This week, the US Tech stock index reached a new all-time high and aims to repeat this success. The forecast for US Tech today is positive.

US Tech forecast: key trading points

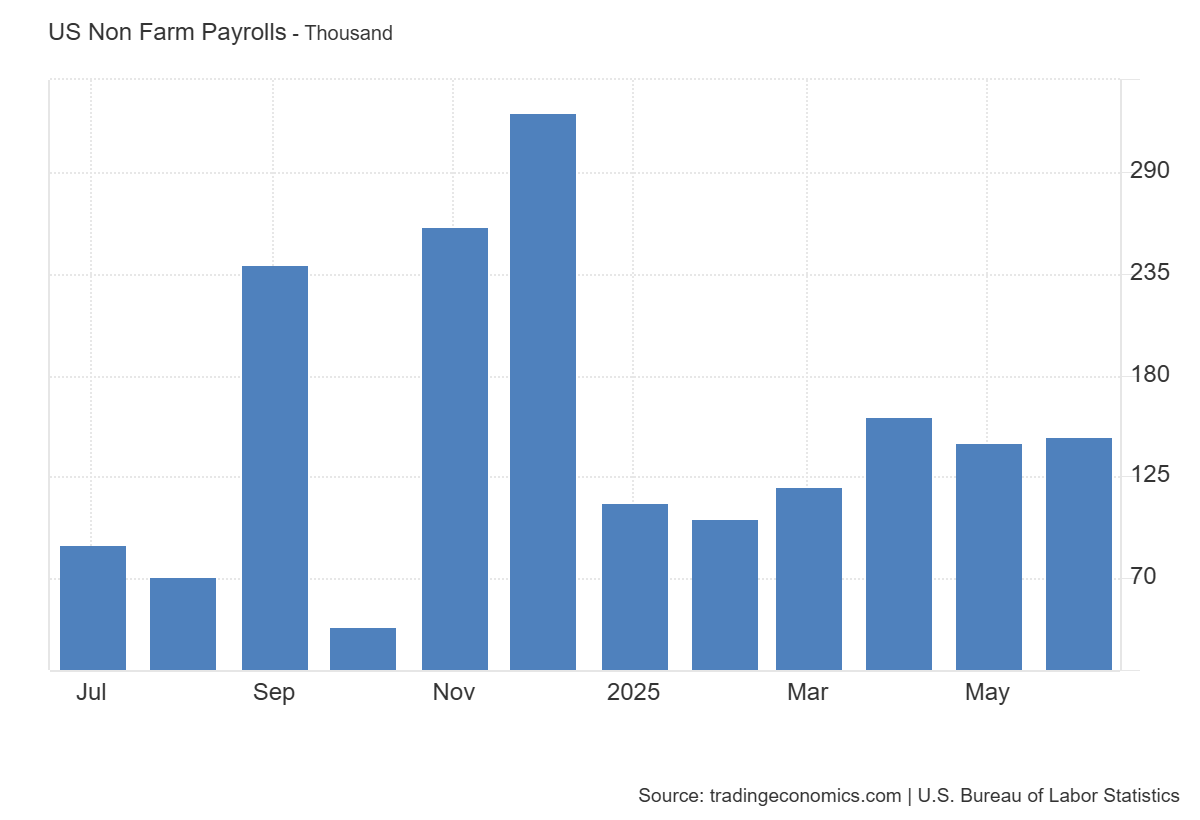

- Recent data: Nonfarm Payrolls for June in the US reached 147,000

- Market impact: this is generally perceived as positive for stocks, as it supports company revenues and reduces recession fears

US Tech fundamental analysis

Strong job growth indicates continued momentum in the labour market and reinforces confidence in consumer demand and economic growth. The fall in unemployment signals labour market strengthening, reducing risks for consumer spending and company fundamentals.

United States Non Farm Payrolls: https://tradingeconomics.com/united-states/non-farm-payrollsThe drop in unemployment confirms labour market improvement and reduces socio-economic risks. This boosts investor confidence and lowers the likelihood of sharp Fed tightening. For the technology sector, this means continued access to cheap and available borrowing, which is crucial for large-scale innovation development and implementation.

US Tech technical analysis

For US Tech, this acts as an additional growth driver, since most major tech firms target a wide consumer base. June data indicate continued strengthening of the US labour market, creating a strong foundation for consumer demand and corporate profits.

