Microsoft stock is in a consolidation phase. In which direction will it move next?

From 5 July to 5 August 2024, Microsoft Corporation’sshares declined by 17%. Despite the company meeting all forecasted targets, investors are concerned about the slowing growth rates amid rising expenses for developing and implementing artificial intelligence (AI). Clearly, market participants are uncertain about Microsoft’s ability to monetise AI within its products effectively. However, there has been no evidence of panic selling, with prices remaining within the range of 400 to 440 USD. It seems investors are waiting for significant triggers before buying the stock.

This article discusses Microsoft Corporation and its business activities, provides a fundamental analysis of its report, and includes a technical analysis of MSFT stock. This information forms the basis for a forecast of Microsoft’s stock performance for December 2024 and the upcoming 2025.

About Microsoft Corporation

Microsoft Corporation is among the world’s largest technology companies, specialising in software development, computer hardware, cloud services, and other technologies. The company was founded on 4 April 1975 by Bill Gates and Paul Allen. Microsoft is renowned for its flagship products, including the Windows operating system, the Microsoft Office suite, the Bing search engine, the Azure cloud platform, Xbox gaming consoles, and various other innovations. It is actively expanding its initiatives in artificial intelligence, corporate solutions, and software development. Microsoft’s initial public offering (IPO) occurred on 13 March 1986, when its shares were listed on the NASDAQ stock exchange under the MSFT ticker. Today, Microsoft holds a leading position in the global technology industry.

Key revenue streams of Microsoft Corporation

Microsoft’s revenue comes from three core business segments – Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Each of these is described below:

- Productivity and Business Processes: products and services aimed at enhancing productivity and business processes. This segment covers the following products:

Microsoft Office (Office 365 and Microsoft 365) – software suites designed to improve productivity and optimise business processes.

LinkedIn – a professional networking platform.

Dynamics 365 – cloud-based and on-premises business management solutions, including ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management).

The primary clients of this segment include corporate users, small businesses, and individuals.

- Intelligent Cloud: cloud-based platforms and infrastructure for developing corporate solutions, including:

Microsoft Azure – is one of the world’s largest cloud-based platforms, providing data storage, artificial intelligence, analytics, and app development services.

Server products and licences – Windows Server, SQL Server, Visual Studio, and System Center.

Support and consulting services – technical support, training, and cloud and server solution customisation.

This segment focuses on companies developing complex systems and apps based on cloud computing.

- More Personal Computing: products and services focused on individual users and personal devices, including:

Windows – an operating system that forms the basis for managing computer hardware and software resources.

Devices – the Surface line-up (laptops, tablets, hybrid devices) and accessories.

Gaming business – Xbox consoles, Xbox Game Pass subscriptions, sales of games and accessories, and revenues from cloud gaming.

Advertising – revenues from the Bing search engine and advertising on other Microsoft platforms.

This segment is aimed at end users and original equipment manufacturers (OEMs).

Microsoft Corporation’s strengths and weaknesses

Microsoft Corporation has several strengths that give it a competitive edge in the market:

- Leadership in cloud technologies: Microsoft is the leader of this sector through its Azure platform, which competes with AWS from Amazon.com Inc. (NASDAQ: AMZN) and Google Cloud from Alphabet Inc. (NASDAQ: GOOG). Azure’s integration with the company’s other corporate products (Windows and Office) simplifies and enhances clients’ transition process to the cloud. Microsoft holds key positions in the corporate segment as many of its solutions, such as Office 365 and Windows Server, are business standards

- AI innovation and development: the company invests heavily in artificial intelligence and innovation. An example of these efforts is the integration of OpenAI technologies into Microsoft 365 and Azure AI products. Microsoft’s software and device ecosystem offers users a seamless experience thanks to the deep integration of products, including Windows, Office, Xbox, and Surface, and the popularity of developer tools like Visual Studio and GitHub

- Strong position in the gaming sector: Microsoft has strengthened its position in gaming through the Xbox Game Pass subscription service and acquisitions of major game studios – Bethesda and Activision Blizzard. This allows it to compete with companies like Sony (NYSE: SONY) and Nintendo Co., Ltd successfully

- Financial stability: the company demonstrates sustained revenue and profit growth, strong liquidity, and effective debt management, which gives it significant advantages over competitors. High financial liquidity enables Microsoft to invest in strategic areas such as artificial intelligence, cloud technologies, and acquisitions of major market players. The company’s free cash flow of 74.1 billion USD reinforces its position for long-term investments and payouts to shareholders through dividends and stock buybacks. This distinguishes it from the companies that rely on borrowings to fund growth. Microsoft also maintains a low level of debt. Its long-term debt of 42.8 billion USD and available cash of 78.4 billion USD makes the company less dependent on external financing

