Gold (XAUUSD) prices have once again fallen below the 4,000 USD mark following the Federal Reserve’s latest rate decision. Discover more in our analysis for 30 October 2025.

XAUUSD forecast: key trading points

- Market focus: the Federal Reserve cut its benchmark rate to 4.00%

- Current trend: correcting downwards

- XAUUSD forecast for 30 October 2025: 3,900 or 4,000

Fundamental analysis

The US Federal Reserve announced a widely expected 25-basis-point rate cut on Wednesday. However, Chair Jerome Powell noted that another rate reduction in December remains uncertain, citing limited access to key federal data amid the ongoing government shutdown.

Meanwhile, investors are closely watching the US-China trade talks, where Presidents Donald Trump and Xi Jinping are expected to sign a trade agreement during their upcoming meeting in South Korea. Moderate optimism in the market is reducing demand for safe-haven assets such as gold.

XAUUSD technical analysis

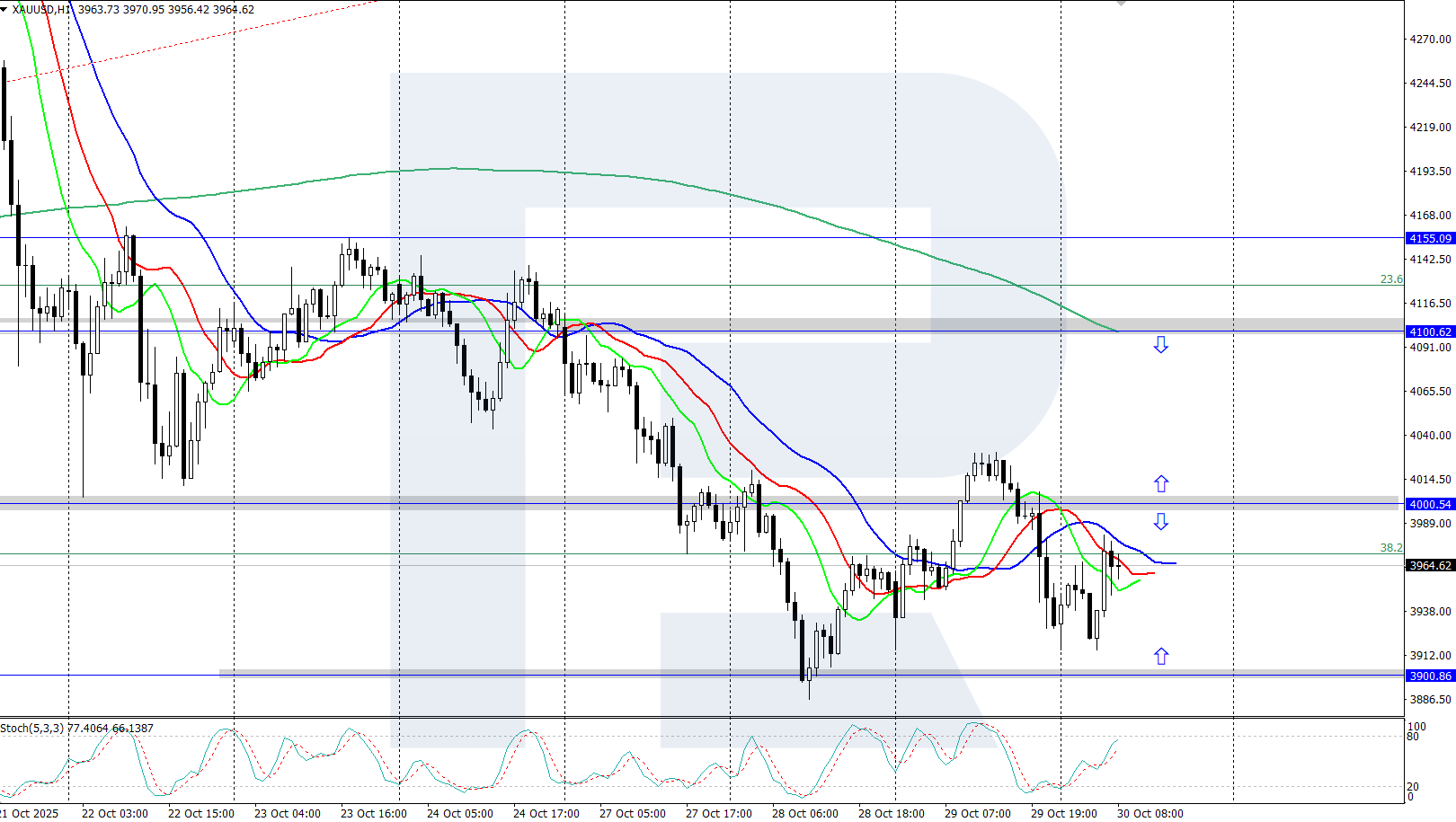

XAUUSD quotes underwent a correction from their all-time high near 4,380 USD amid easing tensions between the US and China. The Alligator indicator is directed downwards, confirming ongoing corrective pressure.

The short-term XAUUSD price forecast suggests a further rally towards 4,380 USD if bulls regain control and push prices back above 4,000 USD. Conversely, if sellers hold quotes below this psychological level, the pair could extend its decline towards the 3,900 USD support level and even lower.

Summary

Gold is undergoing a correction, dipping below the key 4,000 USD threshold. Market participants are awaiting the outcome of the US-China trade negotiations.

Open Account