In anticipation of data from the UK and the US, GBPUSD quotes may reverse and head towards the 1.3500 mark. Discover more in our analysis for 16 July 2025.

GBPUSD forecast: key trading points

- UK Consumer Price Index (CPI): previously at 3.4%, projected at 3.4%

- US Producer Price Index (PPI): previously at 0.1%, projected at 0.2%

- GBPUSD forecast for 16 July 2025: 1.3500

Fundamental analysis

The GBPUSD forecast for 16 July 2025 takes into account that the pair remains in a correction phase and is currently near the support level of the ascending channel.

The UK Consumer Price Index reflects changes in the cost of goods and services for consumers and helps assess consumer behaviour trends and potential stagnation in the economy. Generally, if the CPI exceeds expectations, it has a positive impact on the national currency.

The forecast for 16 July 2025 suggests the CPI for June 2025 may remain at 3.4%. Any increase would support the British pound.

The US PPI is expected to rise to 0.2%, up from 0.1% previously. However, the increase is modest, and the actual figure may differ significantly from the forecast.

Today’s outlook for GBPUSD remains generally neutral for both the USD and the British pound. But in the case of disappointing US data, the pair may rebound from the support level and form an upward wave.

GBPUSD technical analysis

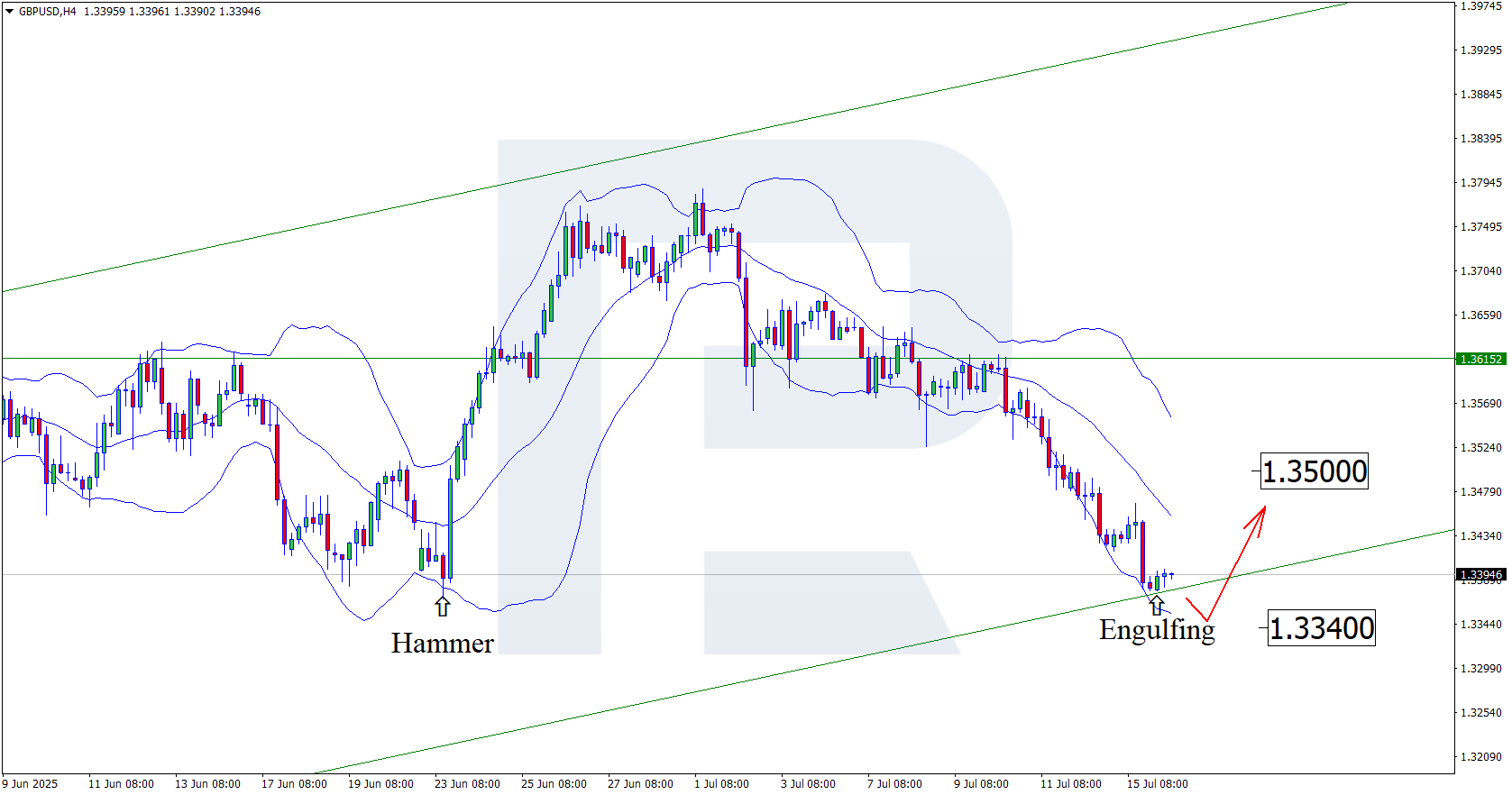

Having tested the lower Bollinger Band, the GBPUSD pair has formed an Engulfing pattern on the H4 chart. At this stage, it may start an upward wave as the pattern plays out. Since the pair remains within the ascending channel and in light of the fundamental data expected from the UK and the US, the upward wave may gain traction.

The key upside target is now 1.3500. A breakout above the resistance level could open the way for further upward momentum.

The GBPUSD forecast also considers an alternative scenario, where the price corrects towards the 1.3340 level before advancing.

Summary

Amid neutral expectations from both UK and US data, the GBPUSD technical analysis suggests a possible rebound from the support level, with the price rising towards the 1.3500 area.