Despite its numerous advantages, Microsoft faces certain challenges that may impair its competitiveness:

- Microsoft product vulnerability to cyberattacks: as the most widely used operating system, Windows is one of the primary targets for hackers. Numerous vulnerabilities and large-scale cyberattacks highlight the product’s security weaknesses, undermining user trust, particularly among corporate clients, for whom reliability and data protection are top priorities. Competitors like Apple Inc. (NASDAQ: AAPL) offer more secure ecosystems, posing additional risks to Microsoft

- Unsuccessful acquisitions: Microsoft invests heavily in acquiring third-party companies, some of which have resulted in significant problems. For example, its purchase of Nokia’s mobile business in 2013 ended with the write-off of nearly the entire deal amount a few years later. The acquisition of Beam (later renamed Mixer) also falls into this category, as this division was wound up in 2020. These mistakes suggest issues with integration and overall strategic planning. If such blunders continue, they could negatively affect the company’s reputation and financial position

- Anticompetitive practices: Microsoft is facing criticism in the cloud services sector, where competitors accuse it of restricting access to popular programs like Office 365. Such allegations could lead to fines and regulatory restrictions, weakening the company’s position

- Overinvestment in AI: Microsoft is investing heavily in this area, including partnerships with OpenAI and the integration of technologies into its products. Despite the potential for AI, large-scale funding in this area carries serious risks, especially if market interest in AI wanes or the technology fails to meet expectations. In the short term, these investments may reduce operating profit and cause negative reactions from shareholders

These challenges are potential threats to Microsoft, and overcoming them will require the company’s strategic approach, flexibility, and innovative thinking.

Microsoft Corporation Q1 2025 report

Microsoft released its Q1 fiscal 2025 report on 30 October 2024. Below are the key figures:

- Revenue: 65.6 billion USD (+16%)

- Net income: 24.7 billion USD (+10%)

- Earnings per share: 3.3 USD (+10%)

- Operating profit: 30.5 billion USD (+13%)

Revenue by segment:

- Productivity and Business Processes: 28.3 billion USD (+12%)

- Intelligent Cloud: 24.1 billion USD (+20%)

- More Personal Computing: 13.2 billion USD (+16%)

Microsoft’s management expressed optimism about the Q1 fiscal 2025 results. Chairman and CEO Satya Nadella highlighted the company’s focus on AI transformation and its impact on work and business processes. Overall, AI revenues will surpass 10 billion USD in annual revenue next quarter, marking the most rapid growth in Microsoft’s history. He also noted that the company continues to expand its capabilities and attract new clients, enabling them to leverage AI platforms and tools for business development.

Looking ahead to Q2 fiscal 2025, Microsoft forecasts a continuation of the trends seen in the past quarter. Robust growth is expected from commercial clients due to long-term contracts, which will likely drive increased capital expenditures on AI.

Expert forecasts for Microsoft Corporation stock for 2025

- Barchart: 34 of 40 analysts rated Microsoft stock as a ‘Strong Buy’, three as a ‘Moderate Buy’, and three as a ‘Hold’, with an average price target of 504.45 USD

- MarketBeat: 27 of 29 specialists assigned a ‘Buy’ rating to the shares, while two gave a ‘Hold’ recommendation, with an average price target of 503.03 USD

- TipRanks: 27 of 30 professionals recommended the stock as a ‘Buy’, while three gave a ‘Hold’ rating for the shares, with an average price target of 497.52 USD

- Stock Analysis: 12 of 30 experts rated the stock as a ‘Strong Buy’, 17 as a ‘Buy’, and one as a ‘Hold’, with an average price target of 503.43 USD

None of the experts recommended selling Microsoft Corporation stock.

Technical analysis and forecast for Microsoft Corporation stock for December 2024

