The NZDUSD pair rose to 0.5913 on Friday, signalling a recovery following market sell-offs. Find out more in our analysis for 29 November 2024.

NZDUSD forecast: key trading points

- NZDUSD closes the week with gains

- A weak US dollar and the RBNZ’s interest rate decision support the Kiwi

- NZDUSD forecast for 29 November 2024: 0.5920

Fundamental analysis

The NZDUSD rate rose to 0.5913. The New Zealand dollar is poised to record a weekly gain against the US dollar, a rare event for the NZD recently.

Robust consumer confidence statistics have supported the New Zealand currency. This measure hit a three-year high in November, reflecting the impact of lower interest rates and easing inflationary pressures.

Earlier this week, the Reserve Bank of New Zealand lowered the rate by 50 basis points to 4.25% per annum. At the same time, the market received signals that a similar rate cut might occur in February next year.

The NZDUSD forecast suggests a localised increase.

NZDUSD technical analysis

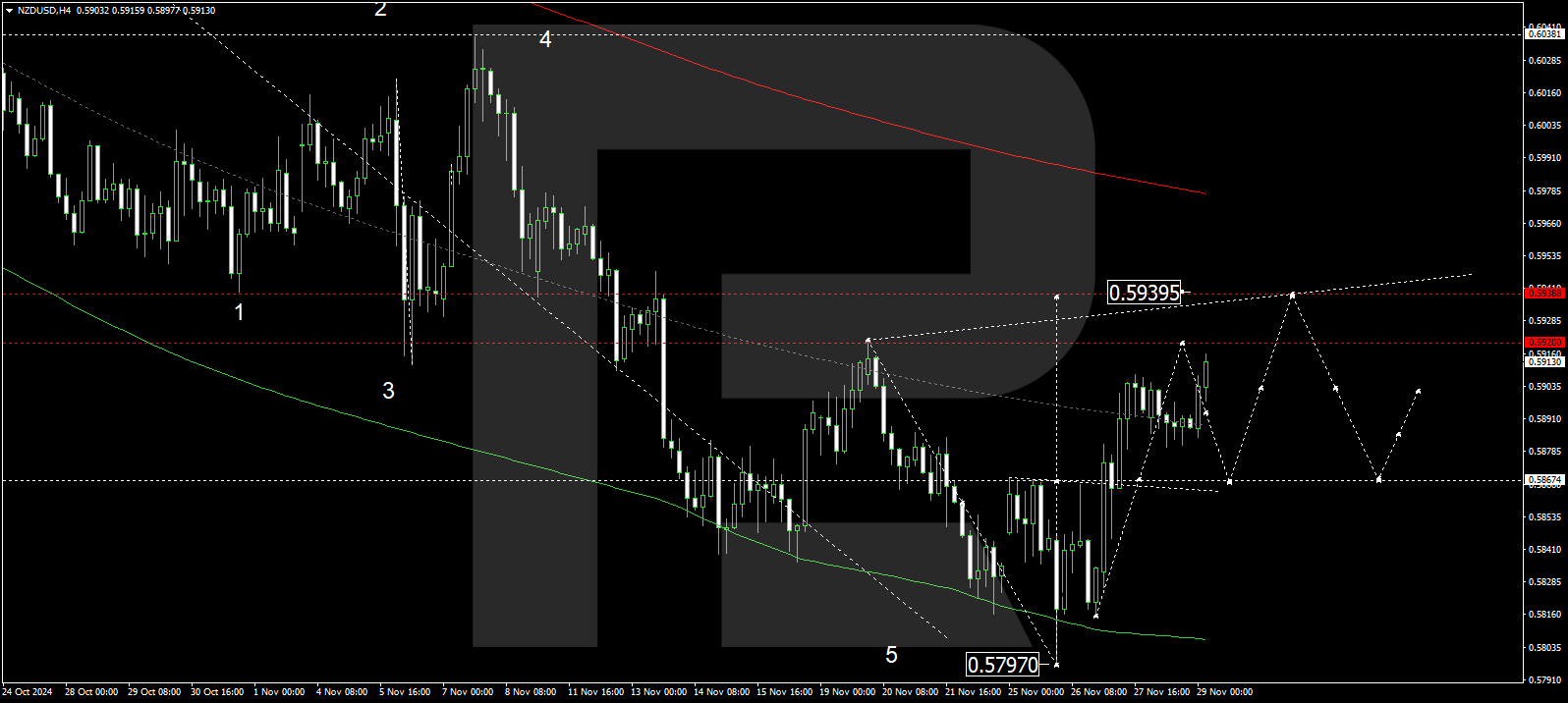

The NZDUSD H4 chart shows that the market is progressing towards 0.5920, the local estimated target. This level could be reached today, 29 November 2024, before a potential decline to 0.5868 (testing from above). Subsequently, a new growth wave might start, aiming for 0.5939 as the first target.

The Elliott Wave structure and wave matrix for the NZDUSD rate, with a pivot point at 0.5867, support this scenario. The market is forming a consolidation range around this level, and a breakout is expected towards the upper boundary of a price envelope at 0.5939. A correction may follow, targeting its central line at 0.5867.

Summary

The NZDUSD pair ends the final week of November with notable gains. Technical indicators for today’s NZDUSD forecast suggest that the growth wave will likely persist, reaching the 0.5920 level.