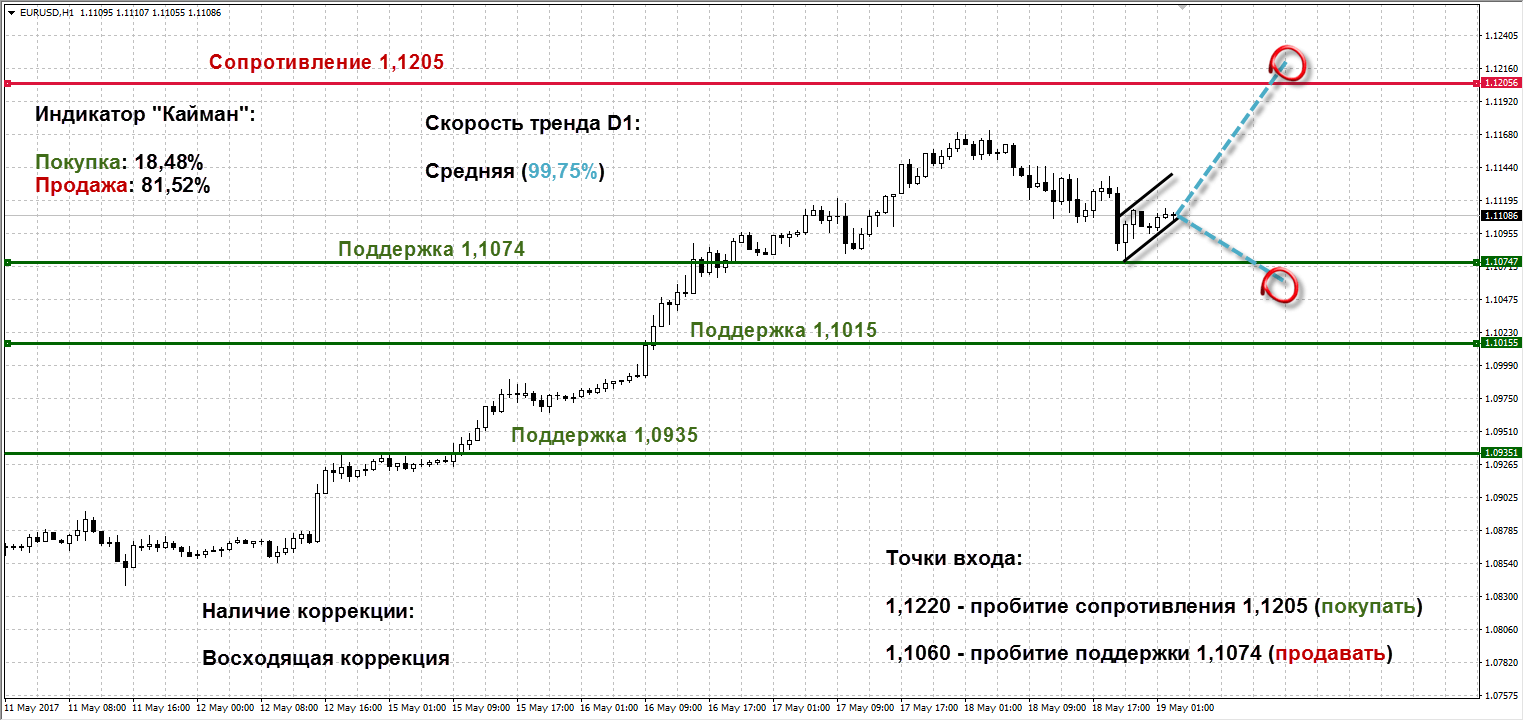

Technical analyst and EURUSD Forecast : Euro tries to continue its growth against the US dollar. Bears were not able to successfully test the next support level of 1.1074, however, if they succeed, we recommend to sell the euro at the level of 1.1060. Most market participants continue to hold short positions and wait for the downward dynamics of the asset (81.52% and 18.48% selling buying). Momentum characterizes the average velocity inside the trend of the day (99.75%). Stochastic line is close to the border zone perekuplennosti (78.51%) and MACD indicator below zero when growing down bars that gives a signal to sell. Bollinger bands forming a slight narrowing channel volatility. If prices continue to rise, the recombination enduem buy euros at the level of 1.1220 after breaking through the 1.1205 resistance.