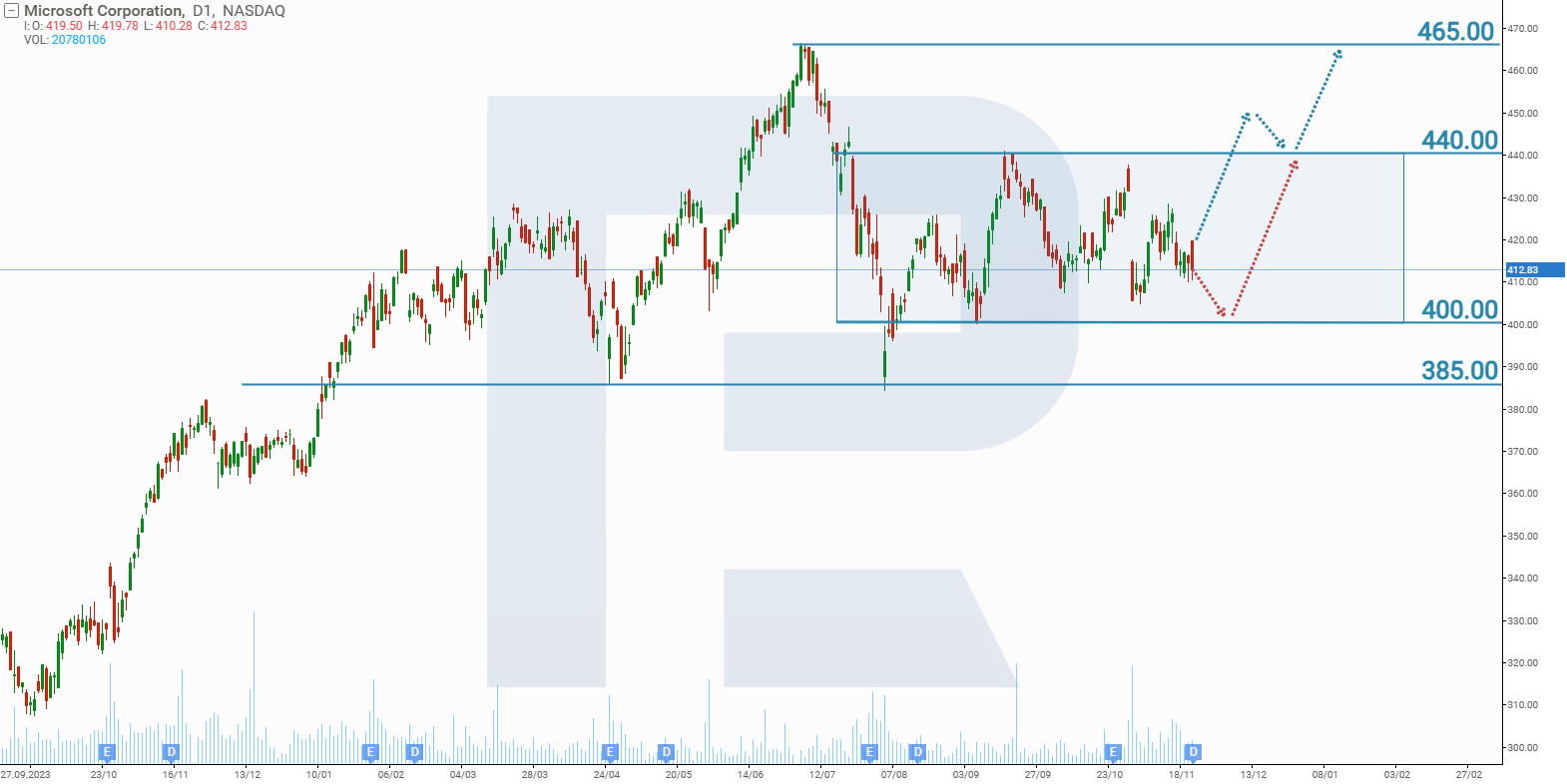

Microsoft Corporation stock is trading between the 400 USD and 440 USD levels on the daily timeframe. Following the release of the quarterly earnings report, the stock price moved towards the lower boundary but has yet to reach it. With December approaching and the traditional New Year rally on the horizon, which typically boosts shares, two scenarios can be considered based on the current Microsoft stock performance:

The optimistic December 2024 forecast for Microsoft stock suggests growth from the current level to the upper boundary of the range – the 440 USD resistance level. An upward breakout could push the stock to an all-time high of 465 USD.

The alternative forecast predicts a test of the range’s lower boundary at 400 USD, followed by a rebound and movement within the range. The stock will most likely reach the 440 USD resistance level again.

MSFT stock analysis and forecast for December 2024Technical analysis and 2025 forecast for Microsoft Corporation stock

