UPS lays off staff and closes facilities to navigate new market conditions

In 2018, Amazon launched its Amazon Logistics delivery service in the US, marking the beginning of a significant structural shift in the delivery market. With its financial performance under sustained pressure since then, UPS has been compelled to restructure its business to restore growth.

United Parcel Service, Inc.’s (NYSE: UPS) Q1 2025 report shows the company’s strategic transformation aimed at restoring profitability amid declining volumes. While revenue fell by 1%, adjusted EPS exceeded expectations, reflecting the success of cost control measures. UPS faces a 3.5% drop in US deliveries, alongside pressure from trade tariffs and reduced volumes from Amazon.com, Inc. (NASDAQ: AMZN). The management is actively restructuring, closing 73 facilities, and laying off 20,000 employees to achieve savings of 3.5 billion USD. While global demand remains stable, pressure on margins persists.

In the upcoming Q2 2025 earnings report, investors will focus on volume stabilisation, the cost-cutting program and UPS’s ability to offset negative factors through its tariff strategy and improvements in network efficiency. Amid lingering macroeconomic and trade risks, investor attention will turn to the company’s financial outlook for 2025.

This article explores United Parcel Service, Inc. and its revenue streams, summarises its Q1 fiscal 2025 financial performance and outlines expectations for 2025. It also presents a technical analysis of UPS, which serves as the basis for the UPS stock forecast for 2025.

About United Parcel Service, Inc.

United Parcel Service (UPS) is the world’s largest logistics and courier company, specialising in freight and parcel delivery as well as logistics solutions. It was founded by James E. Casey and Claude Ryan in 1907 in Seattle, US, as the American Messenger Company. The company was renamed United Parcel Service in 1919 when it began expanding operations beyond Seattle. Its initial public offering took place on 10 November 1999 on the New York Stock Exchange under the ticker UPS. The company is engaged in express parcel delivery across the US and globally, along with international logistics, contract logistics, supply chain management, and specialised solutions for a range of industries, including e-commerce, healthcare, and manufacturing. It is headquartered in Atlanta, Georgia. UPS’ primary competitors include FedEx (NYSE: FDX) and DHL (XETR: DHL) (part of the Deutsche Post Group), along with regional and local delivery operators, including national postal services and emerging market players such as Amazon Logistics.

Image of the company name United Parcel Service, Inc.United Parcel Service, Inc.’s business model

UPS’s business model is built around a wide range of logistics and transportation services. The company’s revenue is derived from the following key segments:

- US Domestic Package (domestic delivery across the US): this is UPS’s primary revenue stream, comprising parcel delivery to individuals (B2C) and corporate clients (B2B) across the US. Revenue is generated through express delivery services, including UPS Next Day Air, as well as standard and economy options, with additional charges applied for overweight parcels, urgency, and residential delivery.

- International Package (international shipments): this includes revenue from international parcel and freight deliveries worldwide, covering both export and import operations. UPS operates in over 220 countries, and the international division generates particularly high margins from the express delivery of documents and commercial shipments

- Supply Chain Solutions (logistics and supply chain operations): this segment includes revenue from comprehensive logistics solutions, including contract logistics (warehousing, packaging, and inventory management), specialised solutions for healthcare, manufacturing, e-commerce and technology, LTL transportation services, ocean and air freight, as well as supply chain management and reverse logistics services

- Surcharges and Value-Added Services: this category includes fuel surcharges, peak load charges, insurance, tracking, rerouting, and other related services, which increase the average revenue per shipment

Thus, UPS generates revenue through a diversified portfolio of logistics services, serving both the mass segment (retail clients) and the large corporate sector with tailored supply chain solutions.

United Parcel Service, Inc. Q2 FY 2025 report

On 23 April 2025, UPS published its results for Q1 fiscal 2025, which ended on 31 March 2025. Below is its key financial data compared to the corresponding period of last year:

- Revenue: 21.55 billion USD (-1%)

- Net income: 1.27 billion USD (+4%)

- Earnings per share: 1.49 USD (+4%)

- Operating margin: 8.20% (+20 basis points)

Revenue by segment:

- US Domestic Segment: 14.46 billion USD (+1%)

- Operating profit: 1.01 billion USD (+19%)

- International Segment: 4.37 billion USD (+3%)

- Operating profit: 654 million USD (-4%)

- Supply Chain Solutions: 2.71 billion USD (-15%)

- Operating profit: 98 million USD (-55%)

UPS’ Q1 fiscal 2025 report demonstrated the company’s swift adaptation to external challenges and its focused efforts to enhance operational efficiency and maintain profitability. With revenue down 1% to 21.5 billion USD, non-GAAP adjusted EPS was 1.49 USD, exceeding the consensus forecast by over 8%, indicating the stability of key business areas.

