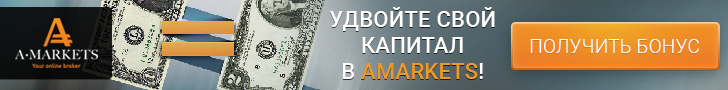

EURUSD Technical Analysis and Forecast : The European currency adjusted up against the US dollar after the strong decline. Nearest level of resistance to ascending correction located at around 1.0915. In the case of rebound from it opens a short position at a price of 1.0905. Long go, since the level of 1.0861, EURUSD pair if the price go away in the support level of 1.0851. MACD on ascending bars is growing, almost approaching the zero mark. Her breakout can be a signal to buy. Stochastics line went from the bottom to the border overbought. The long positions in this is 34.80% of traders, 65.20% of investors have opened shorts. Momentum is equal to 99.97%, shows an average trend rate.

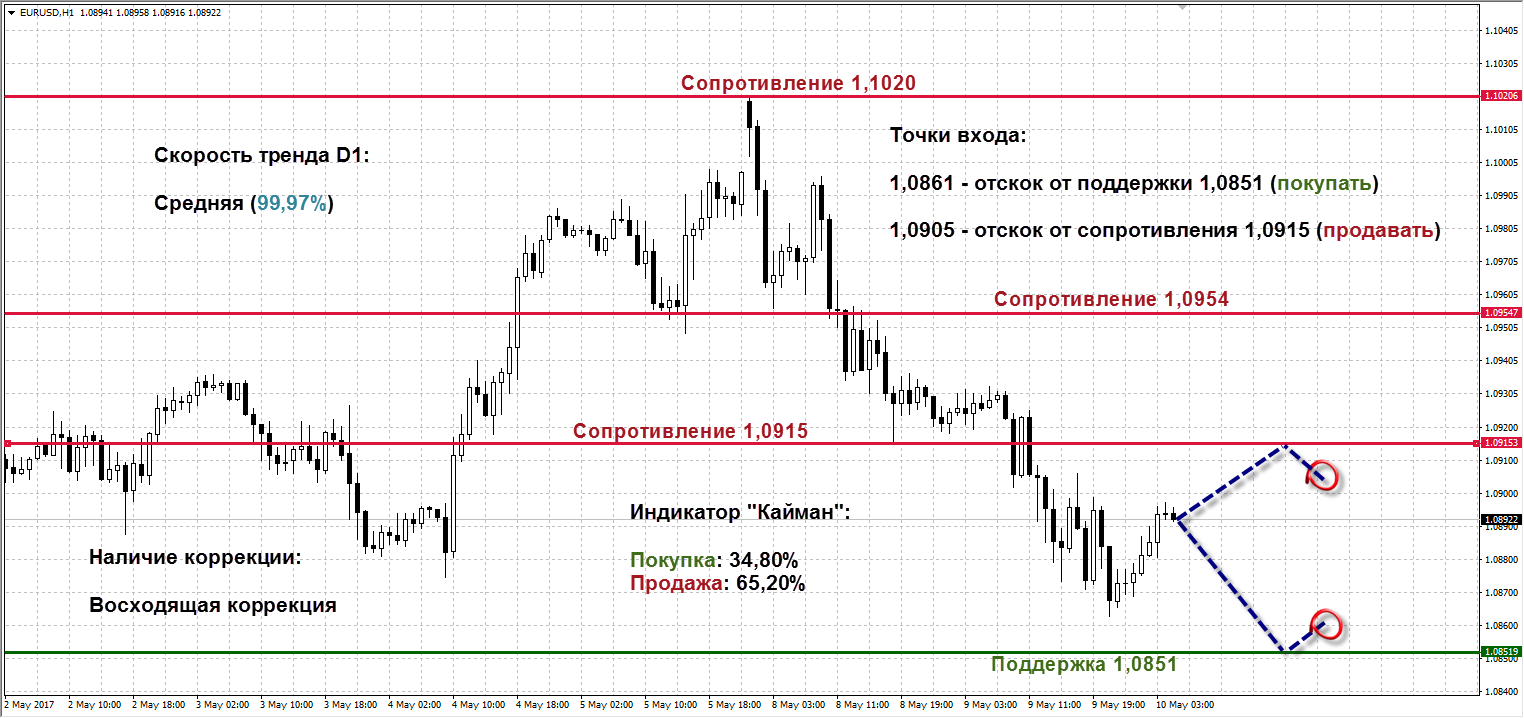

USDJPY Technical Analysis and Forecast: Currency Pair USDJPY negatively corrected after recent gains. The turn is derived from the resistance level of 114.27. In case of repeated rebound takes a short position at a price of 114.17. Long go as low as 113.14 rebound asset quotations from the support level 113.04. As in the beginning of the week, the balance of power between bulls and bears is still in balance: 48.19% of traders are long positions, 51.81% of investors are in shorts. MACD is reduced by falling bars. Stochastic, after spending a short time in the oversold zone, broke it up, and the border went out to the neutral zone, which can be regarded as a signal to buy. Trend average speed, momentum is equal to 99.75%.

