XAUUSD received support from buyers yesterday around the 3,300 USD mark. Market participants await tomorrow’s publication of the FOMC meeting minutes. Details – in our analysis for 8 July 2025.

XAUUSD forecast: key trading points

- Market focus: the market awaits tomorrow’s publication of the FOMC meeting minutes

- Current trend: trading within a wide range

- XAUUSD forecast for 8 July 2025: 3,300 and 3,365

Fundamental analysis

US President Trump signed an executive order delaying the introduction of large-scale trade tariffs until 1 August 2025, giving countries targeted by these tariffs almost four additional weeks to reach an agreement.

Last week’s strong employment report eased concerns over a slowdown in the US economy. Investors now await the publication of the minutes from the June FOMC meeting, scheduled for Wednesday, to assess further prospects for the Fed’s monetary policy.

XAUUSD technical analysis

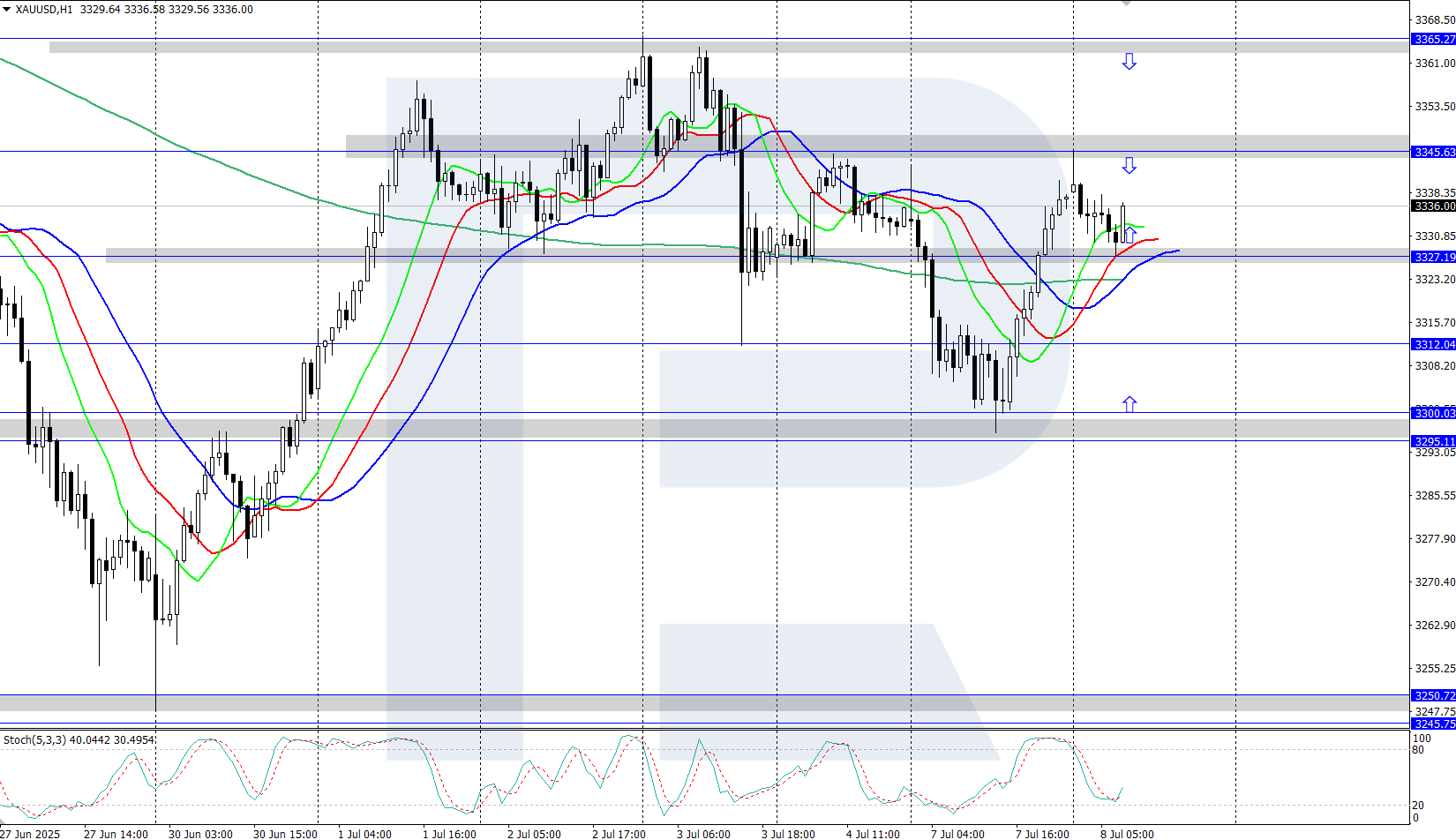

XAUUSD quotes show a local rise, rebounding from support at 3,300 USD. The Alligator indicator is turning upwards, indicating possible continued growth. The key support currently stands at 3,300 USD.

Within the short-term XAUUSD price forecast, if bulls manage to maintain initiative, further growth towards 3,365 USD may follow. However, if bulls fail and quotes move below 3,300 USD, a decline towards the support level at 3,250 USD is possible.

Summary

Gold is attempting to reverse upwards, having received support from buyers at 3,300 USD. The market focus is on tomorrow’s publication of the FOMC meeting minutes.