Gold (XAUUSD) weekly forecast: prices form correction before new record

Gold (XAUUSD) set a new price record, testing the 4,381 per ounce level, and is now forming a correction. The metal was supported by expectations of further Fed rate cuts following the September policy easing decision, and by strong demand for safe-haven assets amid the US government shutdown.

The pullback in prices was triggered by profit-taking after the rapid rally. An additional driver was the partial strengthening of the US dollar and a decline in demand for gold as a haven asset.

This review highlights the key factors likely to influence gold dynamics during the week of 27–31 October.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: XAUUSD is forming a correction after hitting another record high and is hovering around the 4,115 level per ounce

- Support and resistance: the nearest support level is at 4,030, followed by 3,96The resistance level is at 4,351. A breakout above this level opens the path to 4,400, while a consolidation below 4,030 signals a correction towards the 3,960–3,940 range

- Fundamentals: expectations of two Fed rate cuts before year-end, temporary dollar strength, and paused data releases due to the US government shutdown have increased gold volatility, with additional support coming from Asian investors

- Outlook: the baseline scenario for 27–31 October suggests consolidation above 4,120 with potential for new record highs in the 4,381–4,400 zone. A downward breakout would signal a moderate correction, but the overall trend remains bullish

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) ends the week near 4,120 per ounce, forming a correction after hitting a new all-time high above 4,381. The pullback is mainly driven by profit-taking and a partial easing of geopolitical risks. The fundamental backdrop for the metal remains positive.

The primary growth driver remains the Fed’s dovish policy. After the 25-basis-point rate cut in September, markets fully price in another cut in October and nearly 90% chance in December. FOMC meeting minutes confirm the Fed’s concerns over labour market conditions and lingering inflation risks, further boosting expectations of continued monetary easing.

Additional support comes from the ongoing US government shutdown, now in its fourth week. The suspension of federal agencies has delayed macroeconomic data releases, including the key September jobs report. In the absence of official statistics, investors’ focus has shifted to private indicators, which show a decline in employment and weakening business activity. This increases interest in safe-haven assets and reduces the appeal of the US dollar.

Geopolitically, signs of easing tensions in the Middle East have also influenced market dynamics. While lower expectations for further growth in global geopolitical tensions triggered a correction in XAUUSD quotes, strategic investor interest remains high, particularly among central banks and institutional funds, which continue to accumulate gold reserves.

Since the start of the year, gold has surged more than 60%, marking the strongest performance since 1979.

