The JP 225 stock index has reached its highest levels since the end of January 2025. The forecast for JP 225 today is positive.

JP 225 forecast: key trading points

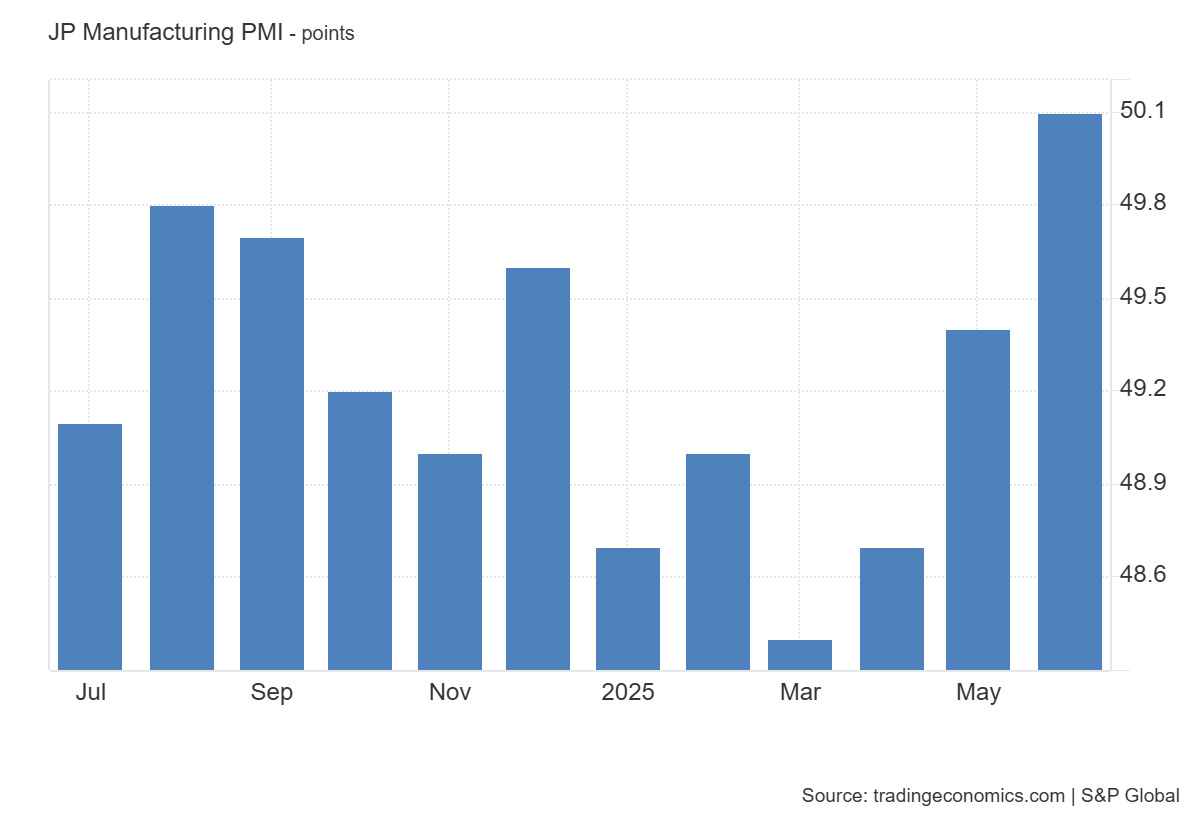

- Recent data: preliminary Manufacturing PMI for June in Japan stood at 50.1

- Market impact: PMI returning above 50 can strengthen investor confidence, supporting the Japanese stock market

JP 225 fundamental analysis

A Manufacturing PMI above 50 (current 50.1 vs previous 49.4) indicates a shift from contraction to growth in Japan's manufacturing sector, though growth remains minimal. This signals stabilisation and gradual recovery in industrial activity, which the market views positively. Recovery in manufacturing benefits the industrial sector, especially equipment and automobile producers.

Slight growth in manufacturing may increase demand for components and electronics, supporting technology companies. Strengthening in the manufacturing sector boosts employment and consumer confidence, supporting retail companies.

