The US 500 index has approached a resistance level and may enter a short-term correction before resuming growth. Today’s US 500 forecast is positive.

US 500 forecast: key trading points

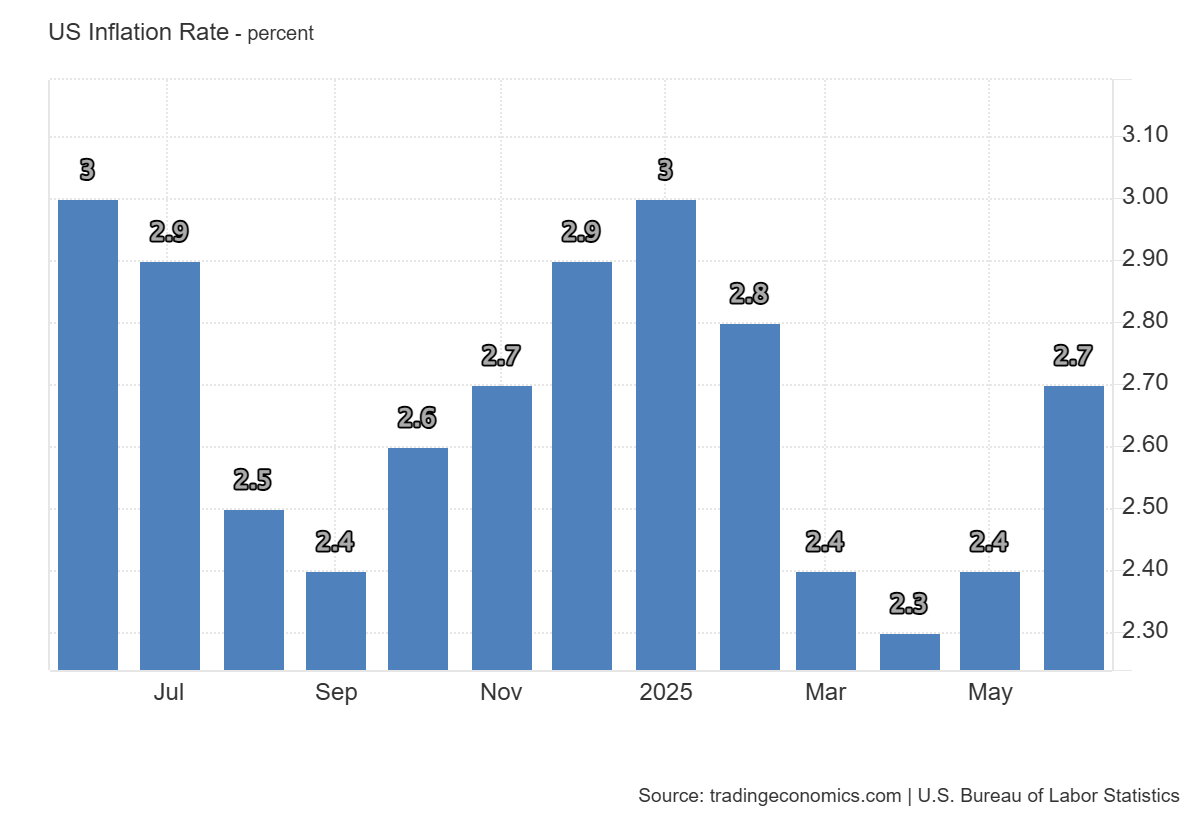

- Recent data: the US Consumer Price Index (CPI) reached 2.7% year-on-year

- Market impact: for the US equity market, particularly the US 500 index, this indicates inflation remains elevated, which could raise concerns about the continuation or tightening of the Fed's monetary policy

US 500 fundamental analysis

The US CPI came in at 2.7% year-on-year, above the forecast of 2.6%. This may lead to increased market volatility due to investor concerns about further easing of the Federal Reserve's monetary policy.

The financial sector may benefit from a potential rate hike, as it would improve banking margins. However, the consumer and IT sectors may face pressure from rising costs and a possible decline in purchasing power.

