XAUUSD prices are showing rapid growth, breaking above the 3,100 USD level. This week, the market will focus on US employment data. Find out more in our XAUUSD analysis for today, 31 March 2025.

XAUUSD forecast: key trading points

- Market focus: another wave of the tariff war is expected this week, with Trump planning to impose a 25% tariff on imported cars

- Current trend: a strong uptrend is underway

- XAUUSD forecast for 31 March 2025: 3,150 and 3,100

Fundamental analysis

Gold continues its rapid growth in the uptrend, now trading above the 3,100 USD mark. The precious metal remains in high demand from investors and central banks amid ongoing tariff wars by US President Donald Trump, who plans to introduce a 25% tariff on imported vehicles and announce a broader reciprocal tariff plan.

This week, market focus will shift to US employment statistics, with the ADP report, Nonfarm Payrolls, and the unemployment rate scheduled for release. Stronger-than-expected figures could support the US dollar and trigger a correction in the XAUUSD pair. Conversely, weaker data would allow Gold to continue its upward move.

XAUUSD technical analysis

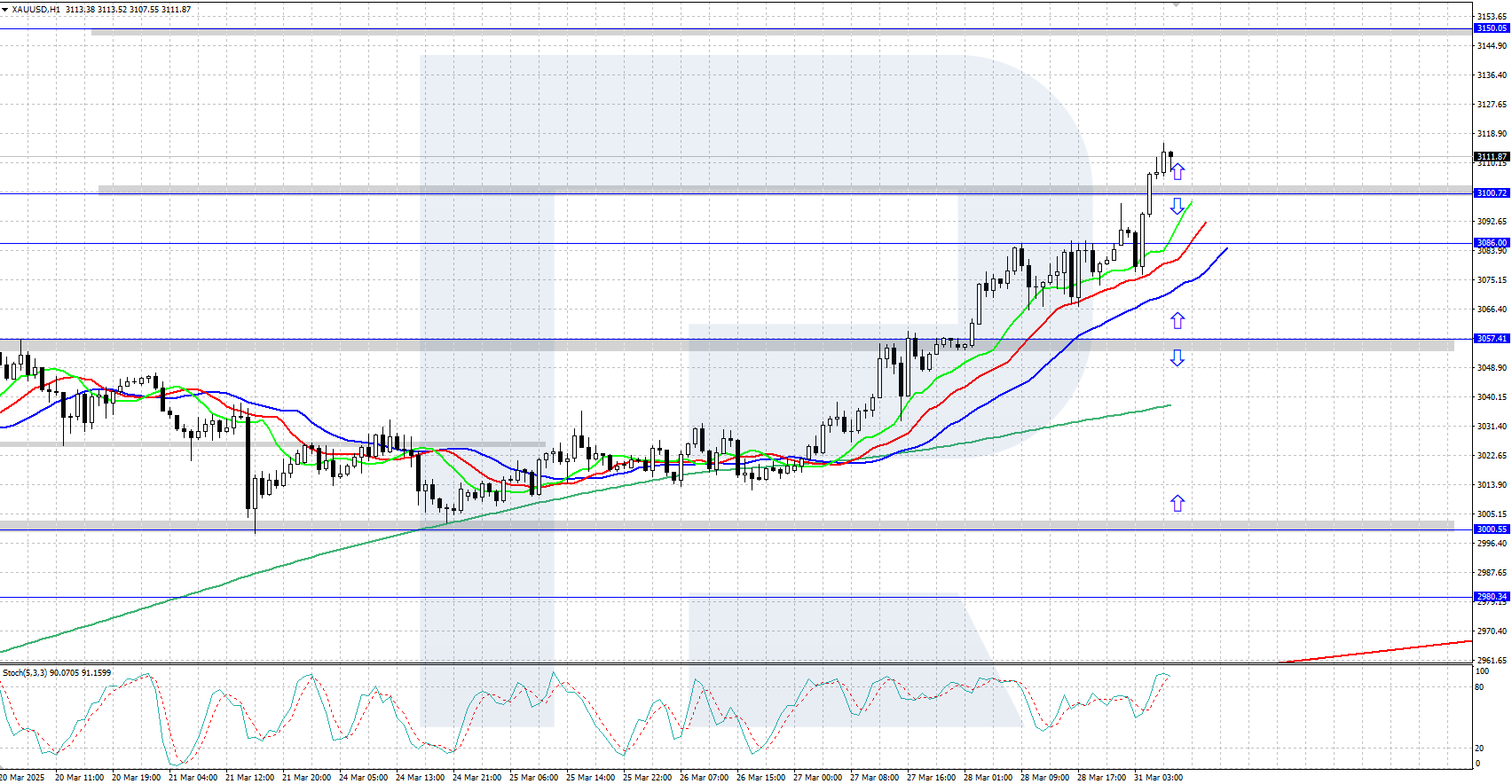

XAUUSD quotes maintain a confident bullish trend, having set a new all-time high above 3,100 USD today. The Alligator indicator confirms the uptrend, with the psychologically important 3,000 USD level now acting as key support.

The short-term XAUUSD price forecast suggests the pair could rise further toward the 3,150 USD area if the bulls retain the initiative. Conversely, a downward correction may begin if the bears regain momentum and push the price back below 3,100 USD.

Summary

Gold (XAUUSD) is strengthening, reaching a new all-time high of 3,116 USD. This week, the spotlight turns to US employment data.