The US 500 stock index entered a downtrend amid mixed US labour market data and the upcoming election. The US 500 forecast for next week is moderately negative.

US 500 forecast: key trading points

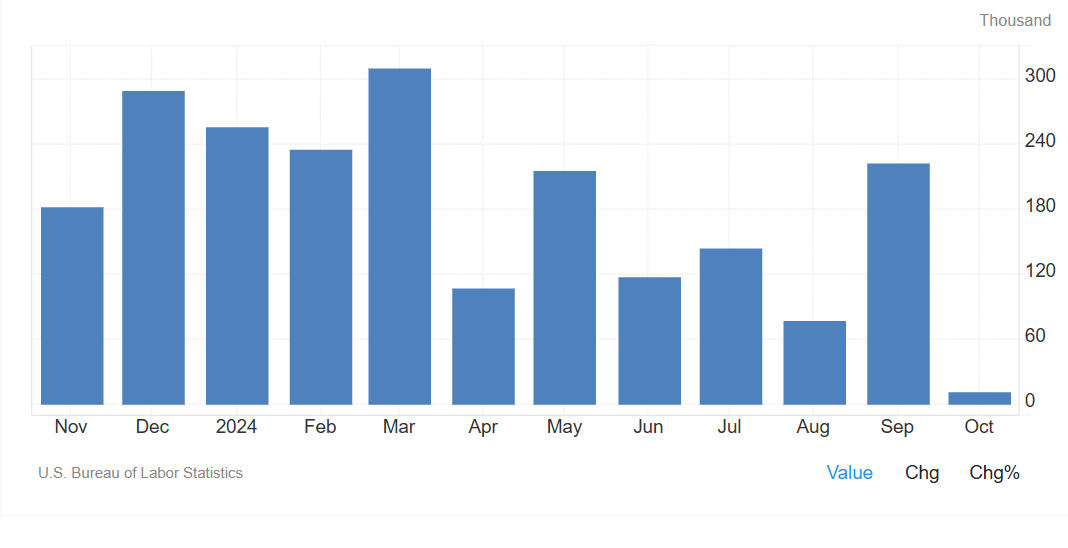

- Recent data: nonfarm payroll growth was just 12,000 in October

- Economic indicators: this metric reflects job growth in the US nonfarm sector in October

- Market impact: NFP is one of the leading labour market indicators considered by the US Federal Reserve in its future policy decisions

