The JP 225 stock index is trading in an uptrend, although volatility has increased significantly. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

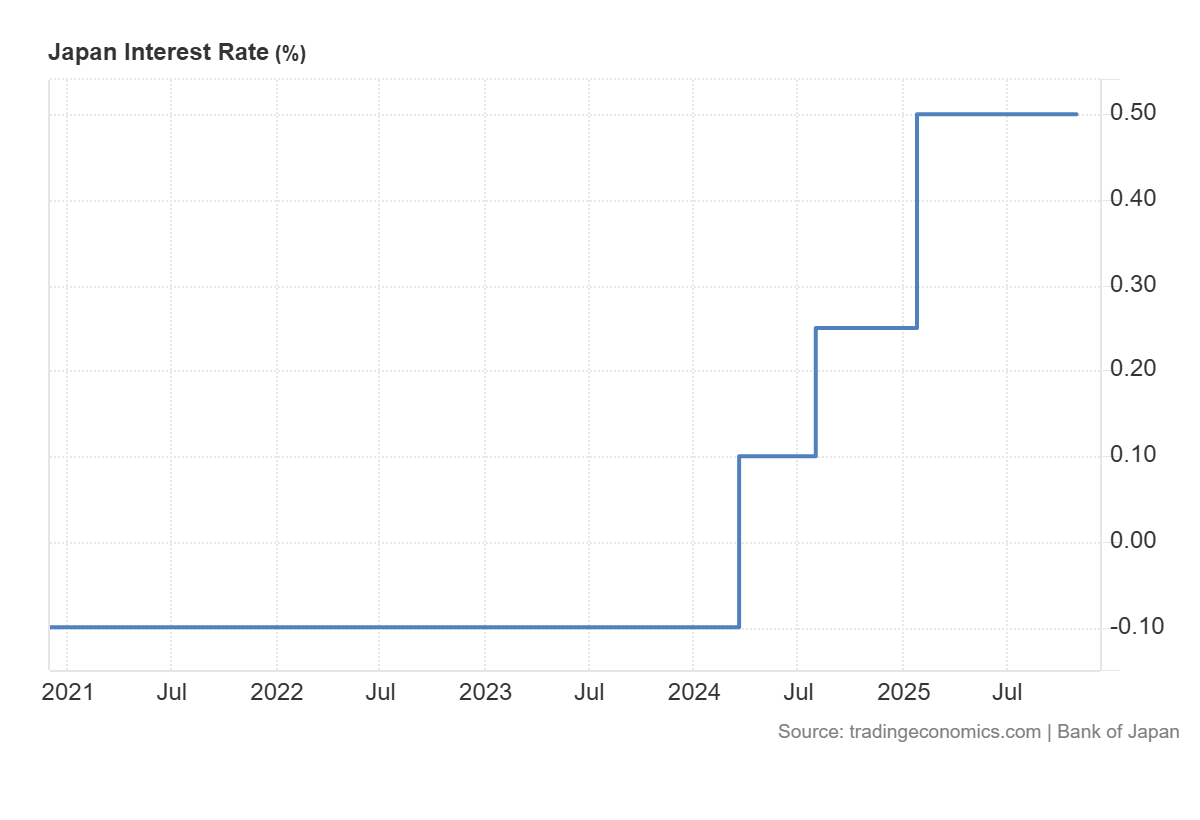

- Recent data: the Bank of Japan set the interest rate at 0.50% per annum

- Market impact: the effect on the Japanese stock market is generally positive

JP 225 fundamental analysis

The Bank of Japan’s decision to keep the key interest rate unchanged at 0.50%, fully matching the forecast and previous level, means there was no monetary surprise for the market. For Japanese stock market participants, this signals that accommodative financial conditions will continue: borrowing costs for corporations and households remain low, and the equity risk premium relative to bonds remains attractive.

For the JP 225 index, which includes a significant share of exporters, industrial companies and financial institutions, the overall effect of the decision appears moderately positive. The absence of surprises reduces short-term volatility and reinforces the base scenario for valuation models: stable monetary policy, controlled bond yields and favourable conditions for corporate financing. Unless the accompanying BoJ comments point to a faster pace of tightening in the coming quarters, the JP 225 index will likely maintain its upward momentum.