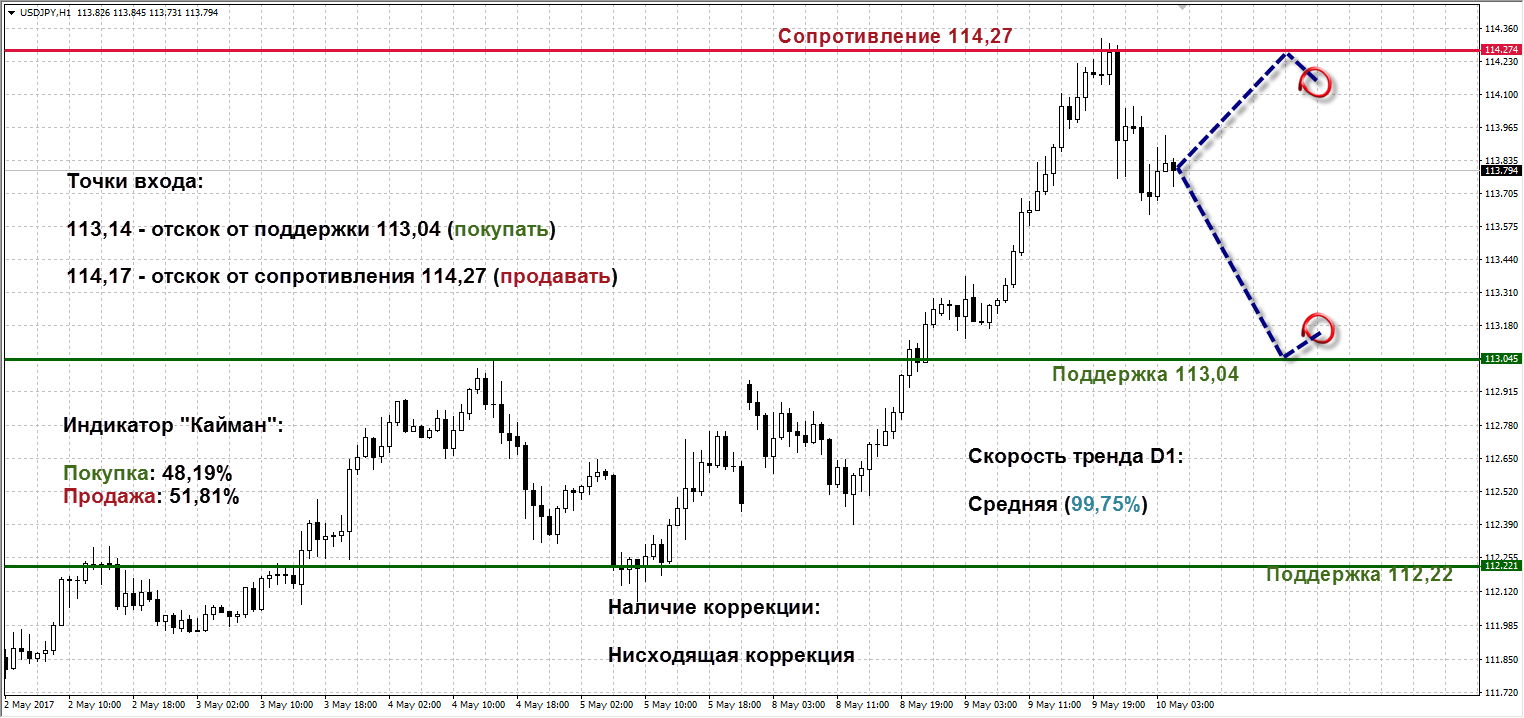

GBPUSD Technical Analysis and Forecast: Quotes GBPUSD currency pair formed a tapering triangle under the resistance level 1.2950. Breakdown of the price level and the upper boundary of the triangle can be considered a strong signal to buy. Long in this case we go, starting with a mark of 1.2970. Short positions are occupied as low as 1.2930, if the asset price will rebound from the resistance 1.2950. In such a scenario believe 81.93% of traders who are in shorts. Long positions occupied 18.07% of the investors. MACD with the shot from the bottom up zeroed and continued growth of the ascending bars that gives a signal in favor of shopping. Stochastic is in the neutral zone, the indicator line while looking down. Momentum 100.17% value indicates the average speed of the trend.

