The GBPUSD pair continues to weaken amid disappointing UK inflation data and expectations of BoE rate cuts, with the price currently at 1.3220. Find out more in our analysis for 29 October 2025.

GBPUSD forecast: key trading points

- Market focus: traders are awaiting upcoming US inflation data (PCE price index) and comments from Federal Reserve officials. Any signs of a dovish shift could briefly weaken the dollar, but for now, the advantage remains with the US currency

- Current trend: the medium-term trend remains downward, with a local target at 1.2570

- Markets expect the BoE to begin cutting rates early next year

- GBPUSD forecast for 29 October 2025: 1.3150 and 1.2570

Fundamental analysis

The British pound remains under pressure following weak UK inflation data. The decline in consumer prices has fuelled expectations that the Bank of England may start to ease monetary policy within the coming months. Meanwhile, persistently high US Treasury yields and the strong US dollar continue to weigh on the GBPUSD pair, limiting upside potential.

Additional headwinds include political risks and weak consumer demand, which increase the likelihood of a recession in Q4.

GBPUSD technical analysis

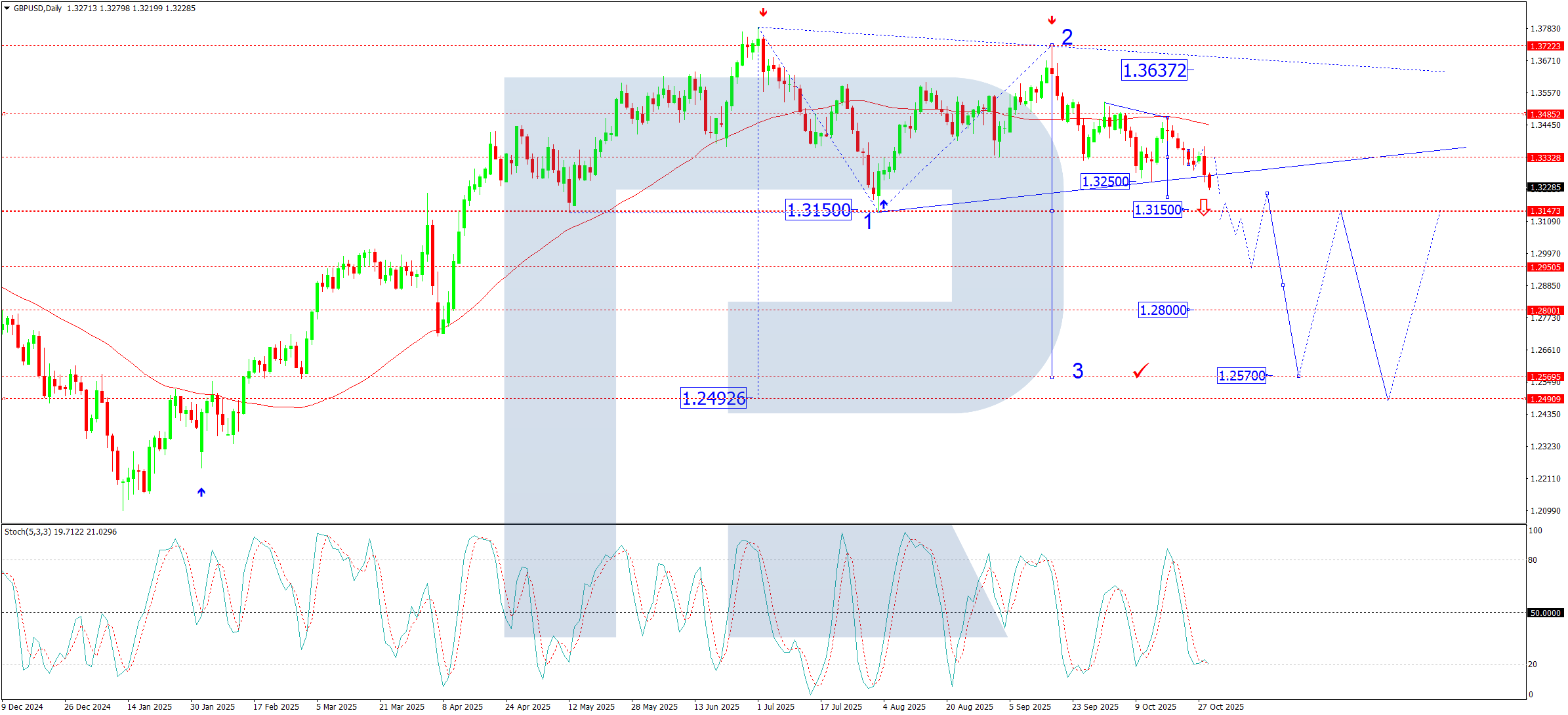

On the daily chart, the GBPUSD pair has completed a wide consolidation range around 1.3485 and resumed its downward movement. The current structure indicates the development of the third wave of a medium-term downtrend.

The nearest target lies at 1.3150; a breakout below this level would open the path towards 1.2800 and the broader bearish target at 1.2570.

The Stochastic Oscillator confirms bearish dominance, with the signal line anchored in oversold territory and pointing downwards, suggesting that downward momentum could persist in the medium and long term.

Summary

The GBPUSD rate remains under pressure within a descending channel. As long as the price stays below 1.3330, the bearish scenario remains the base case, with targets at 1.3150, 1.2800, and 1.2570. Any corrections are likely to be limited to the 1.3330–1.3380 zone, where renewed selling pressure is expected.

Open Account