The AUDUSD rate continues its upward momentum, currently trading at 0.6404. Discover more in our analysis for 25 April 2025.

AUDUSD forecast: key trading points

- Private sector activity in Australia continued to rise in April

- Markets expect the Reserve Bank of Australia to cut interest rates in May

- AUDUSD forecast for 25 April 2025: 0.6315

Fundamental analysis

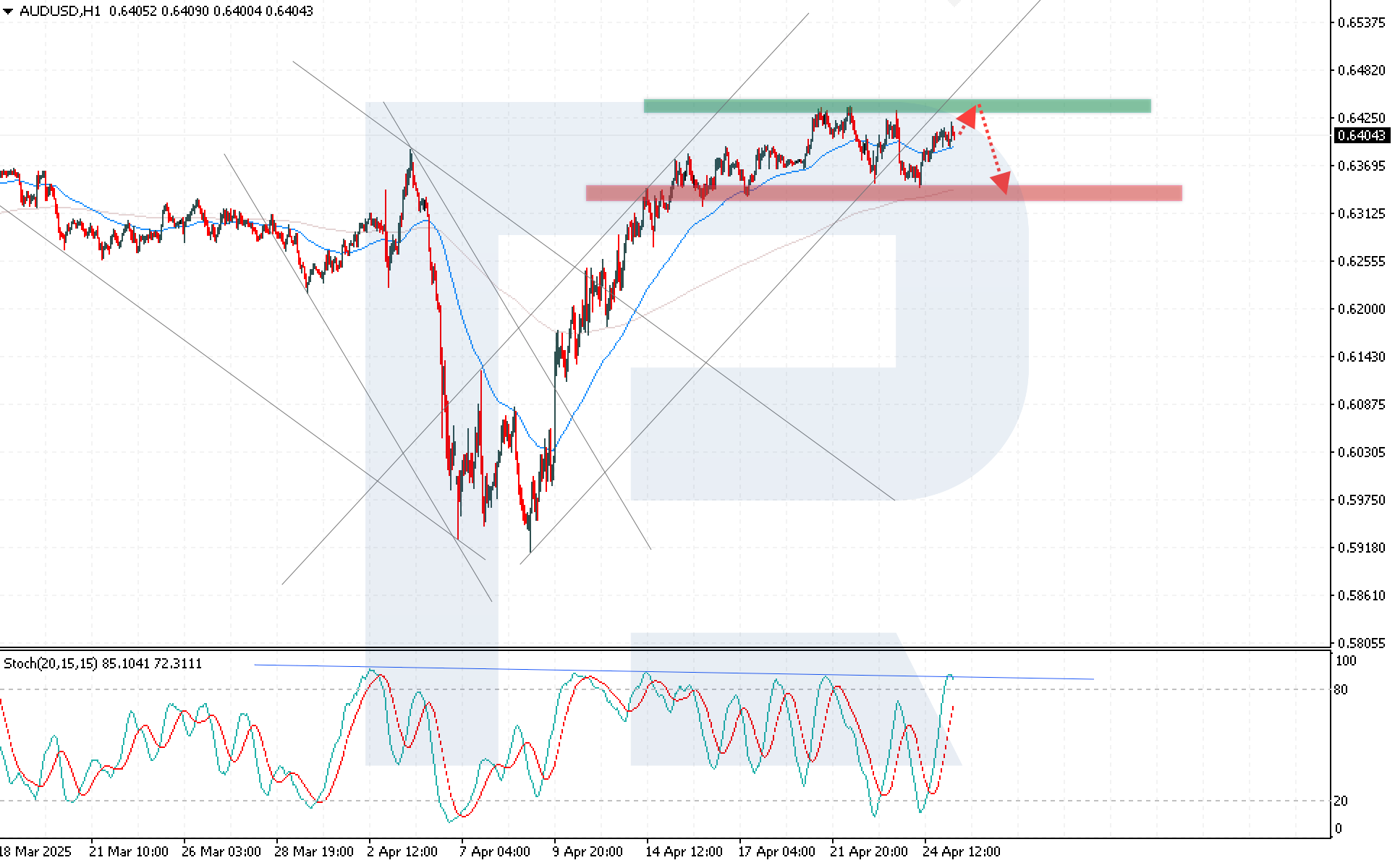

The AUDUSD rate is rising for the second consecutive session, although buyers have yet to break above the 0.6435 resistance level. Trader sentiment shifted after US President Donald Trump stated that trade talks with China would continue, despite denials from Beijing. This uncertainty is capping further gains in the Australian dollar.

Domestic data shows continued growth in Australia’s private sector activity in April, with positive results observed in both manufacturing and services. The S&P Global composite PMI slipped slightly from 51.6 to 51.4, but remains in growth territory.

Despite the encouraging data, markets expect the Reserve Bank of Australia to cut the cash rate by 25 basis points in May. This is seen as a preventive move amid concerns about the potential negative impact of the newly implemented US trade tariffs.

AUDUSD technical analysis

The AUDUSD rate remains in an uptrend, but the pace of gains has slowed, suggesting declining demand from buyers. The AUDUSD forecast for today anticipates a rebound from the upper boundary of the sideways range, with a downside target at 0.6315.

Technical indicators confirm the likelihood of a decline, with Moving Averages indicating waning bullish momentum and the Stochastic Oscillator reaching overbought territory and forming a downward reversal. A breakout below the 0.6395 support level would confirm the bearish scenario.

Summary

The AUDUSD rate is experiencing limited upside due to uncertainty surrounding US-China trade relations and expectations of a Reserve Bank of Australia rate cut in May. The AUDUSD technical analysis points to a potential weakening of the bullish impulse, with a likely downward move towards the 0.6315 level.