XAUUSD quotes pulled back from their all-time high of 3,500 USD and began to correct following signals of possible tariff relief for China from President Trump. Find out more in our analysis for 23 April 2025.

XAUUSD forecast: key trading points

- Market focus: Trump says final tariffs on Chinese imports will be much lower than the proposed 145%

- Current trend: correcting downwards

- XAUUSD forecast for 23 April 2025: 3,500 and 3,300

Fundamental analysis

Gold prices retreated below 3,400 USD after President Donald Trump stated that the final tariffs on Chinese goods would not be anywhere near the previously suggested 145%, signalling a potentially softer approach to the ongoing trade dispute.

Trump also clarified that he has no intention of removing Federal Reserve Chairman Jerome Powell, which helped calm investor fears over central bank independence and policy stability.

Today, markets will focus on the upcoming release of the US Purchasing Managers’ Index (PMI) data, which may provide insight into the current state of the country’s economy. Stronger-than-expected results may support the US dollar, while weaker data could weigh on the USD and reignite bullish momentum in XAUUSD.

XAUUSD technical analysis

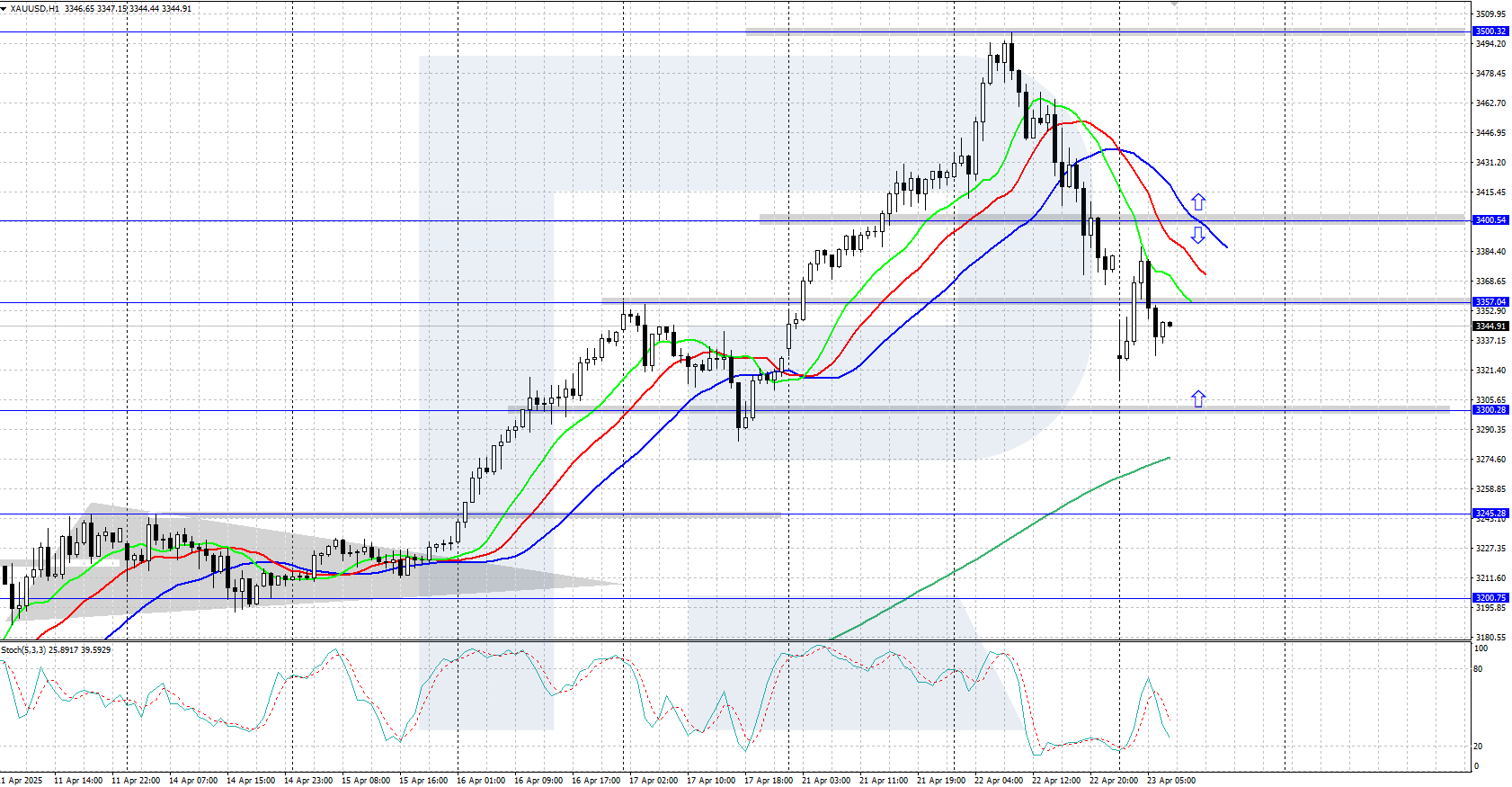

Gold is undergoing a downward correction within the uptrend after peaking at the 3,500 USD level. Quotes are currently trading around 3,350 USD, with the nearest support level at 3,300 USD.

The short-term XAUUSD price forecast suggests the pair could return to 3,400 USD if bulls hold above 3,300 USD. Conversely, if bears reverse prices downwards and push them below 3,300 USD, the correction could continue towards 3,245 USD.

Summary

XAUUSD is correcting downwards amid Trump’s statements about a potential easing of trade tariffs for China and his refusal to remove Fed Chairman Jerome Powell. US PMI statistics for April could influence the asset’s further movements today.