A spike in US inflation may drive the EURUSD pair up to 1.1320. Discover more in our analysis for 16 May 2025.

EURUSD forecast: key trading points

- Eurozone trade balance: previously at 24.0 billion, projected at 17.5 billion EUR

- US inflation expectations from the University of Michigan: previously at 6.5%, projected at 7.7%

- EURUSD forecast for 16 May 2025: 1.1320 and 1.1130

Fundamental analysis

Today’s EURUSD forecast considers a package of economic data from both the eurozone and the US. The actual eurozone trade balance data will be released today, with the previous figure at 24.0 billion and the forecast suggesting a decline to 17.5 billion EUR. A drop in the trade balance may negatively impact the euro and adjust the EURUSD rate accordingly.

Fundamental analysis for 16 May 2025 also takes into account that the University of Michigan US inflation expectations will be published at the start of the US trading session.

The previous reading was 6.5%, while the forecast for 15 May 2025 suggests a rise to 7.7%. This would be a significant increase. If the actual data matches the forecast or comes in even higher, it could put downward pressure on the US dollar and affect the EURUSD rate.

EURUSD technical analysis

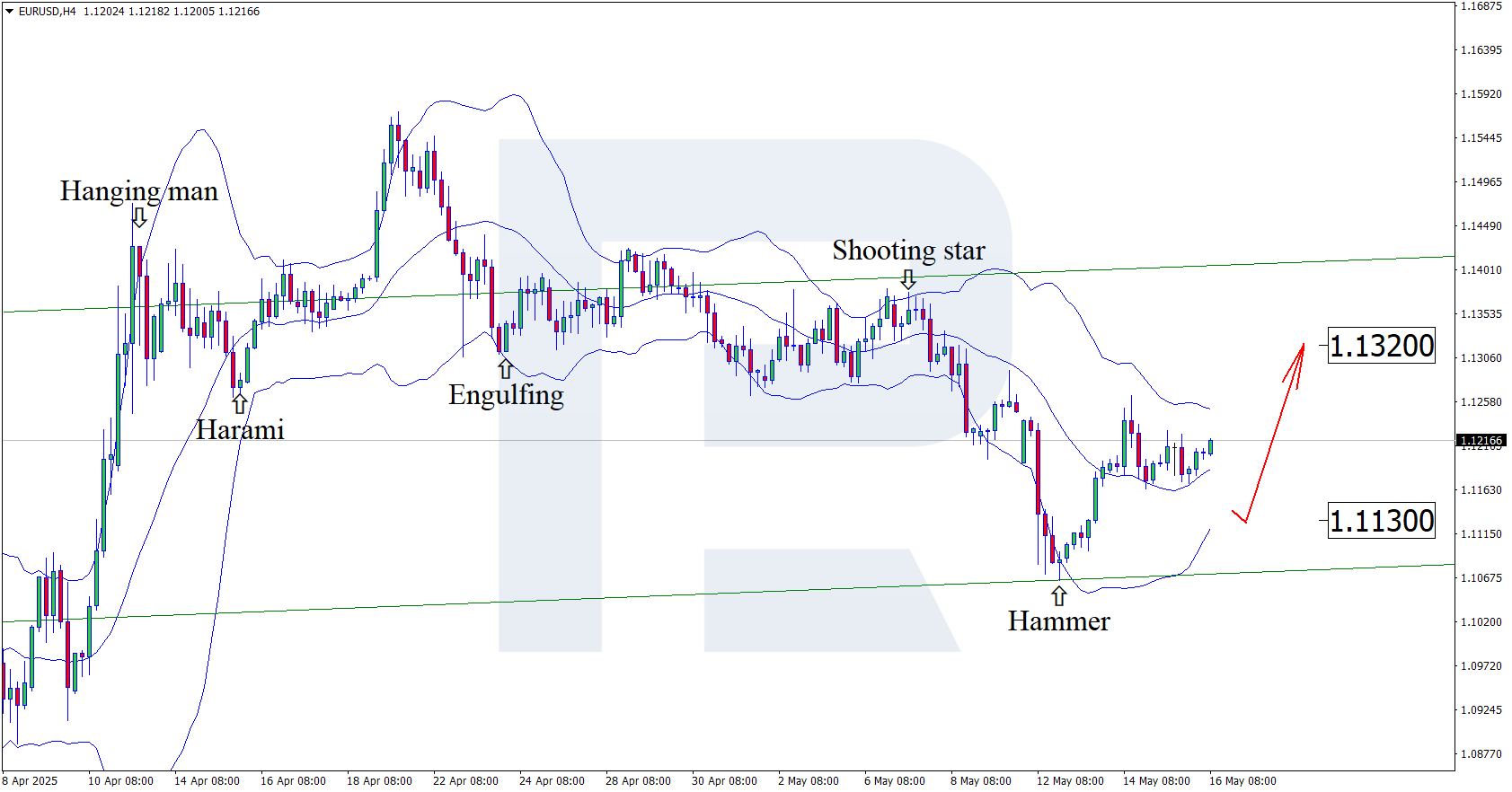

On the H4 chart, the EURUSD pair has formed a Hammer reversal pattern near the lower Bollinger Band. The pair currently continues its upward momentum, following through on the bullish signal. Since prices remain within an ascending channel, a further rise towards the nearest resistance at 1.1320 is likely. A breakout above this level would signal the continuation of the uptrend.

However, the EURUSD rate could also correct towards 1.1130 and gain its upward momentum after testing the support level.

Summary

The decrease in the eurozone trade balance and a potential uptick in US inflation, combined with EURUSD technical analysis, suggest growth towards the 1.1320 resistance level following a correction.