Nicholas Korzeniowski - Trading Ideas October 2016. Systemic risk in German.

Key points:

- News about Deutsche Bank issues come to the fore. We expect that this will lead to the first increase in volatility in the EURUSD, and then a pair of fall.

- The first televised debate of the US presidential candidates did not clarify the political picture. Wait till the second and third circle debate.

- In the current environment, we continue to prefer on Long CHFJPY and XAGGBP. Couple EURRUB seems good speculative Short.

In early October, the mood on the market are determined by two main themes: the US presidential election and now has almost full-blown crisis Deutsche Bank. Both events carry significant risks, and both are in development. Impact of the elections, we fully palpable, apparently, after the announcement of the results of voting on 8 November. As long as US policy greatly affects only the Mexican peso. For the past two months MXN negatively react to the rating of Trump, known for his unfriendly remarks against Mexico.Correlation popularity of Donald and Mexican currency at the moment is strong, negative and greater than 70% (assuming rank correlation based on forecasts of bookmakers and daily close the American session at USDMXN). However, this instrument is liquid enough to somehow affect the whole spectrum of EM-currencies, so it remains to local history. Other markets are calmly react to the political race in the United States due to a lack of clarity. Make any conclusions is still premature.

An important event, of course, became the first debate of the US presidential candidates, held on 26 September. Most experts and viewers give the victory in the debate, Hillary Clinton. Indeed, after the debate, former US Secretary of State increased the lead of his rival, Donald Trump is still 2 percentage points. However, to write off Trump off early. It is easy to see that a large part of the Republican speech was aimed at the so-called "oscillating" states. To some it may seem that the increased attention being paid to Trump Ohio, Michigan, Pennsylvania, and others., Made his speech in general weak. But we remember that the gap between the candidates is minimal, and the last word in November it will be for the people of these key areas. We do not exclude the fact that it is a game to undecided voters in the end will help Trump elections. However, a more accurate prediction can be made after the completion of all three stages of the debate.

The influence of politics on markets should intensify closer to November. To this there are two obvious reasons. The first is the expectation of changes in the fiscal sphere. Investors are not ready to Trump's program and in no way it is not discounted. If his chances of winning will increase, all asset classes move into higher volatility regime. Secondly, we believe that the pause in the American Central Bank action caused solely by a desire to avoid unnecessary risks in a hot political season. When Hillary will be able to provide a significant lead over rival, the market will start preparing to raise interest rates in December. In our opinion, this may cause some destabilization. But not because of the actual policy tightening - this has all ready - and in view of recent developments in the European financial markets.

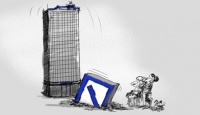

Here we are, of course, talking about the second major topic of the month: the financial problems of Deutsche Bank. The company burns to the eyes, which significantly and extremely adversely can affect the markets. Deutsche Bank was in a very dangerous situation. US authorities require from Deutsche $ 14 billion for the settlement of the case with mortgage bonds. The amount of the fine is comparable to the cost of the entire company, and in fact it may be buried. Brewing is a real risk that the bank will attract additional capital.

It turns out a kind of a negative vicious circle. Potential dilution of equity shares of Deutsche collapses to historic lows. This, in turn, is fueling speculation about the company's instability. Money is becoming more necessary, but it is absolutely unclear where the bank will take them. Angela Merkel and Mario Draghi has made it clear that to solve the problems of individual organizations, they are not going to. Madam Chancellor and does exclude the possibility of any state aid to Deutsche. Such a decision can be explained by the fact that the German authorities are preparing for the upcoming elections and did not want to risk a vote, putting the salvation of taxpayers. But Mr Draghi pointed to a weak business model. She was not able to adapt to zero and now the negative interest rates, although many banks have succeeded. Compounding situation and the fact that Deutsche is in the process of reducing their derivatives portfolio. The size of investments declined by almost half, from 75 trillion to 46 trillion dollars. It is hardly possible to hope that all positions were liquidated at a profit.

But here's the problem becomes and the system. According to the Bank for International Settlements, at Deutsche for 11% of the total volume of derivative contracts in the world. This makes it a kind of a central counterparty, which now suddenly becomes the weakest link. Now the consequences are already quite well marked. First, a sudden increase in the three-month LIBOR-rate in dollars.Now it is 0.85%, and in July was 0.6%. This jump occurred without any help from the Fed, although in fact it is full raise rates by 0.25 bps This development clearly shows a lack of confidence on the interbank market despite the fact that dollar liquidity in global markets abound. Déjà vu 2008? Partly.

