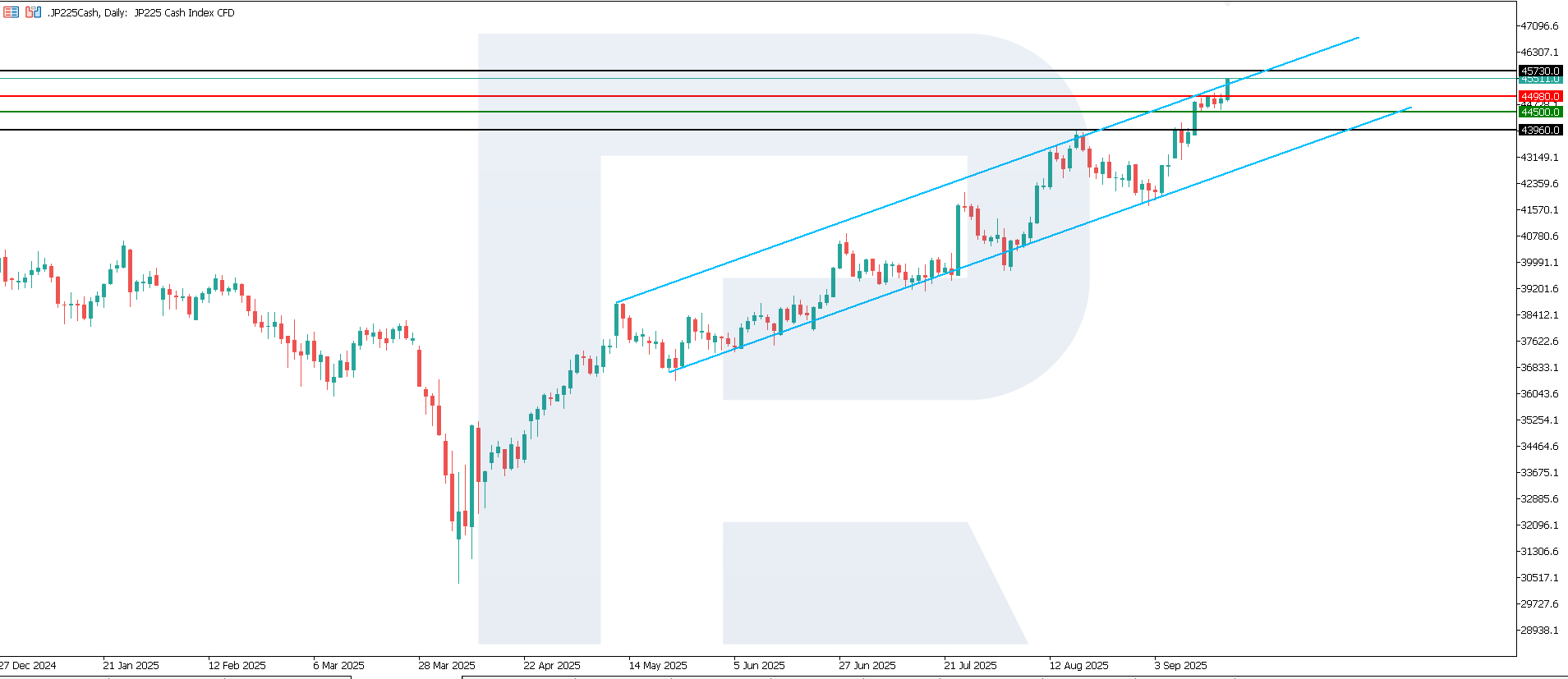

The JP 225 index continued to rise within the upward channel and hit a new all-time high. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