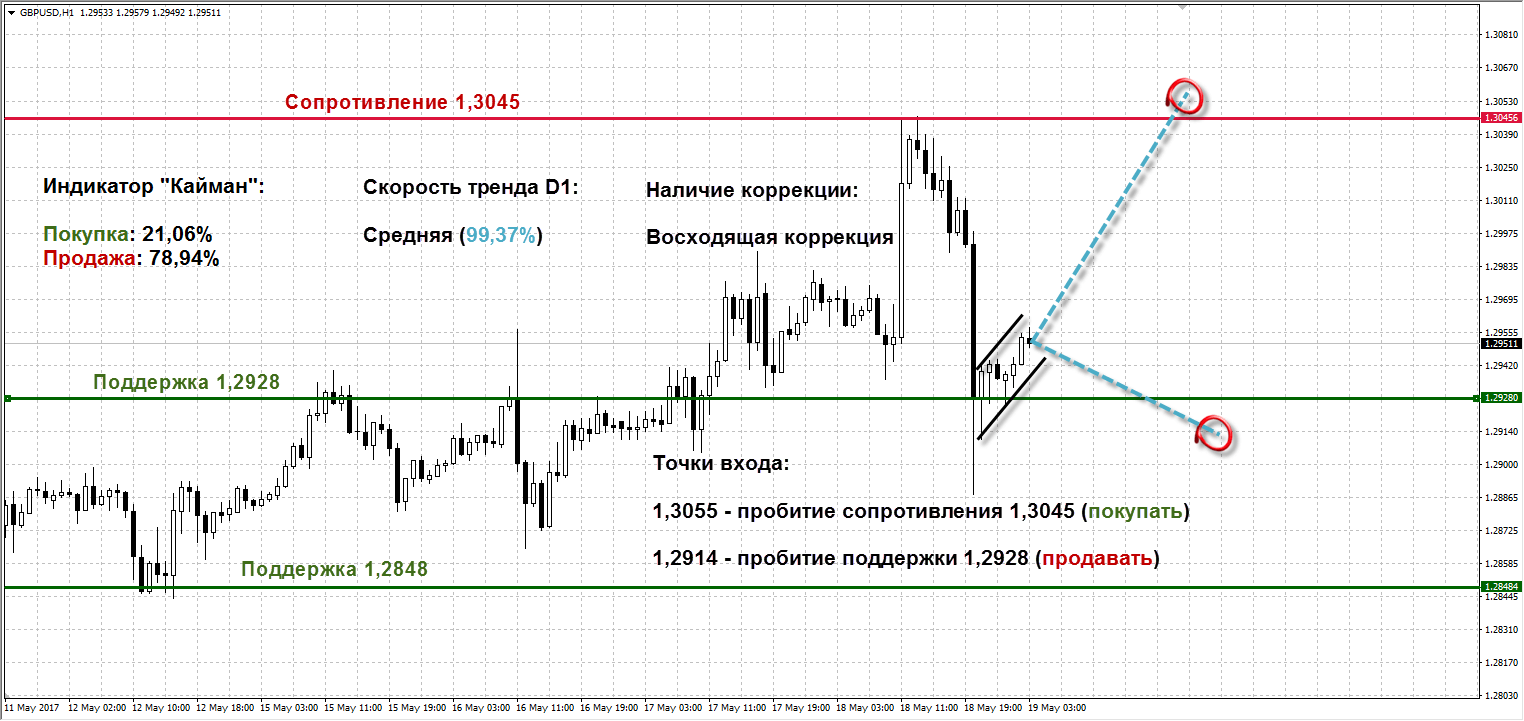

Technical analyst and forecast GBPUSD : British Pound positively adjusted to the US dollar. The sharp rise and fall of the price of the currency pair set new local levels. Most traders continue to hold short positions and wait for the downward dynamics of the asset (78.94% and 21.06% selling buying). Momentum characterizes the average velocity inside the trend of the day (99.37%). Line Stochastic abroad overbought (87.50%) and MACD indicator during zero crossing downwards when growing down bars that gives a signal to sell. Bollinger bands form a channel expansion volatility. In the case of falling prices, we recommend selling the Briton with a mark of 1.2914 after breaking through support near 1.2928, while the opposite scenario - to buy from the level 1.3055 after breaking through the 1.3045 resistance.

Technical analyst and USDJPY Forecast: US dollar negatively adjusted to the Japanese currency. Most investors buy American and await its upward trend (62.02% and 37.98% buy sell). Momentum characterizes high speed inside the trend of the day (100.86%). Stochastics line is directed to the border oversold zone (36.02%), and the MACD indicator may soon cross the zero point from the bottom up, that when growing up bars, will give a buy signal. Bollinger bands form a channel expansion volatility. If the currency pair price begins to grow, it is recommended to buy the US dollar with a mark of 112.60 after breaking through the 112.46 resistance next. If the quotes begin to decline, then we can try to open short positions at the level of 110.20 after breaking through the 110.30 support.