But suppose that the increased levels of LIBOR can be explained by some other factors. There is one more indication that the problem lies precisely in the EU banking system. The amount of loans granted in the framework of the ECB's dollar line, suddenly soared to $ 6 billion. Such large-scale assistance to the central bank was no more than two years. This can be explained only by the fact that some bank failed to find funds in the open market. I would like to emphasize that the bank, which came to a lender of last resort, is not necessarily the Deutsche. However, this does not improve the situation. Anyway, someone does not have enough liquidity. Is this a consequence of the problems of Deutsche, we have yet to learn.

We turn to the implications for the markets. First, there are signs of some repatriation flows in euro. Whether Deutsche suffering or some other European banks, they are likely to sell foreign assets to reduce leverage. This is quite logical and expected step that gives EUR short-term support. This is most likely due to the fact that the currency is still trading above $ 1.12. However, such a demand is short-lived.

Second, there are signs of a lack of dollar liquidity. I would like to emphasize that under the current monetary policy of the Fed and the ECB, it is unlikely to lead to system crashes. Here the situation for 2008 minutes is quite different. However, the forces of supply and demand has not been canceled. And finally, they must support the American. Lingering Fed inaction weighs on the dollar, but nevertheless, the regulator has made it clear that he intends to raise rates at least once this year. It is the softest of our scenarios, but we firmly believe that under otherwise equal conditions, the Fed is ready to raise in December. This, in turn, will make LIBOR-rate is even higher and lead to greater purchasing USD against the EUR, GBP, and JPY.

And, thirdly, separately back to the question of general liquidity. In the global financial system, it is still a lot. Moreover, the balance sheets of key CB grow, due to changes in the policy of the ECB and the Bank of Japan. Thus, problems in the banking sector the EU will mostly concern the euro and, to a lesser extent, other currencies funding. High Yield EM-tools is must be stable. The Russian ruble remains our favorite candidate for the purchase of the currencies of the emerging market. Couple USDRUB targeting the mark of 58, and the current price levels do not seem to us to be too low. There are, however, a risk that the Bank will intervene and Russia will resume buying the currency to replenish reserves. In view of the above, a reasonable option, we believe the opening of Short EURRUB for the purpose of 65. The Chinese yuan, on the contrary, remains unattractive. People's Bank of China is likely to give the currency a little bit loose in anticipation of the Fed raising rates.

EURUSD: structural rally is unlikely, therefore, we continue to short

Sell at the level of 1.1265, building up to 1.14 for the purpose at the level of 1.086 / 1.05, a stop at 1.151.

First, we must recognize that the open short position on EURUSD was incredibly difficult. The couple does not want to come out of a very narrow range, and it is annoying. On the reasons for the "stability", we discussed in detail in our previous reviews. Alas, since then, little has changed. The main disappointment is the lack of differences in the monetary policy of the ECB and the Fed, or rather inaction of the latter. The most likely scenario, we still think the rate hike in December. The market has, however, partially discounted such an outcome, therefore under strong pressure EURUSD pair will not appear even if we finally see this increase. But December is still a lot of time.

However, we can not ignore the new developments in the markets. Issues Deutsche Bank could lead to a significant weakening of the euro. Given the volatility of the time, we would use any opportunity for opening new shorts on EURUSD. 1.126 seems a good entry point, but do not rule out move to a mark 1.14. Those who think that the repatriation is unable to provoke a significant demand, we want to remind about December 2008. Then the return of local capital in Europe has allowed EURUSD «fly away" from 1.26 to 1.46.Now, we do not expect due to significantly higher saturation of the banking system liquidity, such fantastic movement, but the risk-management must be strict. The main objectives are the levels of 1.086, followed by 1.05.

EURRUB: trading liquidity and a positive carry

Sell at the level of 71 for the purpose at the level of 65 to 72.2 feet.

Ruble feels very confident. Currencies showed impressive rally as oil prices back to around $ 50. But it was a local driver. And the main source of power - the demand for Russian assets, primarily in the OFZ. In September, the Bank of Russia cut its key rate 50 bps. n., as expected. However, the accompanying release it sounded pretty tough. The Bank made it clear that is not going to change the policy before the start of 2017, we expect that the next step would be to reduce the key is only 25 b. n., and it will happen in the first quarter.