Japan’s interest rate decision: https://tradingeconomics.com/japan/interest-rateJP 225 technical analysis

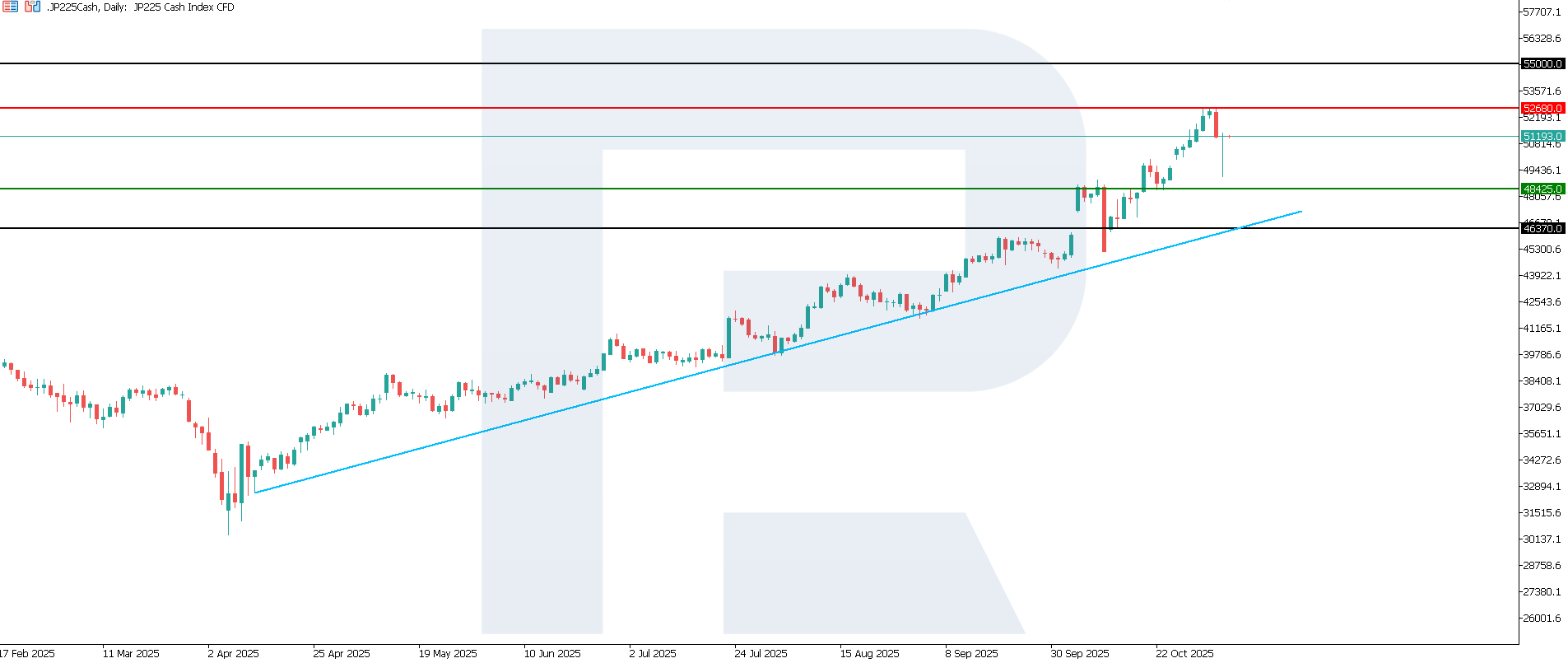

The JP 225 index corrected by more than 6%, with the broader trend remaining upward. The support level is located at 48,425.0, while resistance has formed at 52,680.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 48,425.0 support level could push the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 52,680.0 resistance level could drive the index up to 55,000.0

JP 225 technical analysis for 6 November 2025Summary

The unchanged rate supports company valuations through a lower discount rate for future cash flows and limits the growth of government bond yields, which is positive for rate-sensitive stocks such as developers, infrastructure firms, retail and the REIT segment. However, the scale of further growth will depend on external factors such as global demand dynamics, movements in US and European bond yields and changes in yen expectations. The next upside target for the JP 225 stands at 55,000.0.

Open Account