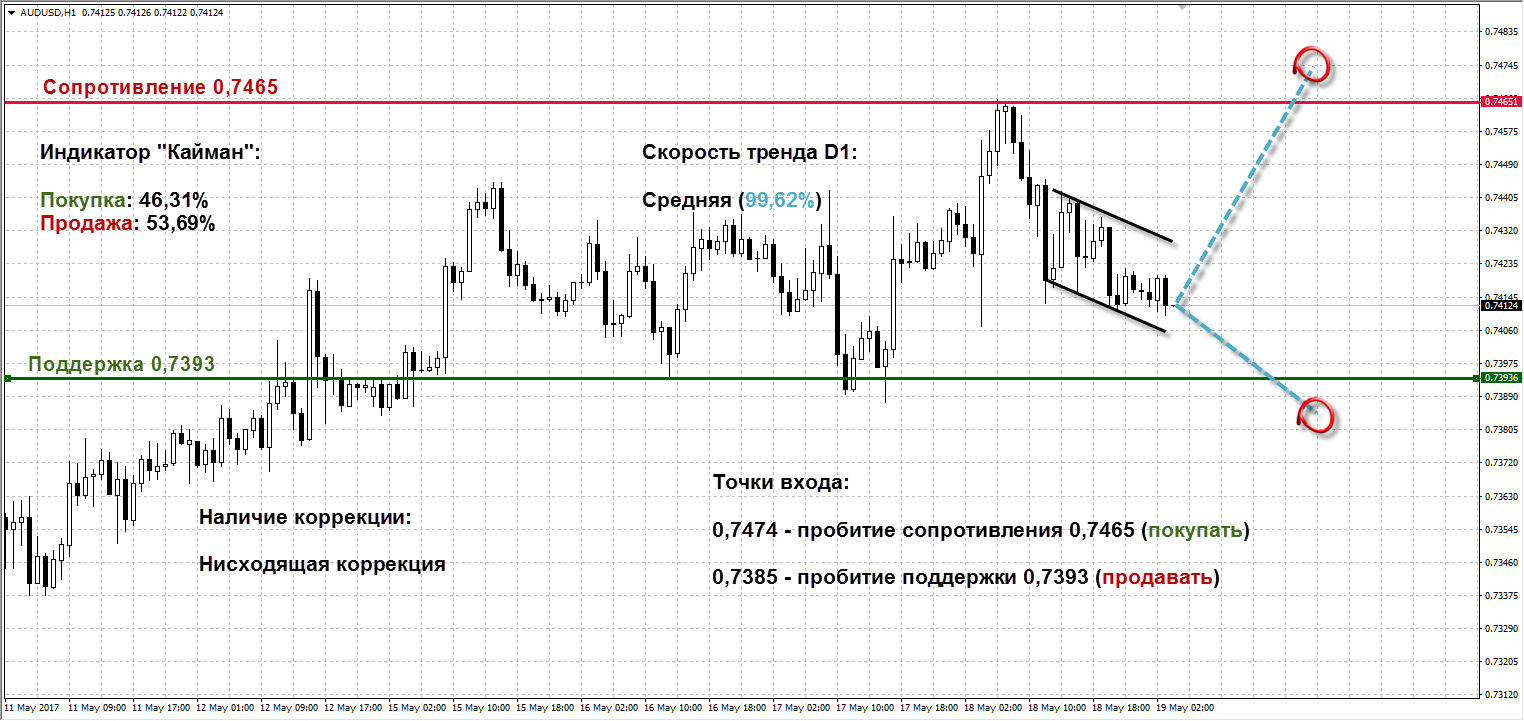

Technical Analyst and Forecast AUDUSD : Australian Dollar lower against the US currency. Medvedev cost to the local minimum of 0.7393 in the case of penetration which, recommend selling AUD at the level of 0.7385. A slight majority of market participants holding short positions waiting for the continuation of the downward dynamics of the currency pair (53.69% and 46.31% selling buying). Momentum characterizes the average velocity inside the trend of the day (99.62%). Stochastic line located in the neutral zone (45%) and MACD indicator below zero when growing down bars that gives a signal to sell. Bollinger bands forming a slight narrowing channel volatility. AUDUSD if prices start to rise, it is recommended to buy the Aussie with a mark of 0.7474 after breaking through the 0.7465 resistance.

Analytics AMarkets

:

Forex Analytics → Forex today. Technical forecasts currency 09/29/2016: Exchange rates EUR / USD, GBP / USD, USD / CHF, USD / JPY, AUD / USD, USD / RUB, GOLD, oil

Forex Analytics → Forex rate forecast USD / JPY 16.09.2016

Forex Analytics → Forex today. Technical forecasts currency 09/30/2016: Exchange rates EUR / USD, GBP / USD, USD / CHF, USD / JPY, AUD / USD, USD / RUB, GOLD, oil

Форекс прогноз → Форекс прогноз курса USD/JPY 16.09.2016

Форекс прогноз → Форекс на сегодня. Технические прогнозы валют 30.09.2016: Курсы валют EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, USD/RUB, GOLD, нефть