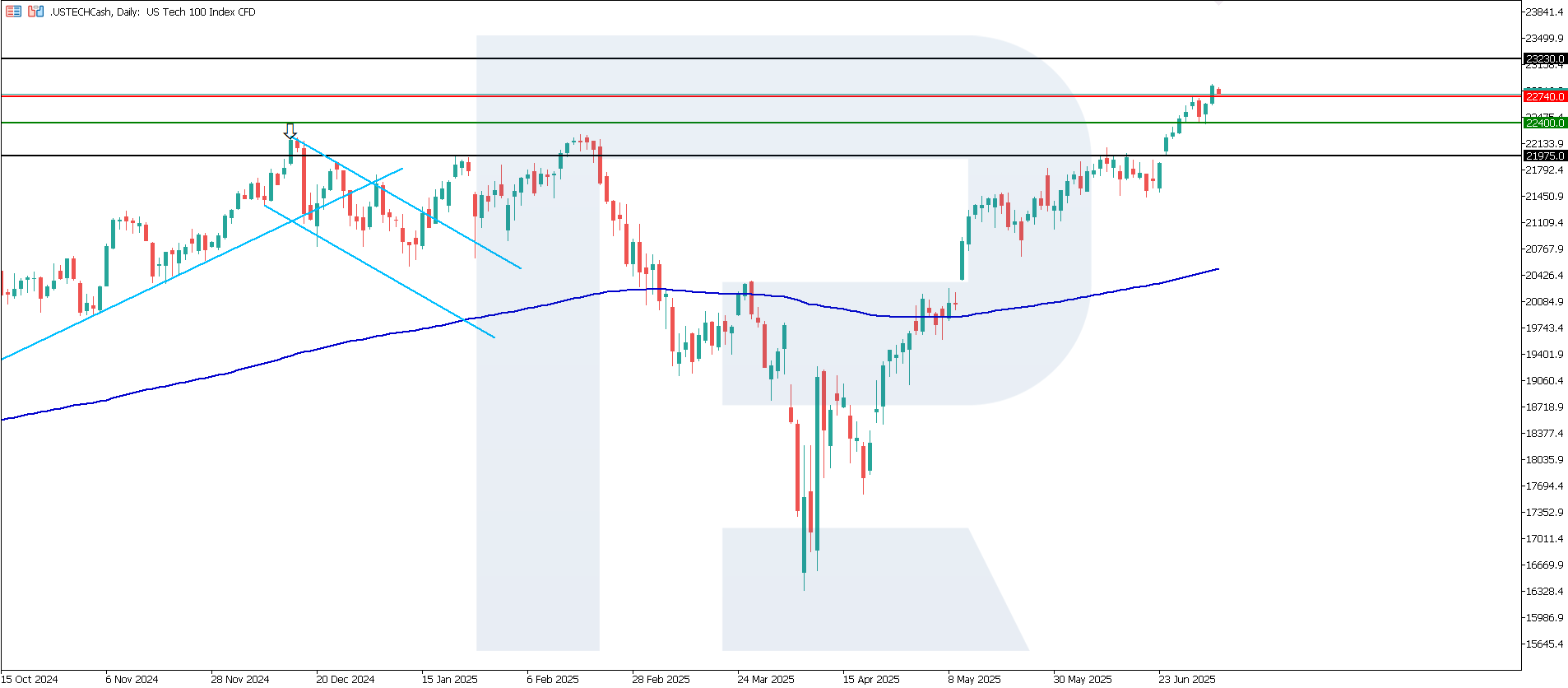

US Tech technical analysis for 4 July 2025The US Tech index broke its previously set resistance level at 22,740.0, and the support level shifted to 22,400.0. A new resistance level has not yet formed. It is worth noting the strong upward momentum that enabled US Tech to reach a new all-time high.

Scenarios for the US Tech index price forecast:

- Pessimistic scenario for US Tech: if the support level at 22,400.0 is breached, prices may fall to 21,750.0

- Optimistic scenario for US Tech: if the resistance level at 22,740.0 is broken, prices may rise to 23,430.0

Summary

For US Tech, this creates a favourable environment: technology and innovation companies benefit from low rates and strong demand. However, the widening trade balance deficit adds moderate pressure on the dollar and introduces an external risk factor that investors should consider when forming their portfolios. Overall, fundamentals remain positive, and the near term should maintain the upward trend for US stocks.