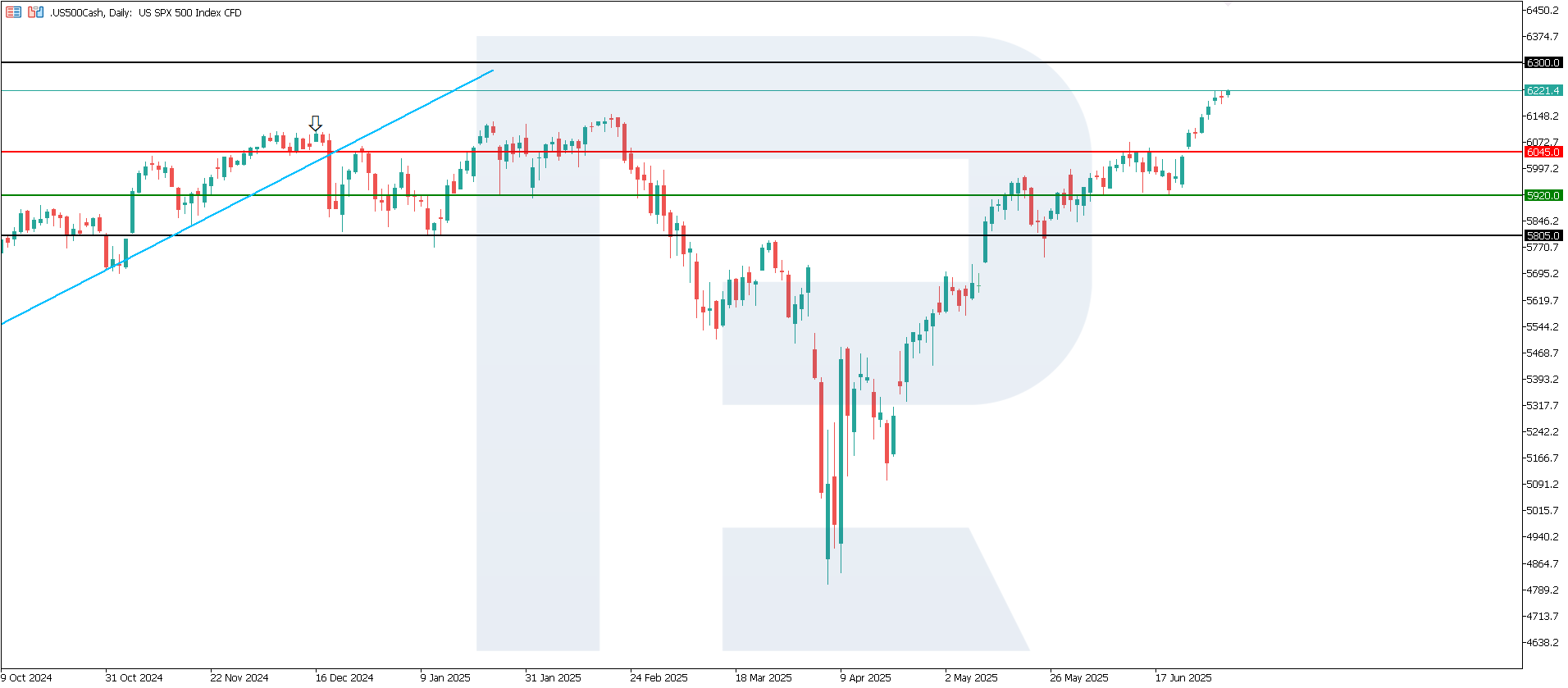

For the first time in history, the US 500 closed above the 6,200.0 mark – Q2 this year became its best quarter since 2023. The forecast for US 500 today is positive.