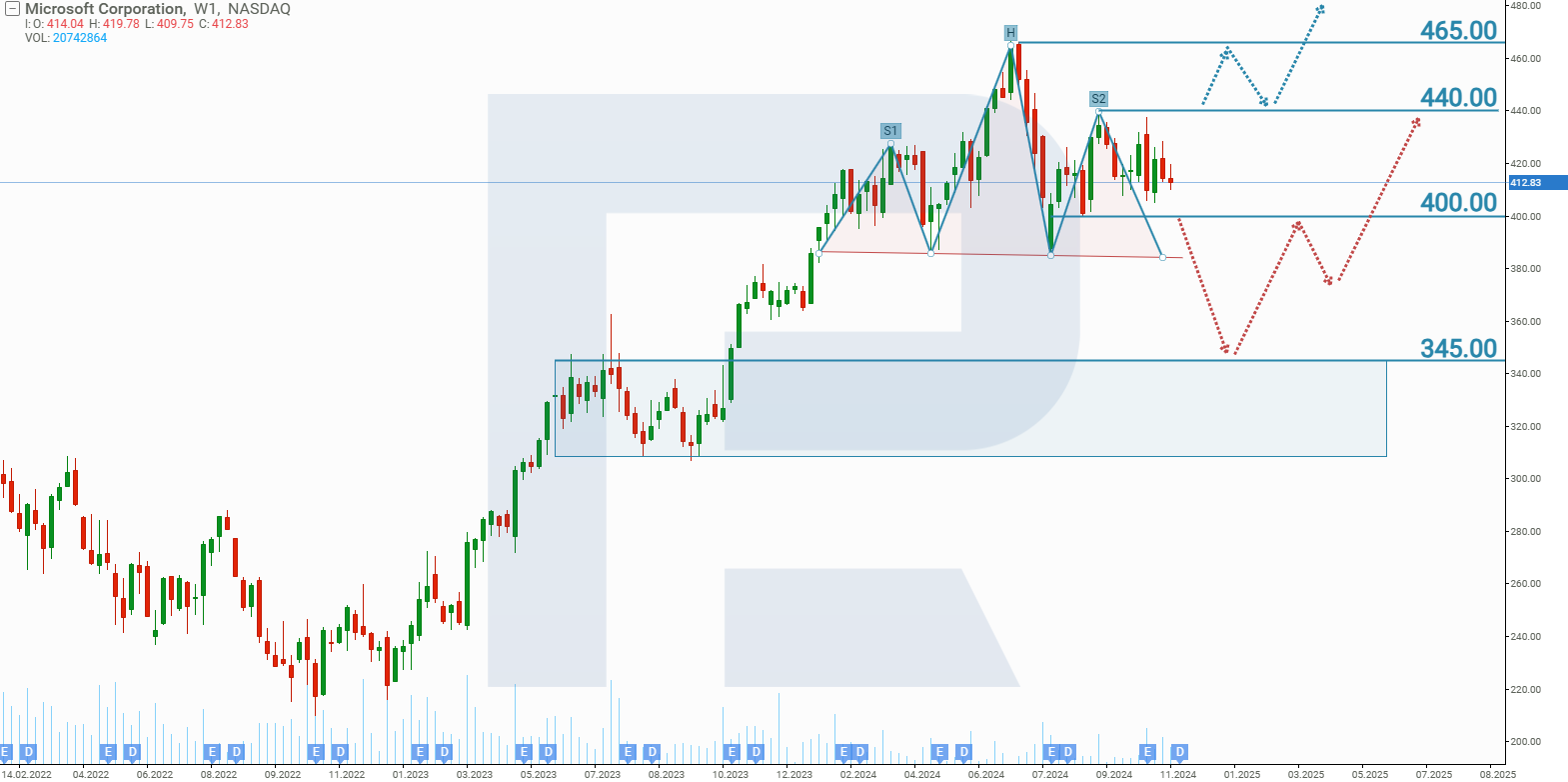

There are preconditions for further growth of Microsoft stock on the weekly timeframe. A head and shoulders pattern has formed on the asset chart, signalling the completion of the previous uptrend and a potential price decline. In this situation, everything will depend on how events evolve in December 2024 and which levels are breached. Based on this, two scenarios are likely for 2025.

The optimistic Microsoft stock forecast implies a breakout above the 440 USD resistance level, followed by a rise to 545 USD. This level was determined using Fibonacci extensions.

The negative forecast suggests a decline in line with the head and shoulders pattern. In this case, a break below the 400 USD support level will be the first signal for the start of the movement. The next signal will be a breakout below the 380 USD neckline, with a target for the decline at the 345 USD support level. A rebound from this level would indicate that Microsoft stock has resumed its growth.

MSFT stock analysis and forecast for 2025Summary

In collaboration with OpenAI, Microsoft Corporation holds a leading position in developing artificial intelligence technologies. However, the inflated costs associated with AI have understandably raised questions among investors about the efficiency of its monetisation. If Microsoft’s management succeeds in not only integrating AI effectively into its products but also outlining clear prospects for this technology, its shares could break out of the current consolidation phase and resume their upward trajectory. On the other hand, if this is not achieved, investor confidence in AI as a strategic focus may weaken, leading to reduced interest in the company’s shares.

That said, Microsoft remains one of the industry leaders with a strong financial position, so a near-term collapse is unlikely.