XAUUSD technical analysis

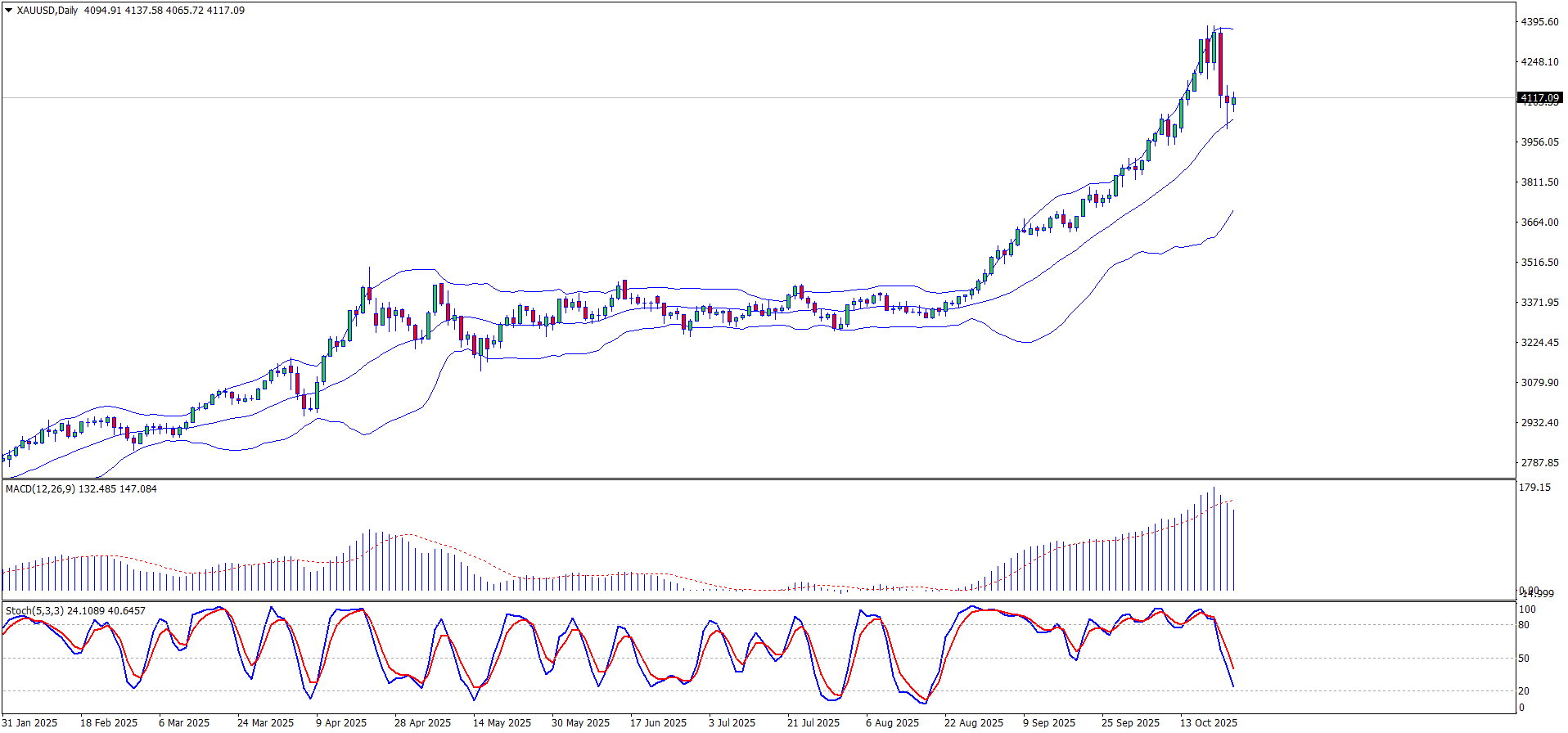

The XAUUSD daily chart shows that after a prolonged consolidation in the 4,350–4,350 range, prices formed a correction, currently trading near 4,110 USD per ounce.

Bollinger Bands are narrowing, indicating reduced volatility and weakening bullish momentum. Prices are moving along the middle band.

The MACD indicator remains in positive territory but is trending downwards, signalling seller dominance.

The Stochastic Oscillator is moving into oversold territory, indicating a technical correction after the sharp rally.

The nearest support level is around 4,030, while key resistance is at 4,351. A solid breakout above this level would open the door to new historical highs in the 4,400–4,500 range. A breakout below 4,030 could lead to a retreat towards the 3,960–3,940 range.

XAUUSD trading scenarios

The fundamental background for gold remains positive: expectations of further Fed rate cuts, continued dollar weakening, and demand for safe-haven assets are supporting buyer interest. An additional factor is the ongoing US shutdown, which adds uncertainty and increases gold's appeal as an alternative asset.

- Buy scenario

Long positions remain favoured if prices hold above the 4,150 support level. A breakout of this mark could send quotes to 4,450–4,500, with a potential extension to 4,600. An additional growth impulse may come from dovish Fed commentary and weak private US labour data.

- Sell scenario

Short positions become relevant if prices break below 4,030. In this case, targets shift to 3,960–3,940. Pressure on gold would intensify with dollar strength and rising US bond yields.

Conclusion: gold remains in the 4,070–4,130 range. The baseline scenario for the week suggests consolidation above 4,351 with potential movement towards 4,450–4,500. A breakout below the support level would lead to a continued correction, but the overall bullish trend remains intact.

Summary

Having reached a new all-time high, gold (XAUUSD) is now undergoing a correction due to profit-taking. Expectations of further Fed easing, dollar weakness, and strong demand for safe-haven assets may trigger another rally. Additional support is coming from active gold purchases by Asian investors and central banks.

The rally was capped by profit-taking after the record high. Key levels include support at 4,030 and resistance near 4,351. A breakout above 4,351 would open the path to new highs near 4,450–4,500, while a drop below 4,030 would increase the risk of a correction towards 3,960–3,940.

In the coming days, gold’s performance will depend on Fed commentary, interest rate decisions, and geopolitical developments.