US 500 forecast: key trading points

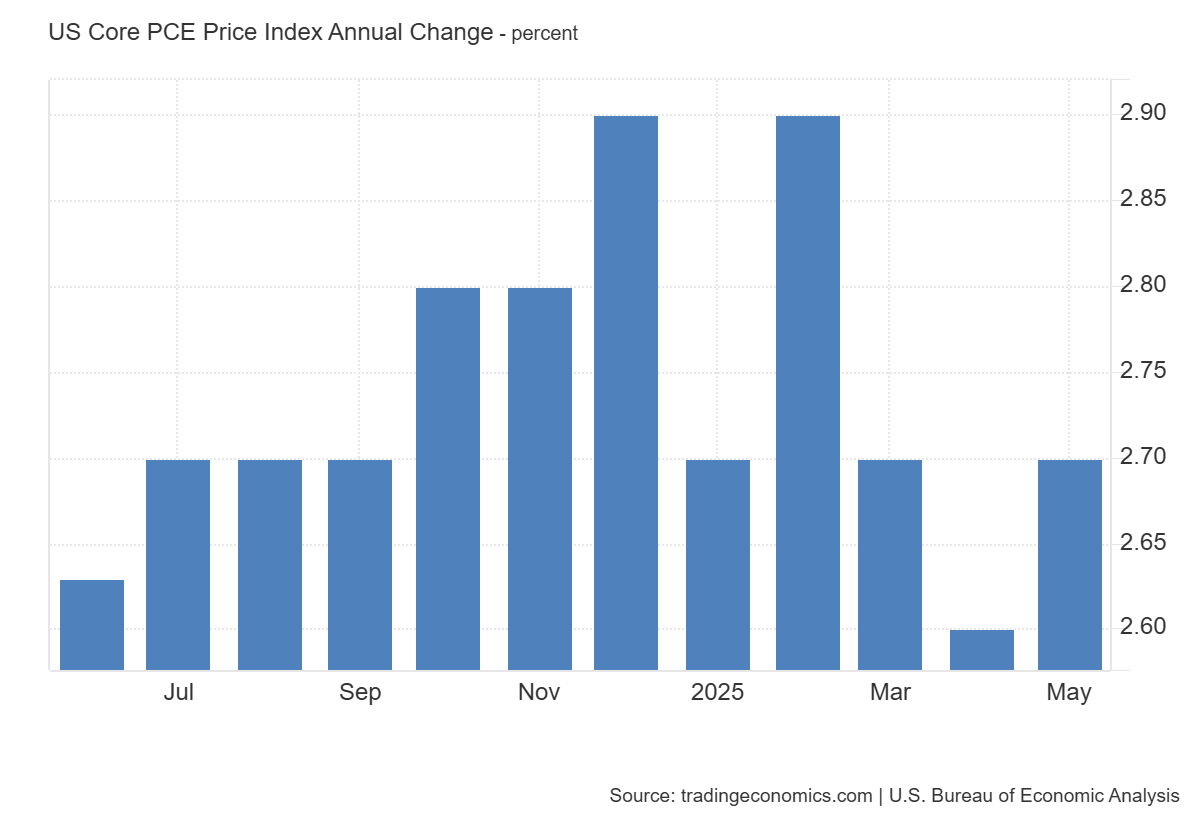

- Recent data: the Core PCE Price Index in the US stood at 2.7%

- Market impact: rising Core PCE may push the Federal Reserve towards tighter monetary policy, including potential rate hikes, which investors usually view as a negative signal for the stock market

US 500 fundamental analysis

The current Core PCE Price Index reading (2.7%) exceeds both the forecast (2.6%) and the previous figure (2.6%), indicating some strengthening of inflationary pressure. This is a key measure of inflation in the US, excluding energy and food prices, and is closely monitored by the Federal Reserve when making monetary policy decisions.

An increase in Core PCE to 2.7% signals mounting inflationary pressure and may lead to expectations of Fed policy tightening, putting pressure on equities, particularly in the technology and consumer sectors, while supporting the financial sector.

United States Core PCE Price Index: https://tradingeconomics.com/united-states/core-pce-price-index-annual-changeUS 500 technical analysis

The US 500 stock index has reached a new all-time high above 6,200.0. Support has formed at 5,920.0. A new resistance level has not yet formed. A strong uptrend remains, although a slight corrective pullback cannot be ruled out. There is still potential for further updates to the historical high.

Scenarios for the US 500 index price forecast:

- Pessimistic scenario for US 500: if the support level at 5,920.0 is breached, prices may fall to 5,745.0

- Optimistic scenario for US 500: if prices hold above the broken resistance at 6,045.0, they may rise to 6,300.0

US 500 technical analysis for 2 July 2025Summary

The increase in Core PCE may lead to tighter monetary policy by the Fed, including potential rate hikes, which in the short term is usually seen as a negative factor for the stock market. However, the Fed Chair does not rule out a possible rate cut. The US 500 stock index is trading in a strong uptrend and could reach a new all-time high. The next growth target may be 6,300.0.