Japan Manufacturing PMI: https://tradingeconomics.com/japan/manufacturing-pmiJP 225 technical analysis

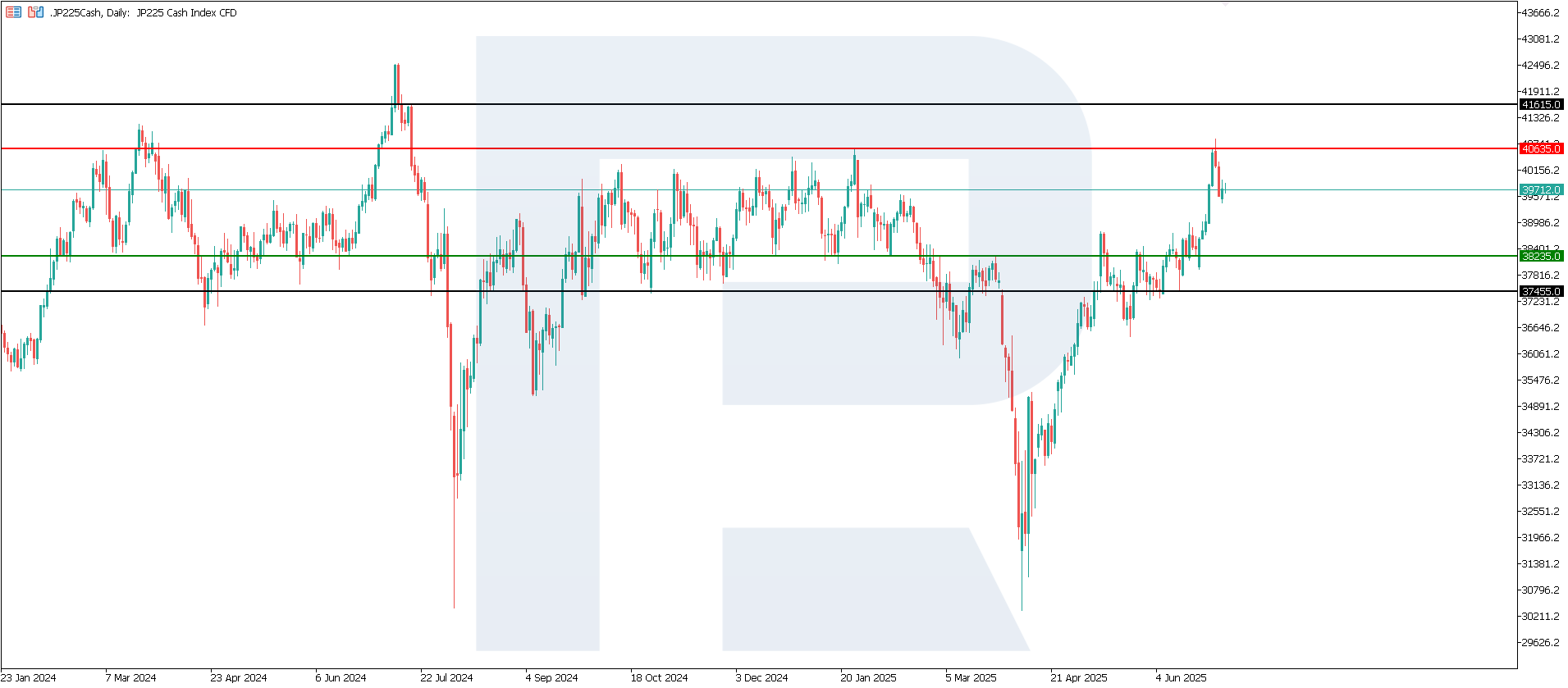

The JP 225 index continues to rise – the upward trend remains strong. A new support level has formed at 38,235.0, with resistance at 40,635.0. A corrective decline is currently observed, although it is unlikely to be long-term or signal the start of a downward trend. At present, there are no signs indicating a trend reversal.

Scenarios for the JP 225 index price forecast:

- Pessimistic scenario for JP 225: if the support level at 38,235.0 is breached, prices may fall to 37,455.0

- Optimistic scenario for JP 225: if the resistance level at 40,635.0 is broken, prices may rise to 41,615.0

JP 225 technical analysis for 3 July 2025Summary

Japan’s Manufacturing PMI returning above 50 signals a gradual recovery in industrial activity, positively impacting industrial, technology, and materials stocks, and creating an overall positive sentiment in the Japanese stock market. The JP 225 index remains in a strong upward trend. The next target may be 41,615.0. No signs of a reversal in the upward trend are observed.