While monetary policy the Bank of Russia remains tough, the ruble will feel relatively well. Foreign investors are profiting from and coupons, and a rise in price of debt securities, and on the strengthening of our currency after recovering oil. And get out of Russian assets is unlikely someone will be until after rate cuts cycle. And with the Central Bank of speed is not soon. On the other hand, and European rates will rise any time soon. Moreover, the events surrounding the Deutsche Bank, likely to provoke an outflow of money from the European Union. And this money is quite could go in protection tools, as well as in revenue, ie in Russia. Do not forget that the best results this year show the ruble, the Brazilian real and the Japanese yen. For the market it is extremely uncharacteristic combination. However, it is a good indicator of where capital flees from financial repression Fed and the ECB.

CHFJPY: closely observe the trend for a fall

Buy at 104.1, 102.6 on building up with the aim of 105.2 / 108 to 101.1 feet.

The yen becomes more suitable candidate for sale. Enhancements to the program of quantitative and qualitative easing (QQE), proposed by the Bank of Japan, we seem powerful enough to trigger currency weakening. The main change in the policy is a shift from the monetary base on sovereign bonds (JGB). The Bank of Japan is planning to target profitability along the entire curve. But there are important accompanying details. The head of the Central Bank Haruhiko Kuroda has made it clear that the monetary base can grow even faster in the new policy. In other words, tracking changes in the profitability of Japanese securities, you need to follow and the overall dynamics of the money supply. When a certain combination of factors, it can grow faster than ever before.

Tactically, we continue to believe that you need to sell yen with caution, especially in the traditional USDJPY, EURJPY. The reason for this - the potential demand of speculators on certain debt securities of the Japanese government. The desire of the Bank of Japan to control the yield curve provides a large speculators rather attractive opportunities. This, in turn, may cause the yen buying. There is a risk that the situation will aggravate repatriation flows. So until the end of March 2017, we prefer to simply watch the dynamics of the monetary base and the success of new measures.

Sale of the Japanese currency is likely to become one of the main topics of the next year, after the spring return of profits to the country. We expect that in 2017 the USDJPY will reach the mark of 118. But minutely, our focus is on cross CHFJPY. From a technical point of view, cross-country schedule drawn triangle consolidation. It turns out it can take place in any direction, but it is indicative of the direction of travel. Unpleasant situation with Deutsche Bank makes an attractive Long on the Swiss franc. It traditionally acts as a protective asset and it is likely to benefit from the turbulence in the euro area.

XAGGBP: waiting for the next increase

Buy at 14.65 for the purpose of 18.7, a stop at 13.45.

Long in precious metals we also still like. Unfortunately, after the first part of the upward movement, this class of assets is consolidated in a wide range. However, the price action says about the obvious potential for the resumption of the upward movement.And we continue to expect that gold and silver will look good against the EUR, GBP, and even USD. Such as the crosses XAGGBP, likely to continue to move higher regardless of the Fed's actions and concerns Deutsche.

Consider a few scenarios. If the Fed will raise rates in December, a blow to a greater extent will pair GBPUSD, than XAGUSD. If the Fed for some reason continue to idle, will benefit mainly metals and raw materials. In the case of the collapse of the Deutsche Bank will rise a wave of demand for protective assets, which easily becomes gold, platinum, as well as some currencies, particularly CHF. And if the bank still will be able to settle matters with the US government, the British pound will fundamentally weaker than solid materials.Anyway, the whole spectrum of cross XAU and XAG looks good. You just sit volatility. We also stress that the cost of retaining positions (swap Kerry) is negligible, so you can be in it long enough.

forecast Author - Nicholas Korzeniowski, AMarkets analyst, author and host of "The Economy. The course of the day "on the TV channel" Russia 24 ".

Analytical reviews and comments reflect the personal opinion of the authors and are not a recommendation to trade. AMarkets shall not be liable for any damages in the case of review materials.

:

Forex news → How to make money on oil today? Trading ideas for oil traders 08/04/2020: Will Brent test $ 45 a barrel?

Forex news → How to make money in the foreign exchange market today! Trading ideas for traders 03.12.2020: GBPUSD What will happen to the pound?

Forex news → How to make money on Forex today? Trading goes traders 09/23/2020: Steam and GBP / JPY - another candidate for the medium-short!

Новости Форекс → Как сегодня заработать на нефти? Торговые идеи трейдерам по нефти 04.08.2020: Протестирует ли Brent $45 за баррель?

Forex news → How to make money on the foreign exchange market! Trading ideas for traders 11/26/2020: EUR/USD is about to hit 1.20!