The USDCAD rate strengthens despite yesterday’s rebound from the key resistance level. Discover more in our analysis for 27 November 2024

USDCAD forecast: key trading points

- The US Federal Reserve noted uncertainty in economic data, which complicates interest rate decisions

- The Bank of Canada is considering further rate cuts; however, the chances of a 50-basis-point cut have decreased due to rising inflation

- Canada’s core inflation grew to 2.6% in October, exceeding expectations

- Canada’s wholesale sales increased by 0.5% in October but fell short of forecasts

- USDCAD forecast for 27 November 2024: 1.4011

Fundamental analysis

The USDCAD rate has risen for the fourth consecutive trading session, showing a steady bullish trend. Buyers are likely preparing to retest the crucial 1.4110 resistance level. The Canadian dollar fell to 2020 lows after Donald Trump threatened to raise Canadian import tariffs by 20%.

The Federal Reserve emphasised the difficulty of making decisions amid uncertainty in evolving data and the impact of a neutral interest rate. The policy remains dependent on economic trends, so interest rates are expected to remain elevated if inflation stays steady and be reduced if the labour market weakens. Against this backdrop, the likelihood of a Federal Reserve rate cut in December rose to 62.8% from 55.9% a week ago.

The Bank of Canada is poised to lower the interest rate next month. However, the likelihood of a 50-basis-point cut decreased after the release of inflation data. Core inflation, the gauge preferred by the Bank of Canada, rose to 2.6% in October from 2.4% in September, exceeding forecasts. According to today’s USDCAD forecast, lower expectations of an aggressive Bank of Canada rate cut could limit the potential for further US dollar strength.

Meanwhile, Canada’s wholesale sales increased by 0.5% month-on-month in October, following a 0.8% rise in September, but missed the forecast of 0.9%. The growth was partly due to increased sales in the automotive sector, including spare parts and accessories.

USDCAD technical analysis

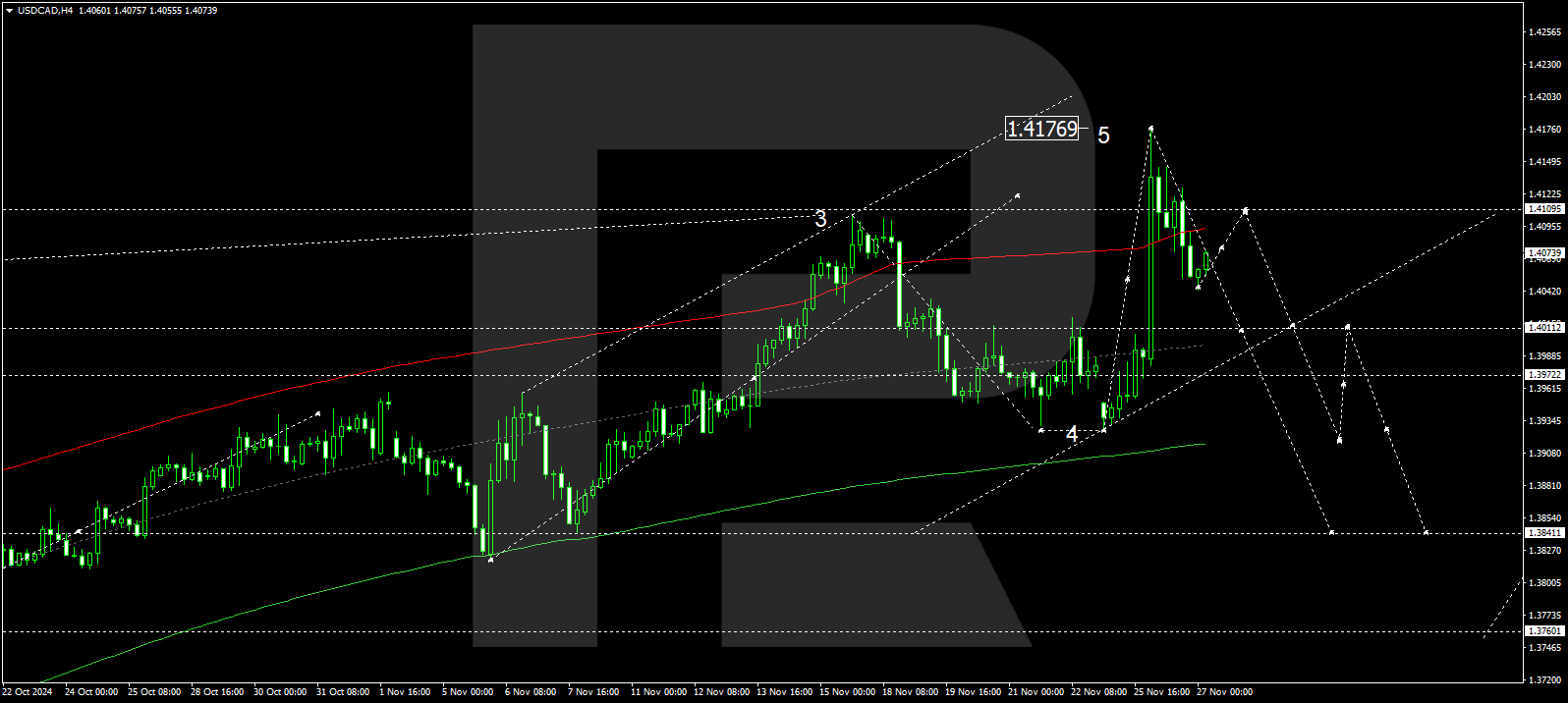

The USDCAD H4 chart shows that the market has formed a growth wave towards 1.4176. The first downward wave towards 1.4044 was completed today, 27 November 2024. The price is expected to rise to 1.4109, with the market outlining the consolidation range boundaries. A downward breakout is expected, with the target at 1.4011. A breakout below this level will open the potential for a downward wave towards 1.3900, the local target.

The Elliott Wave structure and wave matrix, with a pivot point at 1.4011, technically support this scenario. This level is crucial for a corrective downward wave in the USDCAD rate. The market is forming a downward structure towards the central line of a price envelope at 1.4011. After the price reaches this level, a new consolidation range will form around the envelope’s central line. A breakout below the range will open the potential for a decline to the envelope’s lower boundary at 1.3844.

Summary

The USDCAD rate maintains its upward trajectory amid the weakness of the Canadian dollar due to Donald Trump’s trade threats. At the same time, the gap in the monetary policy between the US and Canada is widening, with the Fed considering a cautious rate cut and the Bank of Canada poised to ease the policy despite accelerating inflation, which also supports the US currency. Technical indicators for today’s USDCAD forecast suggest that a corrective wave could continue towards the 1.4011 level.