US inflation rate: https://tradingeconomics.com/united-states/inflation-cpiUS 500 technical analysis

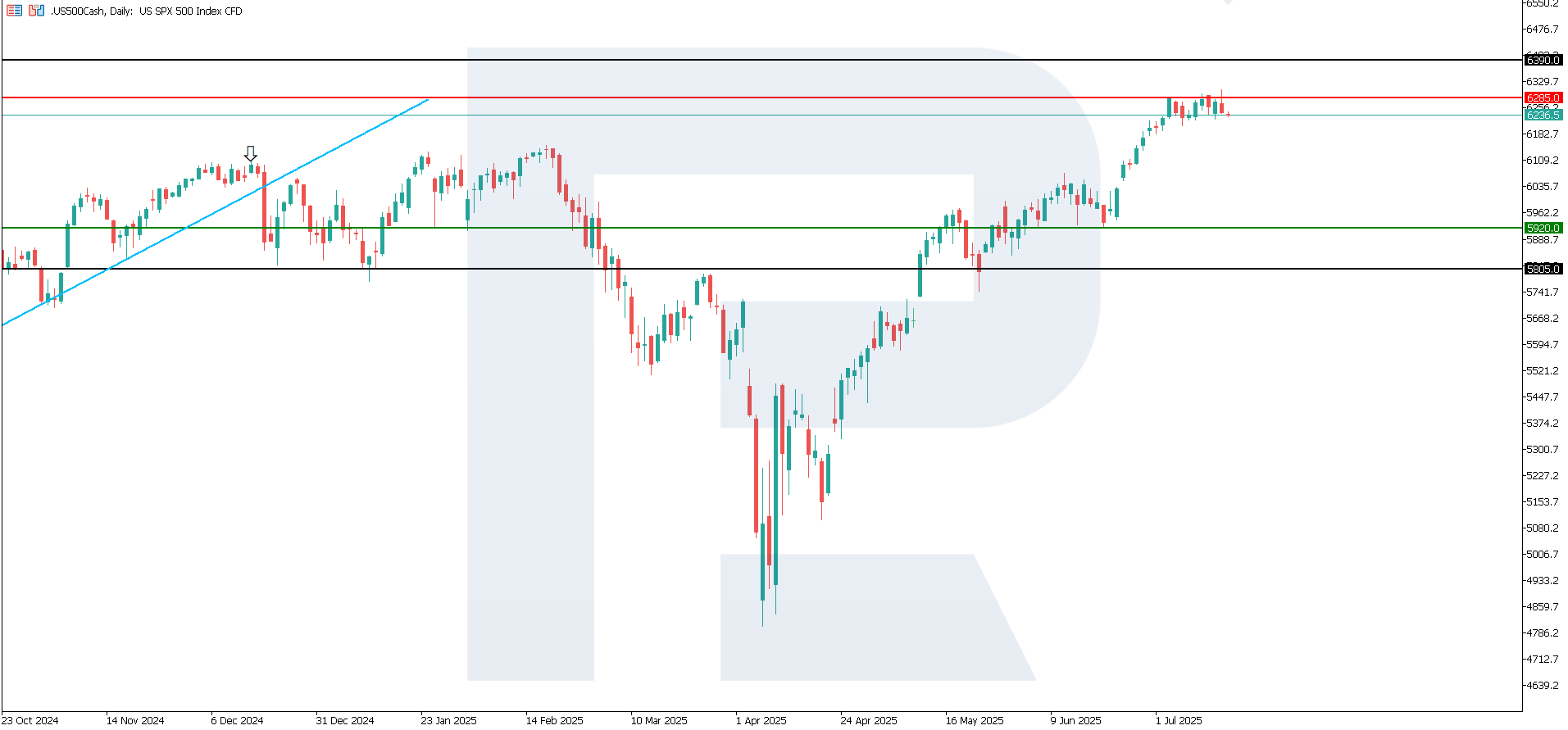

The US 500 index reached a new all-time high, surpassing the 6,230.0 level. Support stands at 5,920.0, with resistance at 6,285.0. While a strong uptrend remains intact, a minor correction is possible before the index resumes growth and sets a new record.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 5,920.0 support level could push the index down to 5,745.0

- Optimistic US 500 scenario: a breakout above the 6,285.0 resistance level could boost the index to 6,390.0

US 500 technical analysis for 16 July 2025Summary

Overall, current inflation figures prompt investors to reassess risks and rebalance between growth stocks and defensive assets. The US 500 index remains in a steady uptrend with the potential to reach a new all-time high. The next upside target could be 6,390.0. However, in the near term, a minor correction appears likely.