USDJPY reacts specifically to tariffs on goods from Japan; quotes may form a correction towards support around 145.20. Details – in our analysis for 8 July 2025.

USDJPY forecast: key trading points

- Trump imposes a 25% tariff on goods from Japan

- Investors seek refuge in USD

- USDJPY forecast for 8 July 2025: 145.20

Fundamental analysis

US President Trump announced the introduction of 25% tariffs on goods from Japan from 1 August. The trade confrontation between the US and Japan does not end at this stage. Earlier, Trump spoke of 50% import tariffs, but gradually his fervour is cooling down, and he does not rule out the possibility of easing tariffs and extending their deadlines.

Attempts to support US manufacturers through higher import tariffs ultimately affect consumers, who will have to pay these tariffs out of their own pockets. Importers, including Japan, China, and the EU, may eventually increase prices for their goods to compensate for tariffs and gain their own profit.

Today's USDJPY forecast does not look optimistic for the yen, but chances for strengthening against the dollar remain. Investors seek safe assets to preserve capital, but at this stage, even USD does not look reliable.

USDJPY technical analysis

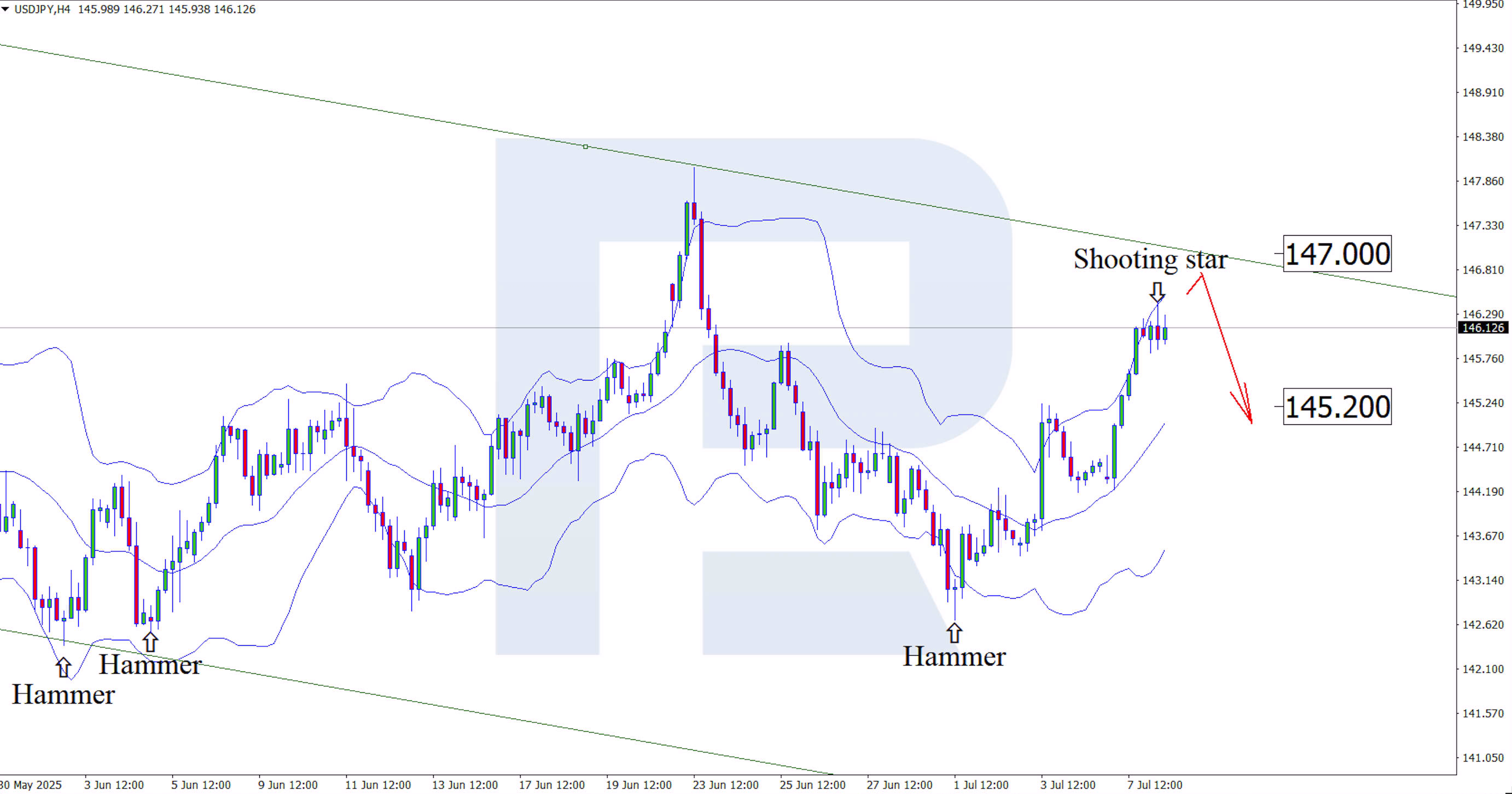

On the H4 chart for USDJPY, price tested the upper Bollinger Band, formed a reversal pattern ‘Shooting Star’ and is located around 146.20. At this stage, it may form a downward wave in line with the pattern signal. USDJPY quotes remain within the descending channel, so it can be assumed they have every chance to reach support at 145.20.

However, the USDJPY forecast also considers another scenario – with a price increase towards 147.00 before declining.

Summary

US trade tariffs bring their adjustments, while USDJPY technical analysis suggests a price correction to the level of 145.20.