XAUUSD prices are rising, surpassing the 2,650 USD resistance level and reaching the next resistance at 2,700 USD. The market awaits US inflation data today. Find out more in our XAUUSD analysis for today, 11 December 2024.

XAUUSD forecast: key trading points

- Market focus: US consumer inflation data - the Consumer Price Index (CPI) will be released today

- Current trend: moving upwards

- XAUUSD forecast for 11 December 2024: 2,720 and 2,650

Fundamental analysis

Gold has broken out of the sideways range and shows upward momentum on the daily chart. This is supported by geopolitical instability, which increases demand for safe-haven assets, and the interest rate-cutting policies of global central banks. The ECB, SNB, and the Bank of Canada are expected to lower interest rates already this week.

During the American trading session, market participants will focus on US inflation data for November, with the CPI scheduled for release. It is expected to rise by 0.3% month-on-month and 2.7% year-on-year. The central bank considers inflation data when making decisions on interest rate changes. A significant rise in inflation may force the Federal Reserve to pause the current cycle of monetary policy easing.

Weaker-than-expected statistics will exert pressure on the USD and help strengthen Gold, while stronger-than-expected figures could support the US dollar and push the XAUUSD pair lower.

XAUUSD technical analysis

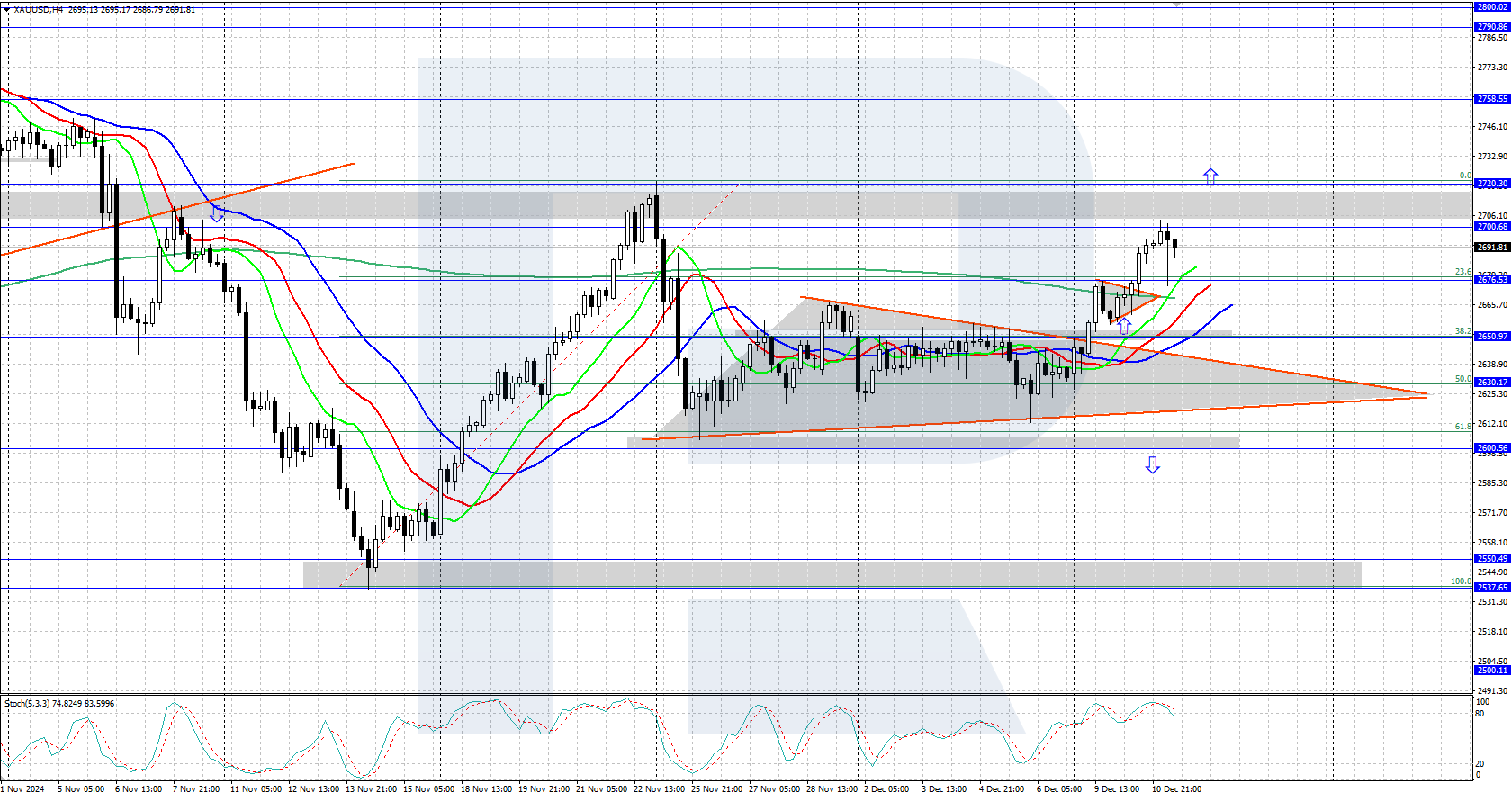

A technical triangle pattern formed on the XAUUSD H4 chart, and the quotes steadily rose above its upper boundary on Monday, reaching the target 2,700-2,720 USD resistance area. With a breakout above this area, the asset will have the potential for growth to an all-time high of 2,790 USD within the long-term uptrend.

The short-term XAUUSD price forecast suggests that, after consolidating above 2,700-2,720 USD, the pair could continue its ascent to the all-time high of 2,790 USD. However, a downward correction may follow if bears seize the initiative and establish themselves below 2,650 USD.

Summary

XAUUSD prices are rising, reaching a significant 2,700-2,720 USD resistance area. Today, the market will focus on US inflation data (the CPI), which could drive further Gold price movements.