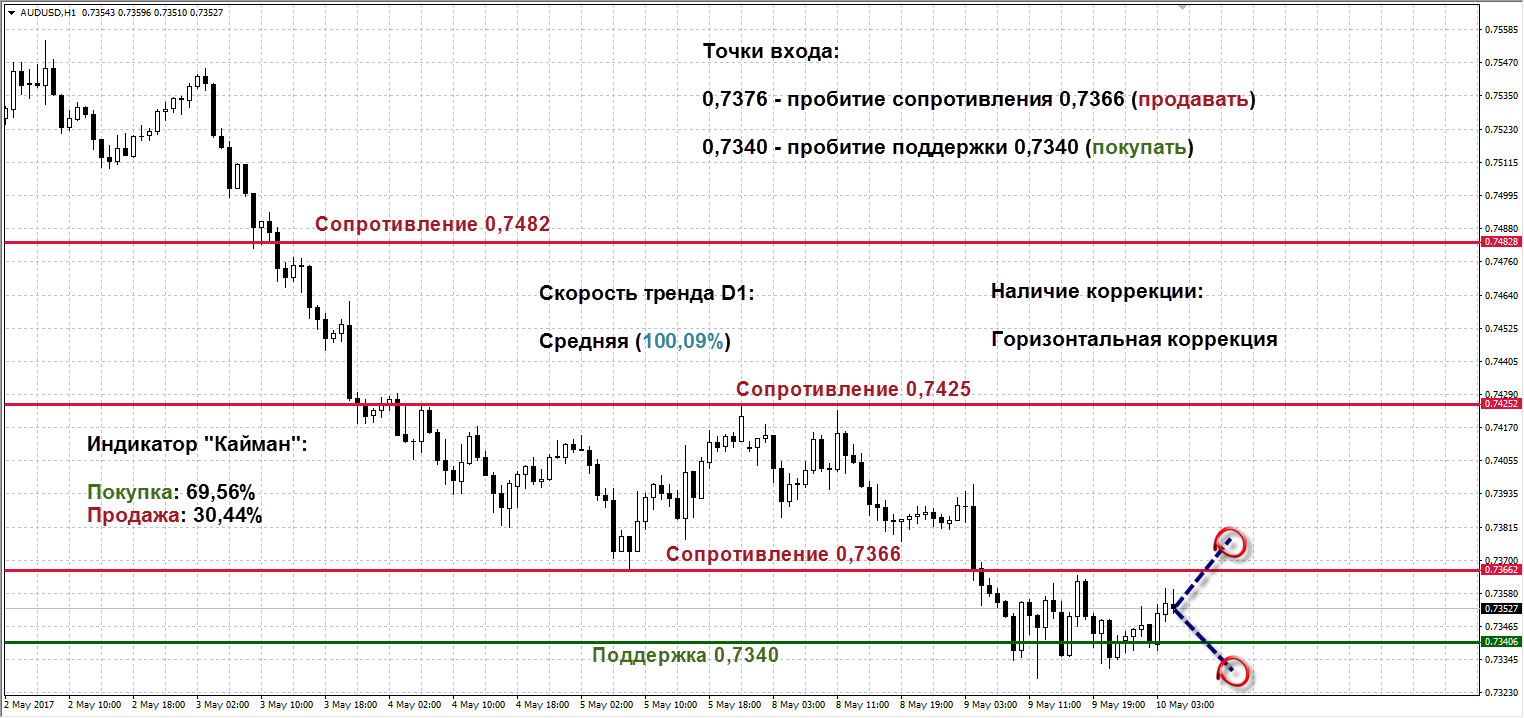

Technical analysis and forecast AUDUSD: The pair AUDUSD traded in a fairly narrow horizontal consolidation between the two price levels. In the event of a range upward and penetration resistance of 0.7366 buy an asset level as low as 0.7376. The short positions go, since the level of 0.7330, if continued downtrend and is broken the support level 0.7340. Among traders dominated by bullish sentiment, 69.56% of them hold long positions. The shorts is 30.44% of the investors. Technical indicators do not give a strong signal, but longer have to buy. MACD formed light bovine convergence during correction side coming up to zero. K line is trying to break through from the bottom up border overbought. Trend at a value of average speed Momentum 100.09%.

Analytics AMarkets