The US Tech stock index growth rate has slightly slowed, but the likelihood of reaching a new all-time high is still relatively high. More details in our US Tech price forecast and analysis for next week, 2-6 December 2024.

US Tech forecast: key trading points

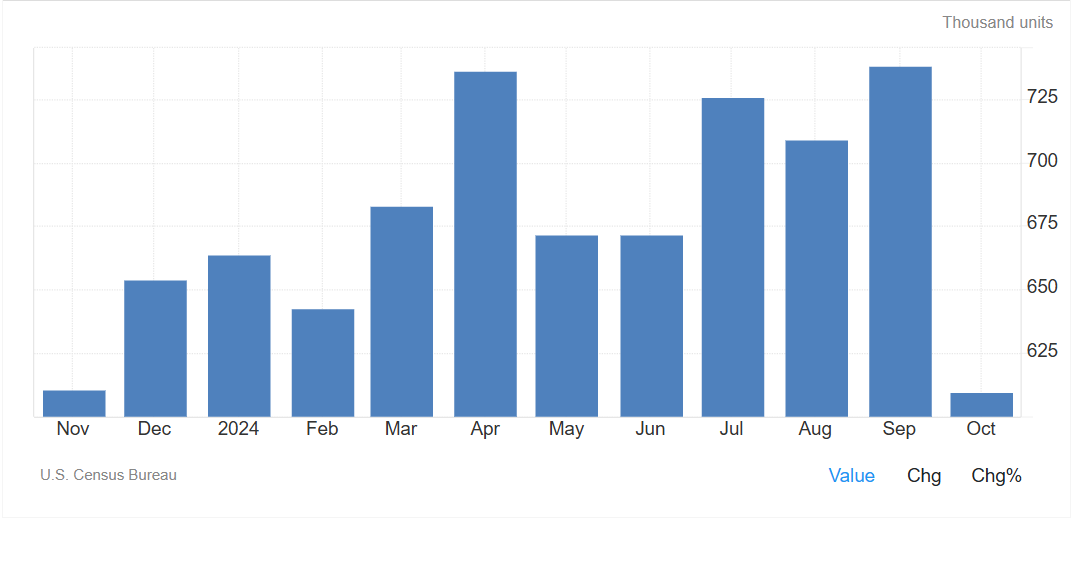

- Recent data: new home sales in the US primary real estate market declined by 17.3% in October

- Economic indicators: this economic indicator measures the state of the US real estate market

- Market impact: lower activity in the real estate sector may slow economic growth

