The GBPUSD rate has corrected towards 1.2700 today after reaching a weekly high of 1.2730, with market participants anticipating the outcome of the US Federal Reserve meeting. Discover more in our analysis for 18 December 2024.

GBPUSD forecast: key trading points

- The US dollar strengthens moderately ahead of the Federal Reserve’s decision, with the market estimating the likelihood of a 25-basis-point rate cut at 95.4%

- UK inflation statistics for November are due today, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) scheduled for release

- GBPUSD forecast for 18 December 2024: 1.2730 and 1.2615

Fundamental analysis

During today’s European trading session, market participants will focus on the UK inflation data for November. The CPI and the PPI are scheduled for release. The CPI is expected to rise by 0.1%, and the PPI is projected to increase by 0.2% month-on-month.

Weaker-than-expected inflation statistics will exert pressure on the GBP and push the pair lower. Conversely, stronger figures will support the pound sterling and could lead to an uptick in quotes.

The US Federal Reserve will announce its decision on the interest rate during today’s American session. The rate is expected to be lowered by 25 basis points. According to the CME FedWatch Tool, the markets currently estimate the likelihood of such a cut at 95.4%. Subsequent comments from the regulator on its 2025 interest rate plans will be crucial for the GBPUSD rate.

GBPUSD technical analysis

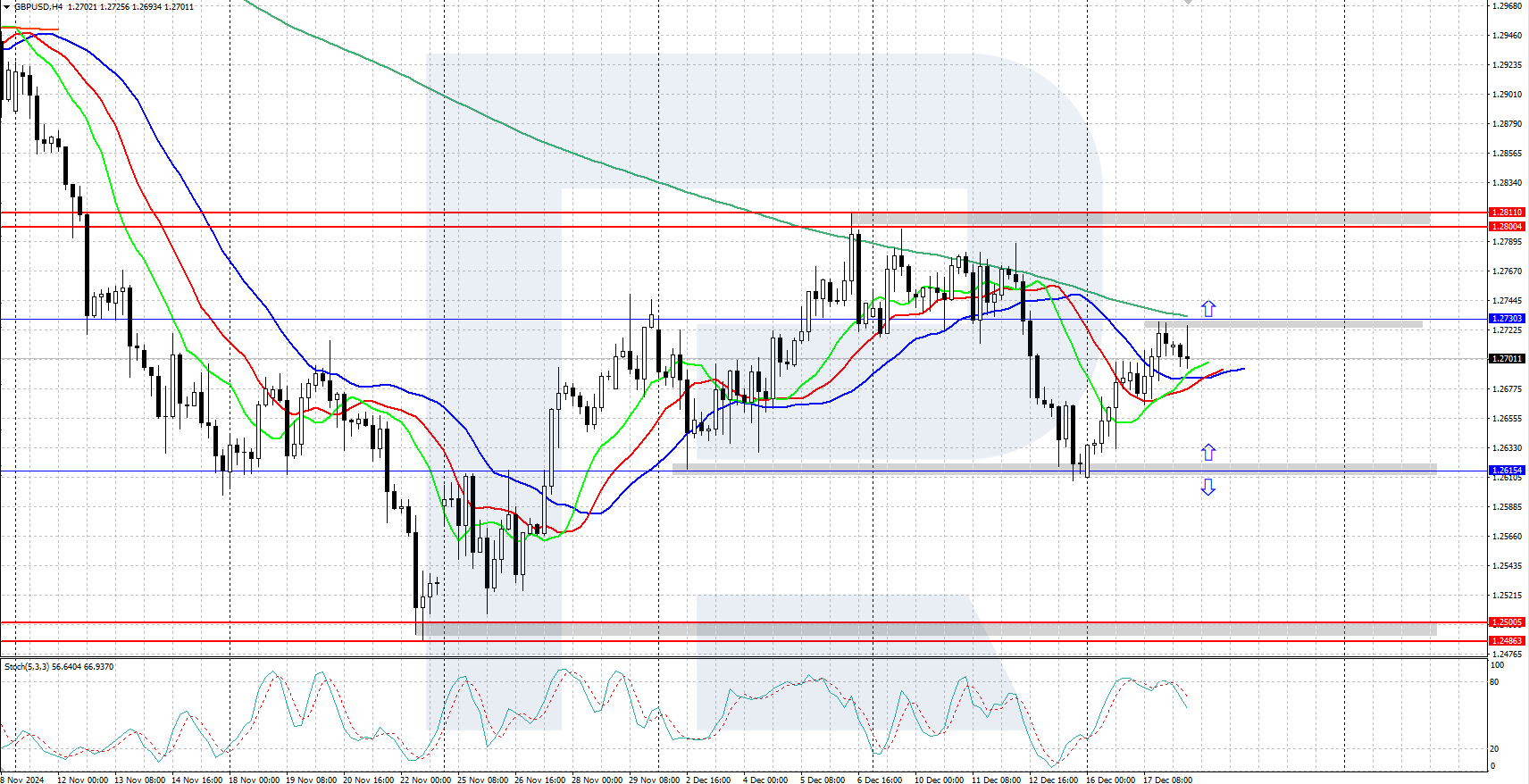

On the H4 chart, the GBPUSD pair shows local upward momentum after bouncing from the 1.2615 support level on Monday. The alligator indicator signals growth. The daily trend remains downward, but bulls are attempting to reverse it upward. A bullish, engulfing reversal pattern has formed on the daily chat.

The short-term GBPUSD forecast suggests the pair could rise to the 1.2800 resistance level if bulls hold the price above the 1.2615 support level. However, the decline may continue if bears establish themselves below 1.2615 again, with the next target at the 1.2500 support level.

Summary

The GBPUSD pair is moderately correcting downwards after reaching a local weekly high of 1.2730. Today, the market will focus on UK inflation statistics and the US Federal Reserve’s main interest rate decision.