CEO Carol Tomé noted that UPS is undertaking the largest transformation of its logistics network in the company’s history, expecting to save 3.5 billion USD this year by closing 73 facilities and laying off 20,000 employees. This move enables the company to offset lower volumes, including a decline in orders from Amazon and tariff pressure on international shipments. UPS is adapting its structure to meet current demand, becoming more compact and efficient.

Although management did not update its full-year 2025 outlook due to macroeconomic uncertainty, particularly relating to tariffs, it provided guidance for Q2. Revenue is expected to reach 21 billion USD, with US parcel delivery volumes projected to decline by 9%. International margins are expected to remain in the mid-double-digit range (percentage terms). Margins in the US delivery segment are also forecast to rise by 30 basis points, supported by the impact of restructuring.

UPS is prioritising strict cost optimisation over revenue growth, and its Q2 guidance reflects a realistic, cautious stance amid ongoing uncertainty. If the company succeeds in implementing the planned 3.5 billion USD in savings, including potential further restructuring, it could emerge from the current cycle more profitable and resilient.

Risks persist, notably in the form of a weak global economy, trade disputes, and continued volume declines, which may constrain revenue growth. However, the proactive transformation strategy, emphasising margin improvement and stable cash flow, positions UPS as a potentially attractive long-term investment.

