Gold (XAUUSD) is trading around 3,218 USD on Friday. The week ends with a loss of around 3%, with the outlook remaining highly uncertain. Find out more in our analysis for 16 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) quotes are closing the week down by about 3% due to declining interest in safe-haven assets

- The Federal Reserve may slow the pace of rate cuts, which is negative for gold

- XAUUSD forecast for 16 May 2025: 3,200 and 3,119

Fundamental analysis

Gold (XAUUSD) prices are hovering around 3,218 USD per troy ounce at the end of the week. The precious metal is closing this period with a roughly 3% loss. Gold has temporarily lost its appeal as a safe-haven asset due to easing global trade tensions.

The US and China agreed to reduce tariffs for 90 days – a temporary measure, yet one that helped ease fears about prolonged fallout from their trade conflict. Geopolitical risks also subsided, with the truce between India and Pakistan remaining stable.

Soft US inflation data typically supports gold. These figures have strengthened expectations that the Federal Reserve may cut interest rates at least twice by the end of 2025.

Fed Chairman Jerome Powell previously mentioned that inflation could become more volatile in the future due to persistent supply disruptions. This scenario may complicate efforts by global central banks to maintain price stability.

The Gold (XAUUSD) forecast is downbeat.

XAUUSD technical analysis

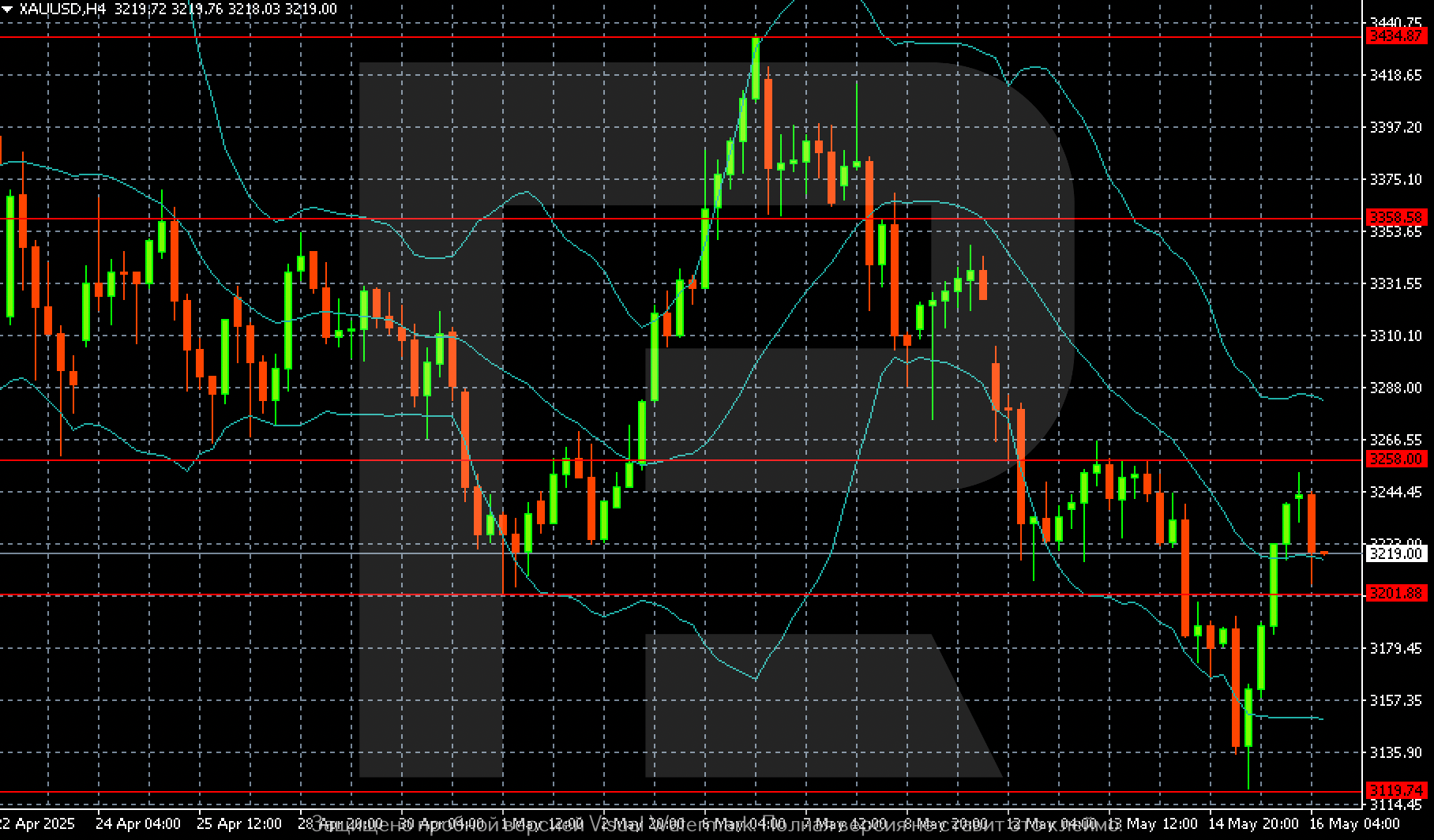

On the Gold (XAUUSD) H4 chart, a breakout below 3,200 would open the way for a retest of the local low at 3,119. Price swings remain highly volatile.

If the price holds near 3,225, the market could rebound to 3,258, which would provide a strong basis for further recovery.

Summary

Gold (XAUUSD) prices are attempting to rebound from their local low, but with no results so far. The precious metal is ending the week down 3%. The Gold (XAUUSD) forecast for today, 16 May 2025, expects renewed selling pressure towards 3,200 and 3,119, respectively.