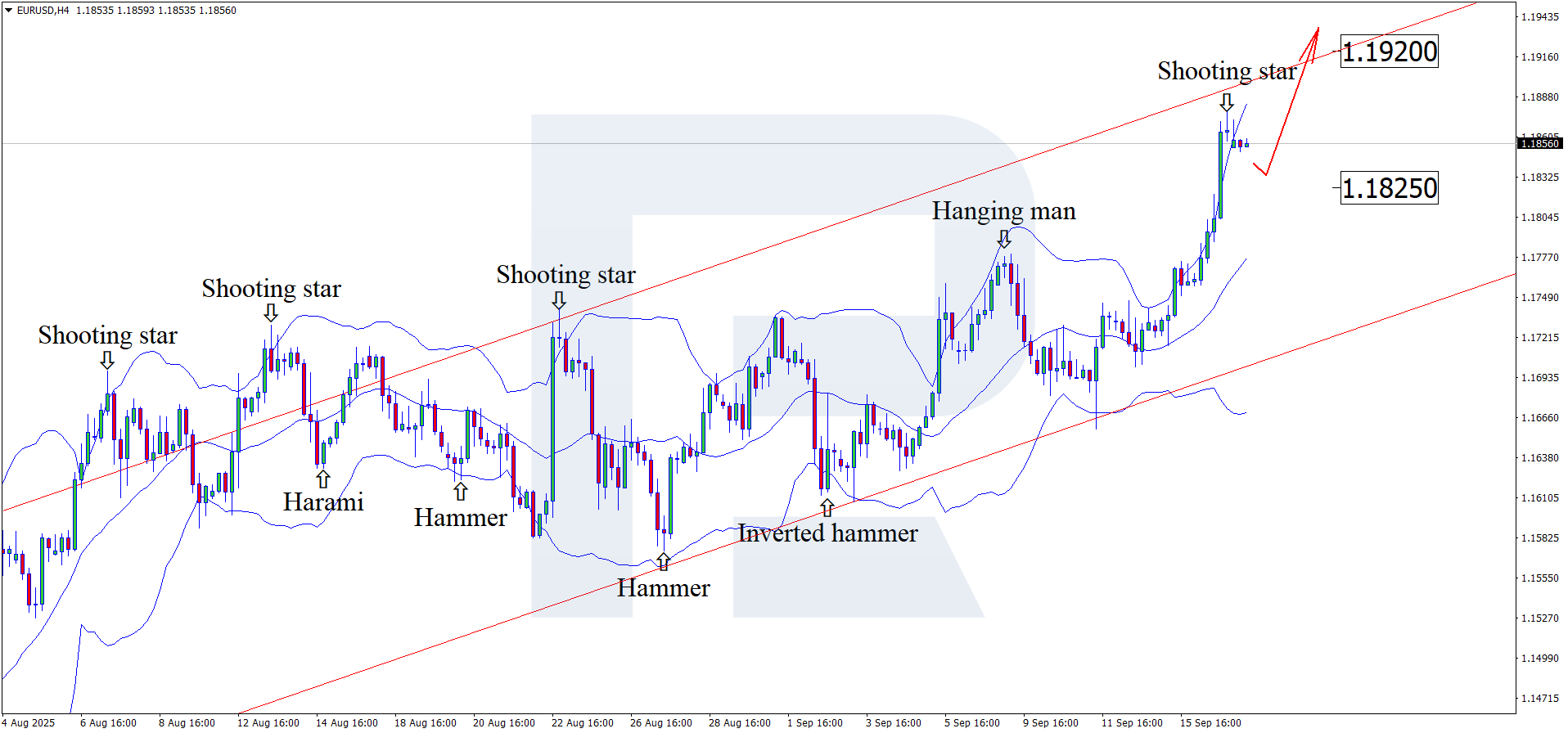

On the H4 chart, the EURUSD pair formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair continues to develop a downward wave in line with that signal. Since the price remains within an ascending channel, there is still room for a pullback to the 1.1825 support level. A rebound from that level would open the path for further upside.

At the same time, the EURUSD rate could climb to 1.1920 without testing the support level.

Summary

Today’s EURUSD forecast favours the euro, as the Federal Reserve’s rate decision is likely to weaken the USD. However, technical analysis suggests a correction towards 1.1825 before the bullish trend resumes.

Open Account