Gold (XAUUSD) begins the week near 4,080 USD as market sentiment remains cautious and investors are monitoring news. Find more details in our analysis for 27 October 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) has retreated from record highs amid geopolitical stabilisation

- Market focus shifts to major central bank rate decisions

- XAUUSD forecast for 27 October 2025: 4,100 and 4,200

Fundamental analysis

Gold (XAUUSD) prices dropped to around 4,080 USD per ounce, extending Friday’s declines as progress in US-China trade talks reduced demand for safe-haven assets.

Following two days of discussions in Malaysia, top negotiators from both sides reportedly reached a preliminary consensus on key issues, including export restrictions, fentanyl trade control, agricultural exports, and transport tariffs. This development sets the stage for a potential agreement to be confirmed by President Donald Trump and President Xi Jinping at their meeting in South Korea later this week.

Meanwhile, attention has shifted towards upcoming meetings of the Federal Reserve, the European Central Bank, and the Bank of Japan, which are scheduled for the coming days.

Markets expect the Fed to cut interest rates by 25 basis points following softer inflation data, while both the ECB and the BoJ are expected to maintain their current policies unchanged.

Overall, the gold (XAUUSD) forecast is neutral.

XAUUSD technical analysis

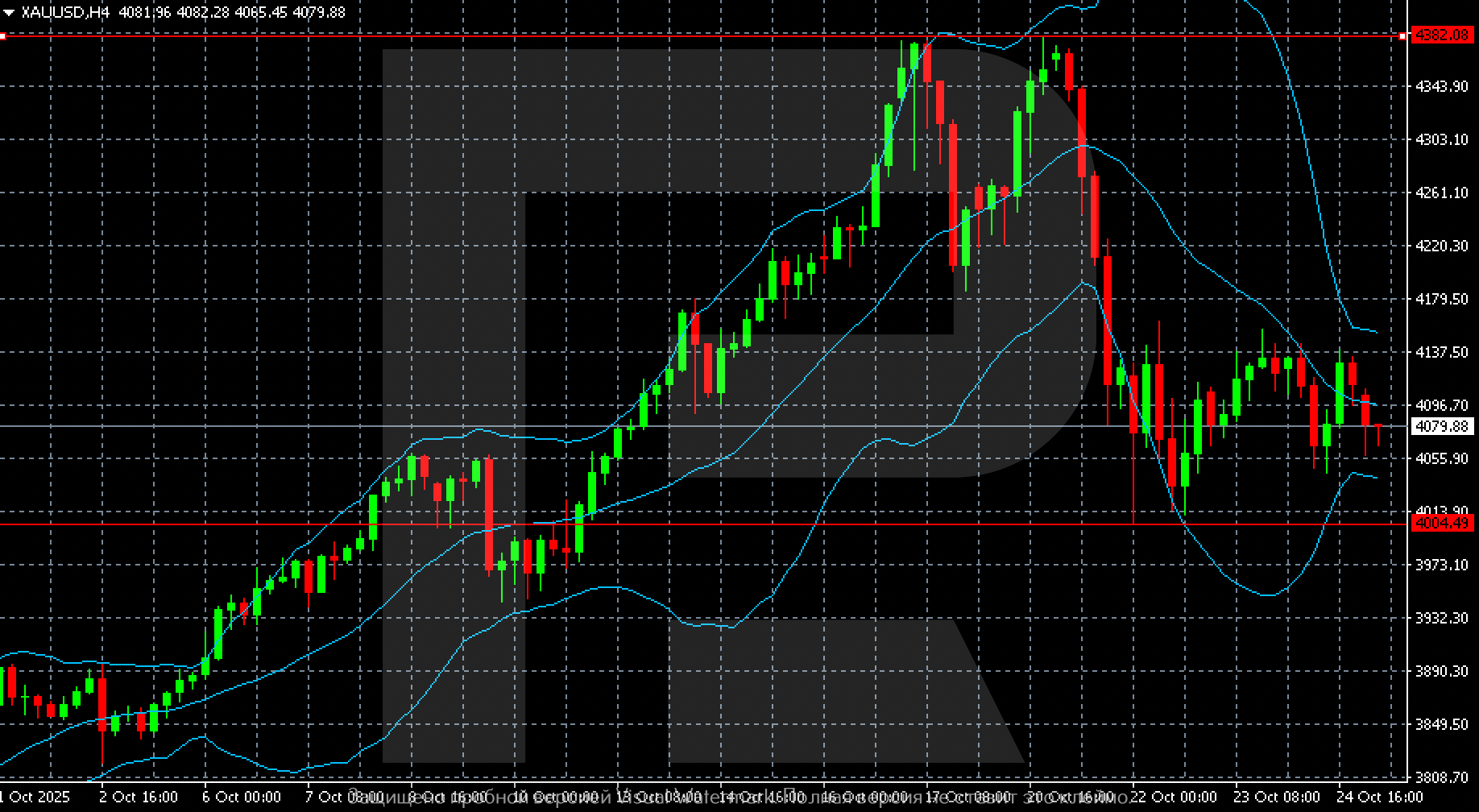

Gold (XAUUSD) is consolidating around 4,080 after a sharp correction from the 4,382 peak reached in mid-October.

Following nearly two weeks of strong gains earlier this month, prices have transitioned into a corrective phase. Movement is currently limited to the range between 4,000–4,100, suggesting that the market is attempting to stabilise after the decline.

Bollinger Bands have narrowed, indicating reduced volatility and a shift towards sideways trading. Prices are moving close to the midline, confirming neutral short-term momentum.

The key support level lies around 4,004, while resistance is located near 4,382, the previous local high.

In the coming days, market direction will depend on whether buyers can defend the 4,000 level. Consolidation above 4,100 would open the way towards 4,200, while a downward breakout could deepen the correction towards the 3,920–3,880 area.

Summary

Gold has completed its correction and appears ready for renewed movement. The gold (XAUUSD) forecast for 27 October 2025 suggests a potential rebound towards 4,100 and further towards 4,200.

Open Account