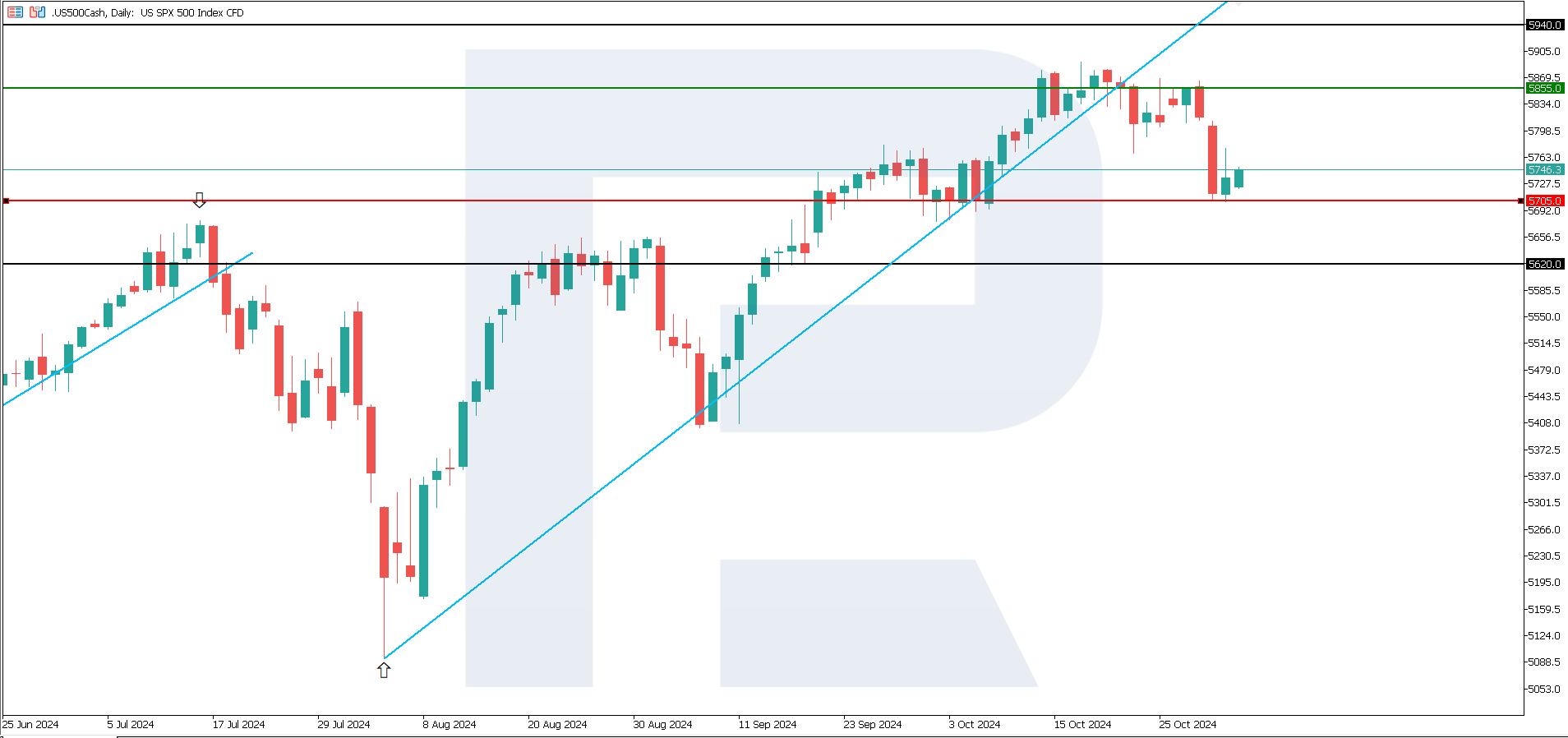

- Resistance: 5,855.0, Support: 5,705.0

- US 500 price forecast: 5,620.0

Fundamental analysis

NFP gains were only 12,000 jobs (well below the expected 106,000 and the previous readings of 254,000 and 223,000), indicating a significant slowdown in job growth compared to previous months and market predictions. As expected, the unemployment rate remained at 4.1%, unchanged from the previous month.

Source: https://tradingeconomics.com/united-states/non-farm-payrolls

Slowing job growth may signal potential economic weakening or that the labour market is already saturated. The reading of 12,000 is a significant deviation from forecasts and previous values, indicating that companies are cautious about hiring or that job openings have become limited. The stable unemployment rate of 4.1% confirms that employment remains relatively high without notable economic fluctuations.

A significant decrease in NFP may raise investor concerns about an economic slowdown, potentially leading to corrections in stock prices, especially in sectors sensitive to economic cycles (manufacturing and consumer goods). The outlook for the US 500 index is moderately negative.

US 500 technical analysis

The US 500 stock index fell by over 3.0% from its highs. According to technical analysis, the US 500 index remains in a downtrend. The price will likely break below the current support level, targeting 5,620.0. There are no signs of a near-term trend reversal.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,705.0 support level could drive the index down to 5,620.0

- Optimistic US 500 forecast: a breakout above the 5,855.0 resistance level could propel prices to 5,940.0

Summary

The US 500 stock index tumbled by over 3.0% and entered a downtrend. Mixed US labour market data was released last Friday. NFP increased by only 12,000 jobs (below the expected 106,000 and the previous readings of 254,000 and 223,000), with a stable unemployment rate of 4.1%. The US Federal Reserve may interpret the current indicators as favouring either a rate or the continuation of current monetary policy parameters. This uncertainty exerts pressure on the index and may lead to a further decline in its value to 5,620.0.