Gold (XAUUSD) prices stabilise around 3,980 USD, as growing demand for risk assets weighs on the metal. Find out more in our analysis for 6 November 2025.

XAUUSD forecast: key trading points

- Market focus: gold (XAUUSD) halts its decline and moves into a sideways range

- Current trend: demand for risk increases as gold’s appeal as a safe-haven asset fades

- XAUUSD forecast for 6 November 2025: 3,886 or 4,046

Fundamental analysis

Gold (XAUUSD) prices traded near 3,980 USD per troy ounce on Thursday, remaining in a narrow range near its four-week low. Investors have further reduced expectations of additional Federal Reserve rate cuts.

Recent reports showed that ADP private employment rose by 42 thousand in October compared to the forecast of 25 thousand, while the ISM services PMI climbed to an eight-month high. These results supported the view that the Fed has little room left for more easing, especially since inflation remains above target and the ongoing government shutdown delays official data releases.

Additional pressure on gold comes from the hawkish tone of Federal Reserve officials, aligning with Chair Jerome Powell’s statement that the recent rate cut may have been the last of the year. However, some policymakers still believe rates will need to come down over the longer term. As risk appetite grows and market sentiment improves, gold’s attractiveness as a safe-haven asset has diminished, limiting its upside potential.

The short-term outlook for gold (XAUUSD) is moderate.

XAUUSD technical analysis

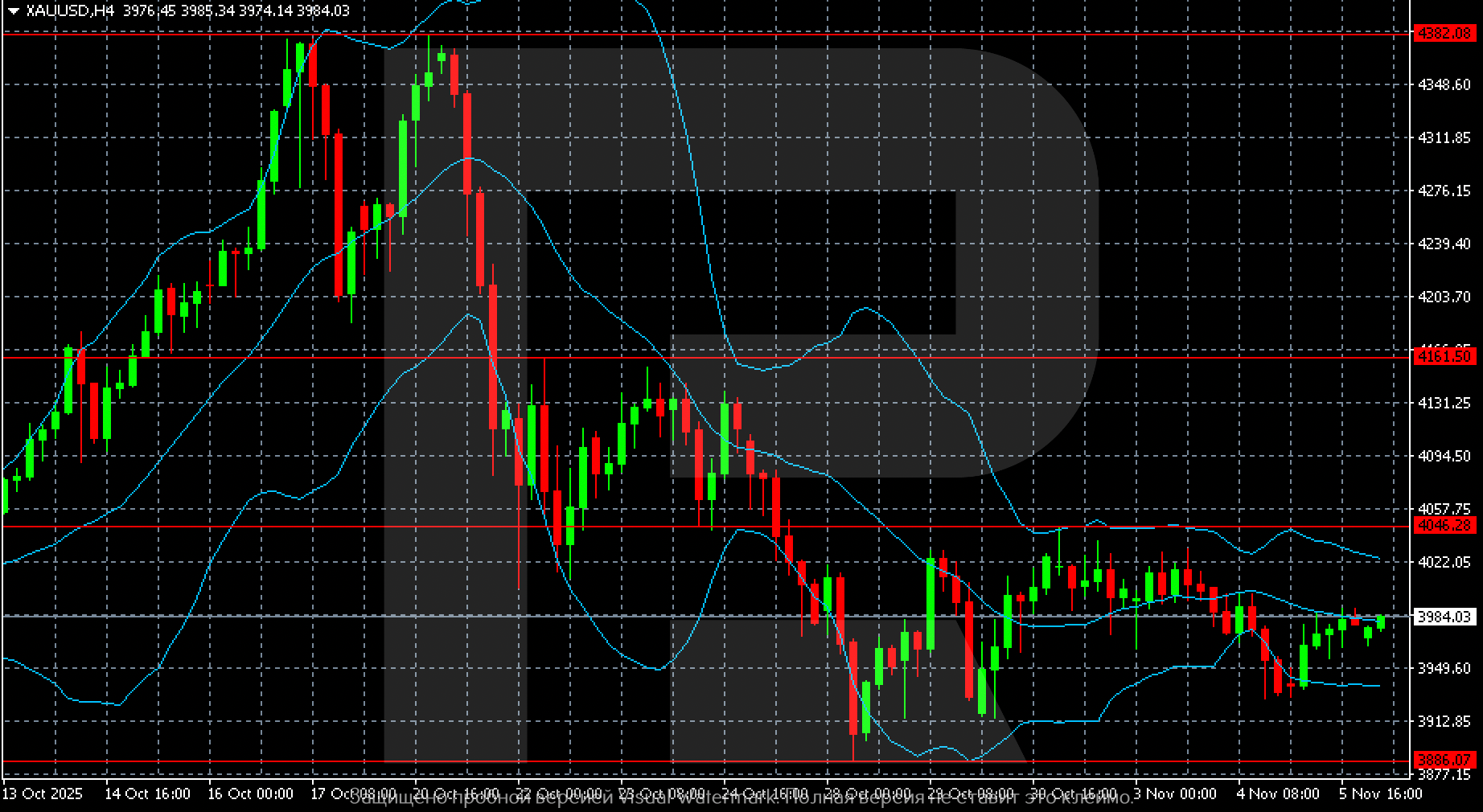

On the H4 chart, gold (XAUUSD) shows clear signs of sideways consolidation after a prolonged decline.

Following the drop from the October high near 4,382, the metal settled below 4,046 and has since been trading in a range between 3,886 and 4,046. Repeated attempts to break above 4,046 have failed, confirming sellers’ dominance.

The Bollinger Bands midpoint lies near 3,980, aligning with current prices – the market is balancing around the channel's middle band, indicating a consolidation phase. The lower band around 3,910 marks local support.

The short-term structure suggests stabilisation after the decline. To resume growth, gold needs to firmly consolidate above 4,046, which would open the path towards 4,160. Conversely, a breakout below the 3,886 support level would likely trigger further downside towards 3,840–3,800.

Summary

Gold has moved sideways following a sell-off phase. The XAUUSD forecast for today, 6 November 2025, suggests fluctuations within the 3,886–4,046 range.

Open Account