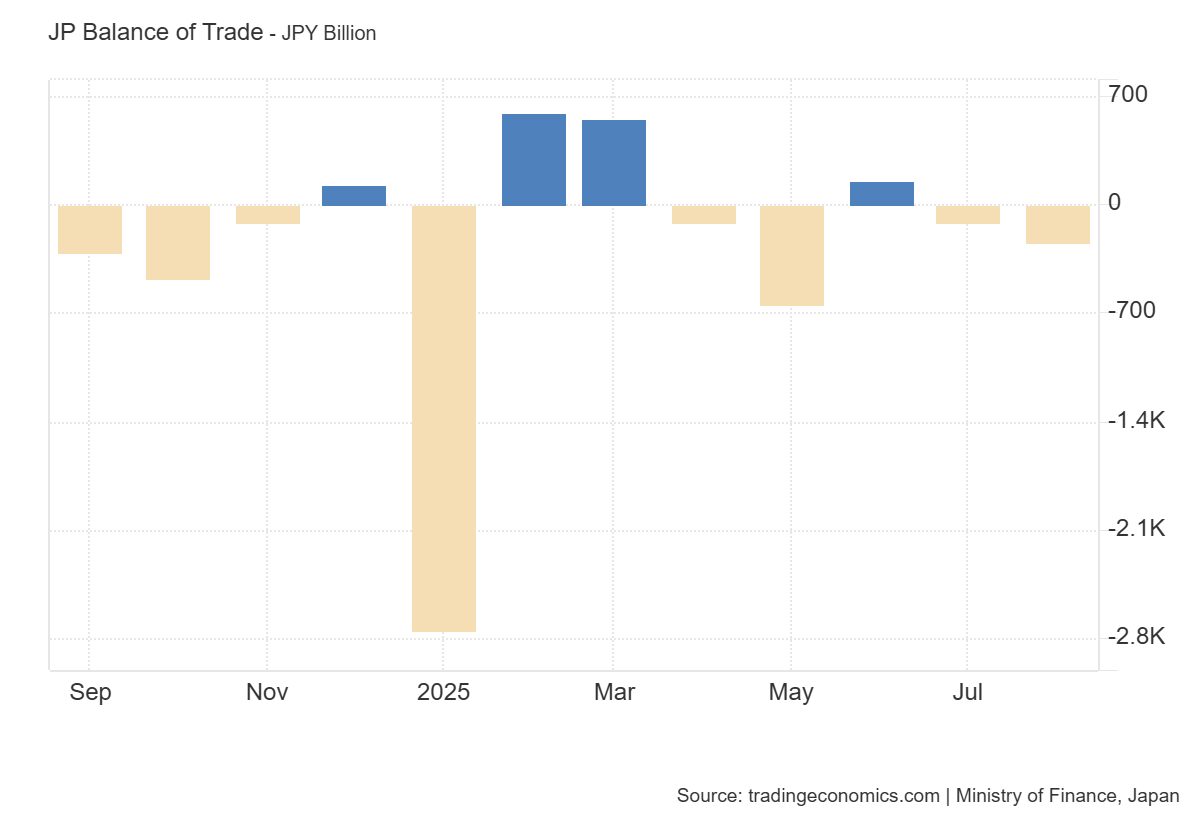

- Recent data: Japan’s balance of trade for August came in at -242.5 billion JPY

- Market impact: this result carries a positive signal for the Japanese equity market

JP 225 fundamental analysis

Japan’s balance of trade for August 2025 stood at -242.5 billion JPY, better than the forecast of -513.6 billion JPY but weaker than the previous reading of -118.4 billion JPY. Although the trade deficit remained, the gap turned out nearly half as small as expected. This indicates stronger external economic conditions than anticipated and reduces concerns about pressure on the trade sector.

For the JP 225 index, the impact is mixed: on the upside, the result exceeded expectations, which supports confidence in Japanese companies’ export activity. On the downside, the deficit still widened compared to last month, reflecting reliance on energy and raw material imports.

Japan Balance of Trade: https://tradingeconomics.com/japan/balance-of-tradeJP 225 technical analysis

The JP 225 index resumed growth and hit a new all-time high. The support level is located at 44,500.0, with resistance at 44,980.0. The narrowing gap between resistance and support may act as an indirect indicator of a forthcoming directional move. Currently, the uptrend is highly likely to continue.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 scenario: a breakout below the 44,50 support level could push the index down to 43,960

- Optimistic JP 225 scenario: a breakout above the 44,980 resistance level could propel the index to 45,730

JP 225 technical analysis for 18 September 2025Summary

The data release is perceived by markets as a moderately positive signal: although the deficit widened compared to last month, the result was significantly better than forecasts. For the JP 225, this increases the likelihood of strengthening positions among export-oriented companies, while the energy sector remains under pressure. The next upside target for the JP 225 is 45,730.0.

Open Account