The USDCAD rate is testing the critical support area. Find out more in our analysis for 20 November 2024.

USDCAD forecast: key trading points

- The strengthening of the Canadian dollar is due to a rise in Canada’s inflation to 2% in October 2024

- Prices increased across five of eight CPI components, primarily driven by petrol price growth

- Weaker expectations of a substantial Bank of Canada rate cut are putting pressure on the USDCAD currency pair

- USDCAD forecast for 20 November 2024: 1.3900

Fundamental analysis

The USDCAD rate is bouncing off the 1.3950 support level. The currency pair is slightly correcting after declining for two consecutive trading sessions. The US dollar lost over 1% amid buyers’ failure to gain a foothold above the 1.4100 level. The current strengthening of the Canadian dollar is fuelled by inflation data, which eases expectations about the size of the Bank of Canada’s interest rate cuts.

Canada’s inflation rose to 2% in October. Prices increased across five of eight CPI components, primarily driven by petrol price growth. The return of inflation to the Bank of Canada’s 2% target suggests that rate cuts will continue, but the size of cuts will depend on the analysis of economic data. According to today’s USDCAD forecast, lower expectations of a substantial BoC rate cut will further pressure the currency pair, contributing to a potential breakout below the key 1.3950 support level.

Market expectations about the Fed’s policy also changed. Federal Reserve Chair Jerome Powell emphasised economic resilience, which allows the regulator to maintain a restrained approach to interest rate cuts. According to the CME FedWatch Tool, the likelihood of a December rate cut decreased to 58.9% from 76.8% a month ago.

USDCAD technical analysis

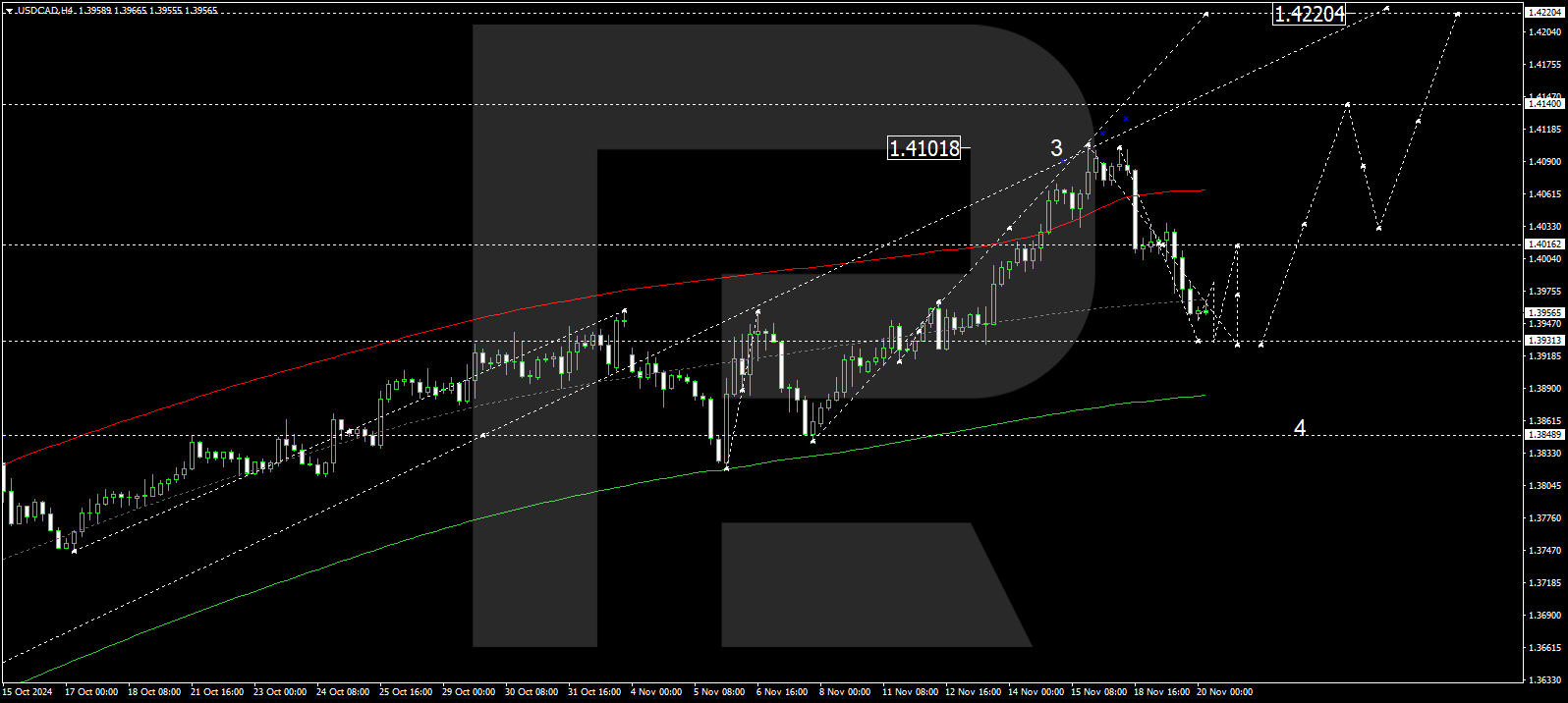

The USDCAD H4 chart shows that the market has formed a consolidation range around 1.4016 and broke below it. The price is expected to tumble to the local target of 1.3931 today, 20 November 2024, with a corrective wave developing. Once the price reaches this level, it could rise to 1.4016 (testing from below). Subsequently, another corrective movement might follow, aiming for 1.3900.

The Elliott Wave structure and wave matrix, with a pivot point at 1.3939, technically support this scenario. This level is crucial for the third growth wave structure in the USDCAD rate. The market is forming a correction towards the lower boundary of an envelope at 1.3900. After the price reaches this level, a growth wave is expected to start, aiming for its central line at 1.4016. A new consolidation range could later form around the envelope’s central line, with the wave potentially continuing to its upper boundary at 1.4140.

Summary

The USDCAD rate remains under pressure as the Canadian dollar strengthens amid rising inflation and lower expectations of a sharp Bank of Canada rate cut. Technical indicators for today’s USDCAD forecast suggest that a corrective wave could extend towards the 1.3900 level.