The JP 225 stock index shows a decline on the H4 chart, breaking below the lower boundary of an ascending channel. The JP 225 forecast for next week is negative.

JP 225 forecast: key trading points

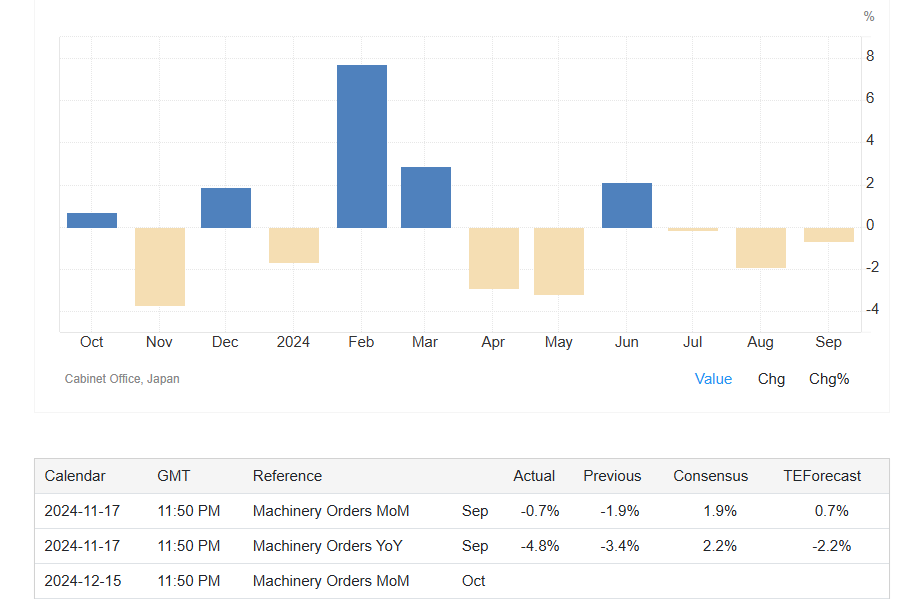

- Recent data: Japan’s machinery orders decreased by 0.7%

- Economic indicators: this indicator measures the total value of machinery orders placed with major Japanese manufacturers

- Market impact: an increase in orders positively impacts the country’s economy, while a decline has an adverse effect

- Resistance: 40,135.0, Support: 37,400.0

- JP 225 price forecast: 37,400.0

Fundamental analysis

Japan’s machinery and equipment orders fell short of market expectations, which had forecast a 1.9% increase. In September 2024, the indicator dropped by 0.7% month-on-month to 852 billion JPY, remaining in negative territory for the third consecutive month.

Source: https://tradingeconomics.com/japan/machinery-orders

Bank of Japan Governor Kazuo Ueda hinted in his comments on Monday that the central bank will gradually raise interest rates if the economy develops in line with expectations. However, he did not refer to any specific timing for future hikes.

Ueda also emphasised that the Bank of Japan monitors various risks, including the US economic situation. The BoJ has recently reiterated its forecast to raise the benchmark interest rate to 1.0% by the second half of fiscal 2025, representing a 75-basis-point tightening compared to the current level.

JP 225 technical analysis

The JP 225 stock index plunges, falling below the lower boundary of an ascending price channel, suggesting a further downward correction. The nearest target for the decline is the 37,400.0 support level.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price secures below the 37,400.0 support level, the index could fall to 37,000.0

- Optimistic JP 225 forecast: a breakout above the 38,550.0 resistance level could propel the price to 39,000.0

Summary

The JP 225 stock index gradually edges lower, falling below the lower boundary of an ascending price channel. The forecast for next week is negative, with the correction likely to continue.