Investors in the USDCAD pair are assessing the latest statistics and forecasts. The Bank of Canada’s actions will determine further movements.

USDCAD trading key points

- The market is considering Canada’s employment market statistics

- The Bank of Canada may lower interest rates at every meeting until the end of 2024

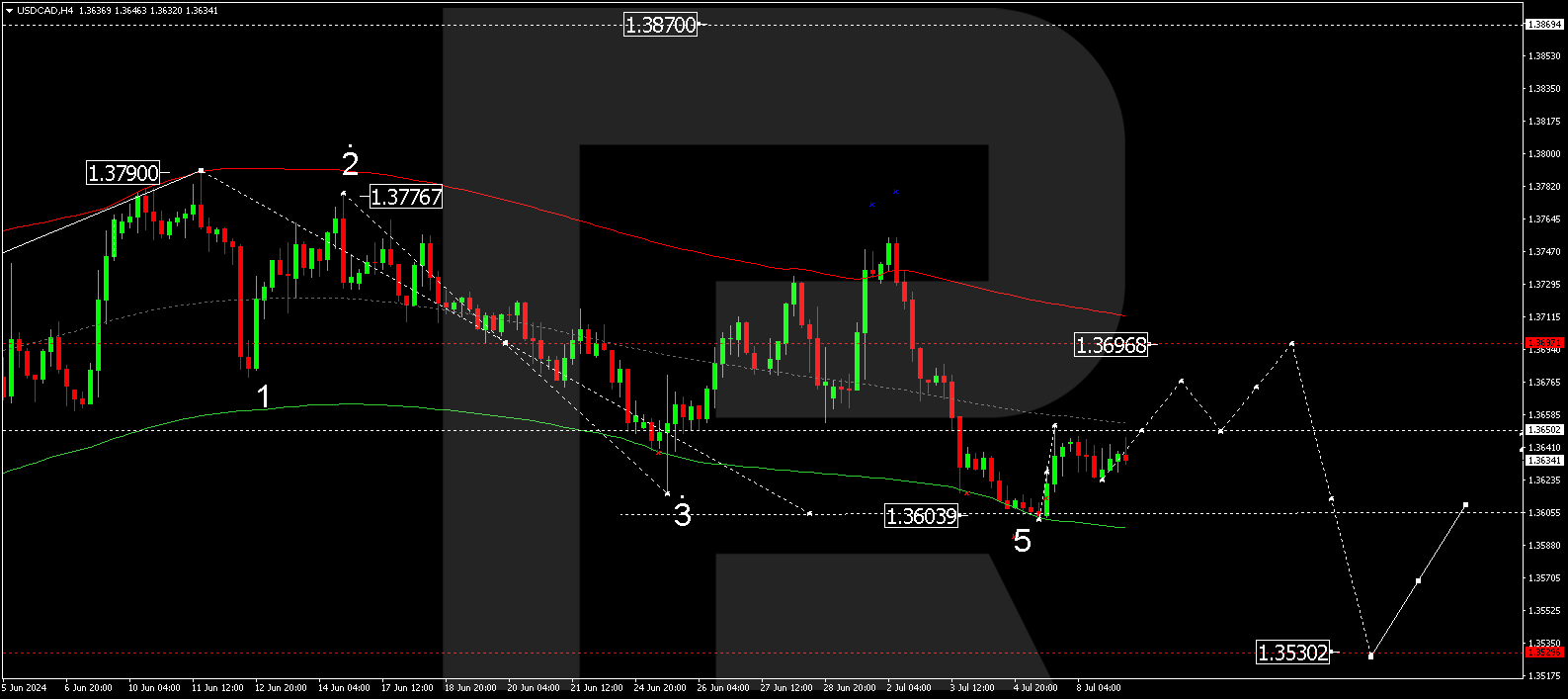

- USDCAD price targets: 1.3696, 1.3600, 1.3530, and 1.3473

Fundamental analysis

The Canadian dollar has stabilised against the US dollar after strengthening markedly in July. The USDCAD pair is hovering around 1.3635.

Investors were prompted to react to last week’s Canadian employment market statistics release. The unemployment rate rose 6.4% from 6.2% in June, with the economy losing approximately 1,400 jobs. Although this is not the largest possible loss, signs of economic weakness are increasing.

The USD’s depreciation also contributed to the previous drop in the USDCAD pair. The slowing US economy is causing widespread concern, intensifying the focus on interest rates. The likelihood of a Bank of Canada interest rate cut at its July meeting is estimated at 60%. If this occurs, it will mark the second consecutive meeting with a rate cut, with markets anticipating a total reduction of 55 basis points by the end of the year.

If the Bank of Canada lowers interest rates again on 24 July, the market will likely interpret this as a signal for further cuts at each subsequent meeting unless unforeseen events happen.

USDCAD technical analysis

In the forecast for 9 July 2024, the USDCAD pair has completed a decline wave, reaching 1.3604. The market then rose to 1.3652 before correcting to 1.3633. Today, the USDCAD rate is expected to continue its ascent to 1.3676, potentially expanding the correction to 1.3696. Once the correction is complete, a new decline wave is anticipated, aiming for 1.3604, a crucial level for further declines in the USDCAD pair. A decline wave is expected to develop to the local target of 1.3530.

Summary

The Canadian dollar rate remains relatively strong. The USDCAD technical analysis indicates a correction towards 1.3696, with the trend continuing towards the 1.3600, 1.3530, and 1.3473 targets.