The USDCAD pair is confidently rising, with the US dollar in demand as the majority of votes favour Trump. More details in our analysis for 6 November 2024.

USDCAD forecast: key trading points

- The USDCAD pair surges

- The market is following the first reports on the US presidential election

- USDCAD forecast for 6 November 2024: 1.3950

Fundamental analysis

The USDCAD rate rose to 1.3921 on Wednesday.

Although the pair declined yesterday evening, the situation changed today with the release of the first US presidential election results. The US dollar is in strong demand as presidential candidate Donald Trump gains more votes than his opponent, Kamala Harris.

Canadian statistics remain off the market’s radar. However, the private sector PMI rose to 50.7 points following a four-month decline. Oil prices also increased after OPEC+ decided to postpone its planned output increase. Although these factors support CAD’s fundamental strength, fortune favours the USD today.

The USDCAD forecast appears optimistic.

USDCAD technical analysis

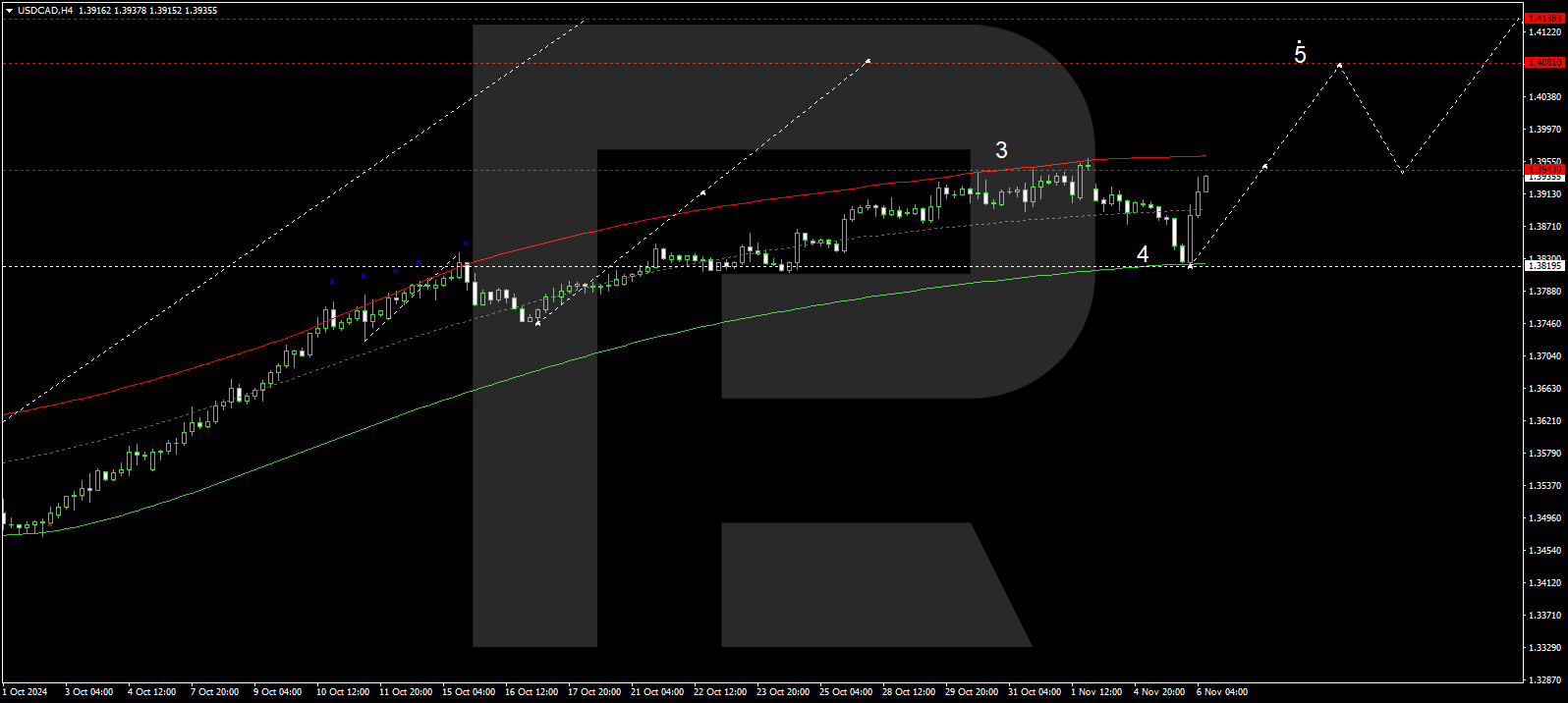

The USDCAD H4 chart shows that the market has completed a growth wave, reaching 1.3944, and has begun to correct. Today, 6 November 2024, the market has completed a correction at 1.3820 and begun the development of the fifth wave, targeting 1.3950. A correction may start once the price hits this level, aiming for 1.3890. Subsequently, another growth wave could develop, with the local target at 1.4080.

The Elliott Wave structure and wave matrix, with a pivot point at 1.3780, technically confirm this scenario for the USDCAD rate. The market has rebounded from the lower boundary of the envelope. The fifth growth wave could start today, aiming for the upper boundary of the envelope at 1.3950, the first target in this wave.

Summary

The USDCAD pair has faced high volatility, with yesterday’s decline giving way to sustainable growth. Technical indicators for today’s USDCAD forecast suggest that the growth wave could continue towards the 1.3950 level.