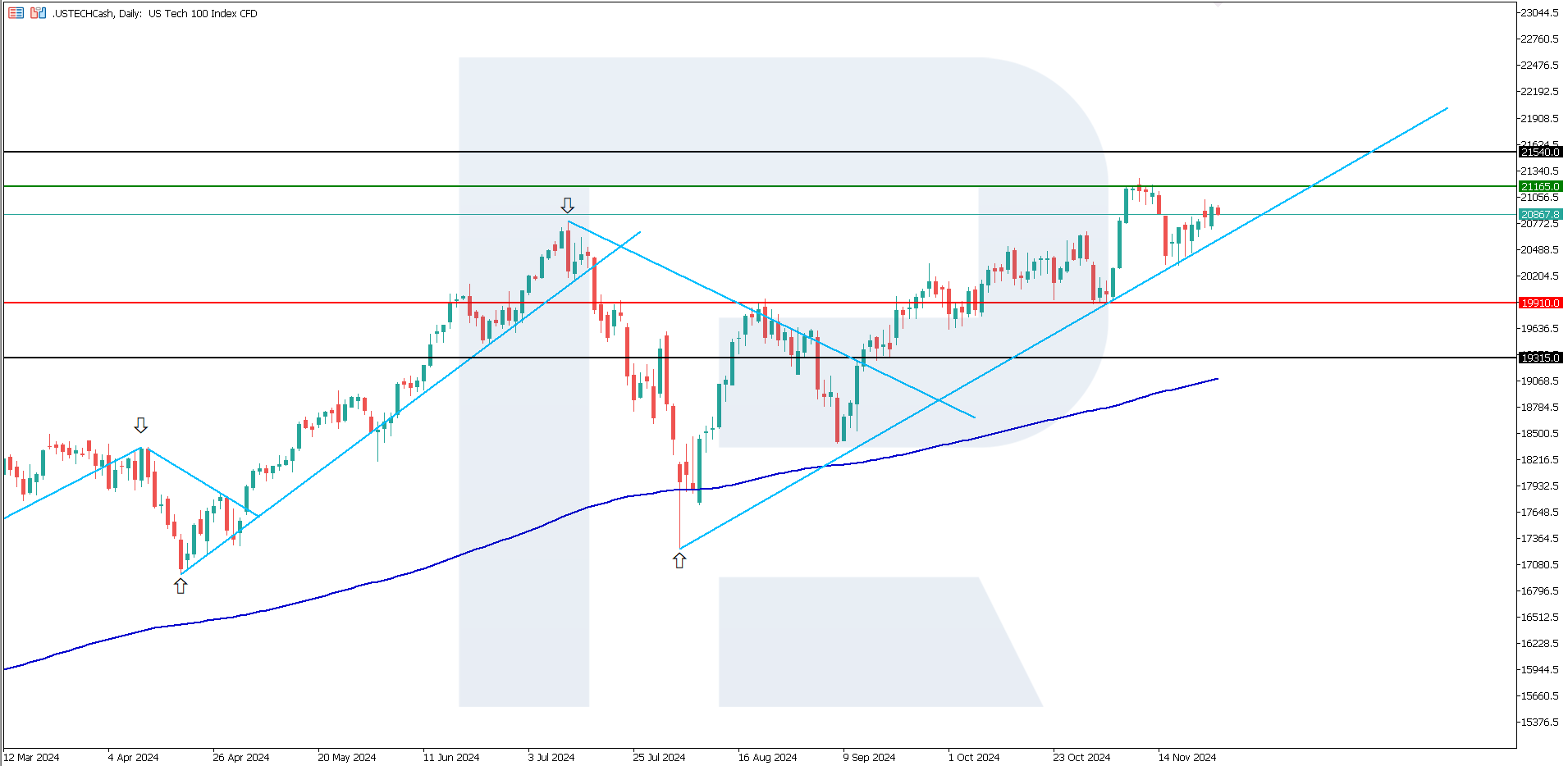

- Resistance: 21,165.0, Support: 19,910.0

- US Tech price forecast: 21,540.0

Fundamental analysis

The 17.3% m/m decline in new home sales significantly exceeded the projected 3.6% drop and starkly contrasted with the 7.0% growth seen in the previous month, signalling a marked slowdown in this segment.

Source: https://tradingeconomics.com/united-states/new-home-sales

High mortgage rates, caused by the previous tightening of the Federal Reserve monetary policy, have increased the cost of residential property. Consumers may delay buying new homes due to economic uncertainty, persistent inflation, or declining real income. While seasonal fluctuations sometimes affect October data, the extent of the downturn highlights structural challenges.

Real estate is closely linked to consumption, employment, and related industries (banking, furniture, and household appliances). Reduced activity may slow economic growth. If the housing market's weakness persists, it will strengthen arguments favouring a softer monetary policy, supporting the stock market in the long term. The US Tech index forecast is moderately optimistic.

US Tech technical analysis

The US Tech stock index continues its upward trend but at a slower pace. According to technical analysis, the US Tech index may achieve a new all-time high if prices surpass and consolidate above the current 21,165.0 resistance level. The price could also rise within the current trend in the short term following the formation of a sideways range.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,910.0 support level could lead to a decline towards 19,315.0

- Optimistic US Tech forecast: a breakout above the 21,165.0 resistance level could drive the index to 21,540.0

Summary

The 17.3% m/m drop in new home sales significantly exceeded the projected 3.6% decline. This development may signal the onset of adverse economic changes, prompting the US Federal Reserve to implement further interest rate cuts. Collectively, these factors create favourable conditions for the stock market.