Expert forecasts for United Parcel Service, Inc. stock

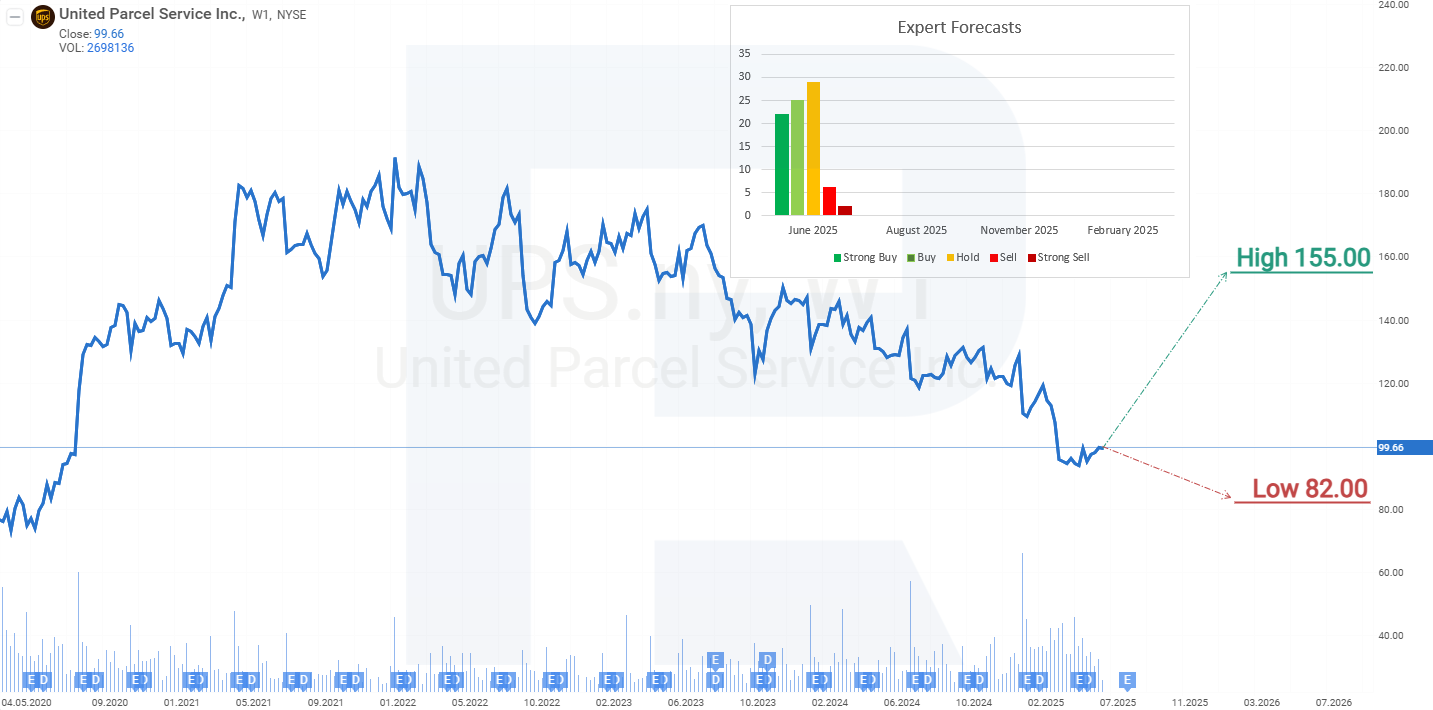

- Barchart: 15 out of 28 analysts rated UPS stock as a Strong Buy, one as a Moderate Buy, 10 as a Hold, and two as a Strong Sell. The high target price is 155 USD, while the low is 80 USD

- MarketBeat: 12 out of 26 specialists assigned a Buy rating to the shares, while 12 gave a Hold recommendation, and two rated them as a Sell. The high target price is 147 USD, while the low is 82 USD

- TipRanks: 10 out of 20 respondents gave a Buy rating to the stock, eight recommended it as a Hold, and two rated it as a Sell. The high target price is 133 USD, while the low is 80 USD

- Stock Analysis: out of 19 experts, seven rated the shares as a Strong Buy, two as a Buy, eight as a Hold, and two as a Sell. The high target price is 147 USD, while the low is 82 USD

United Parcel Service, Inc. stock price forecast for 2025

Since early 2022, UPS shares have been trading within a descending channel on the weekly timeframe, falling to the channel’s lower boundary at 90 USD, which acts as a support level. In addition, an upward trendline dating back to 2009 also intersects around 90 USD, reinforcing this level as a strong support. However, a Flag pattern has formed on the chart, signalling the potential for a continued decline. Based on United Parcel Service’s stock performance, the following price scenarios are projected for 2025:

The primary forecast for UPS stock suggests a breakdown below the 90 USD support level, followed by a decline to the next support at 70 USD, where a potential recovery could begin. UPS target prices in a rebound scenario are projected at 130 and 150 USD. This outlook is supported by the Flag pattern, ongoing US trade disputes with other countries, which are weighing on economic activity, and weak guidance for Q2 2025, with results due on 29 July.

The optimistic forecast for UPS stock predicts a retest of the 90 USD support level, followed by a rebound and a rise to the 130 USD resistance. A breakout above this level could propel UPS shares further to 150 USD. This scenario would require stabilisation or growth in delivery volumes, an improved macroeconomic environment, and an easing of trade tensions – all of which appear unlikely in the current context.

United Parcel Service, Inc. stock analysis and forecast for 2025Risks of investing in United Parcel Service, Inc.

Текст 8

Investing in UPS stock entails several risks that may negatively impact its revenue and financial performance. The primary ones include:

- Economic cyclicality: demand for UPS logistics services directly hinges on overall economic activity. During recessions or periods of lower consumer demand, delivery and freight volumes decline, especially in the B2B and international trade segments

- Rising costs (particularly labour and fuel): UPS relies on large volumes of labour and fuel. Rising diesel and aviation fuel prices and growing wages (among others, due to trade union contracts, for example, with the Teamsters) may significantly reduce operating margins

- Competition: the delivery market is becoming increasingly competitive. The major competitors – FedEx, DHL, Amazon Logistics, and national postal services – pursue aggressive pricing policies, invest in technology, and expand their infrastructure. Amazon, in particular, is actively developing its logistics, reducing its reliance on UPS as a contractor

- Technology and operational disruptions: delivery delays, IT system outages, cyberattacks, accidents, or inefficient management of the logistics chain may lead to losses, reputational risks, and customer attrition

- Seasonality and dependence on peak periods: a significant portion of annual revenue is generated during holiday periods, for example, Q4. Any disruptions during this period, such as adverse weather conditions, personnel shortages, or logistics delays, may cause disproportionate damage

- Investment and capital expenditure: to remain competitive, UPS requires extensive modernisation of its fleet, IT infrastructure, and warehousing logistics. Mistakes in investment decisions or excessive capital intensity can reduce returns on invested capital

Thus, despite its status as the industry leader, UPS is subject to a variety of factors that may limit the company’s growth or reduce its financial resilience