The USDJPY pair climbed to 150.79 as the market anticipates fiscal stimulus and loose monetary policy from the Bank of Japan. Find out more in our analysis for 7 October 2025.

USDJPY forecast: key trading points

- The USDJPY pair surged to a two-month high on political news

- The Bank of Japan will return to rate hikes if GDP and inflation remain positive

- USDJPY forecast for 7 October 2025: 150.80 and 151.30

Fundamental analysis

The USDJPY rate rose to 150.79 on Tuesday, a two-month high, after Sanae Takaichi won the leadership election of Japan’s ruling Liberal Democratic Party. She advocates for a stimulative policy stance. Takaichi’s victory paves the way for her to become Prime Minister, reinforcing expectations of large-scale fiscal stimulus and continued monetary easing.

Bank of Japan Governor Kazuo Ueda reiterated on Friday that the central bank is ready to resume rate hikes if economic growth and inflation evolve in line with projections. He also noted that US tariffs are pressuring Japanese exporters’ profits, especially in the auto sector, although broader effects on investment, employment, and wages remain limited.

According to newly released data, household spending in Japan rose by 2.3% in August, exceeding forecasts and marking the fastest growth in three months. The increase was supported by government measures to reduce costs and offset the impact of US tariffs.

The USDJPY forecast is positive.

USDJPY technical analysis

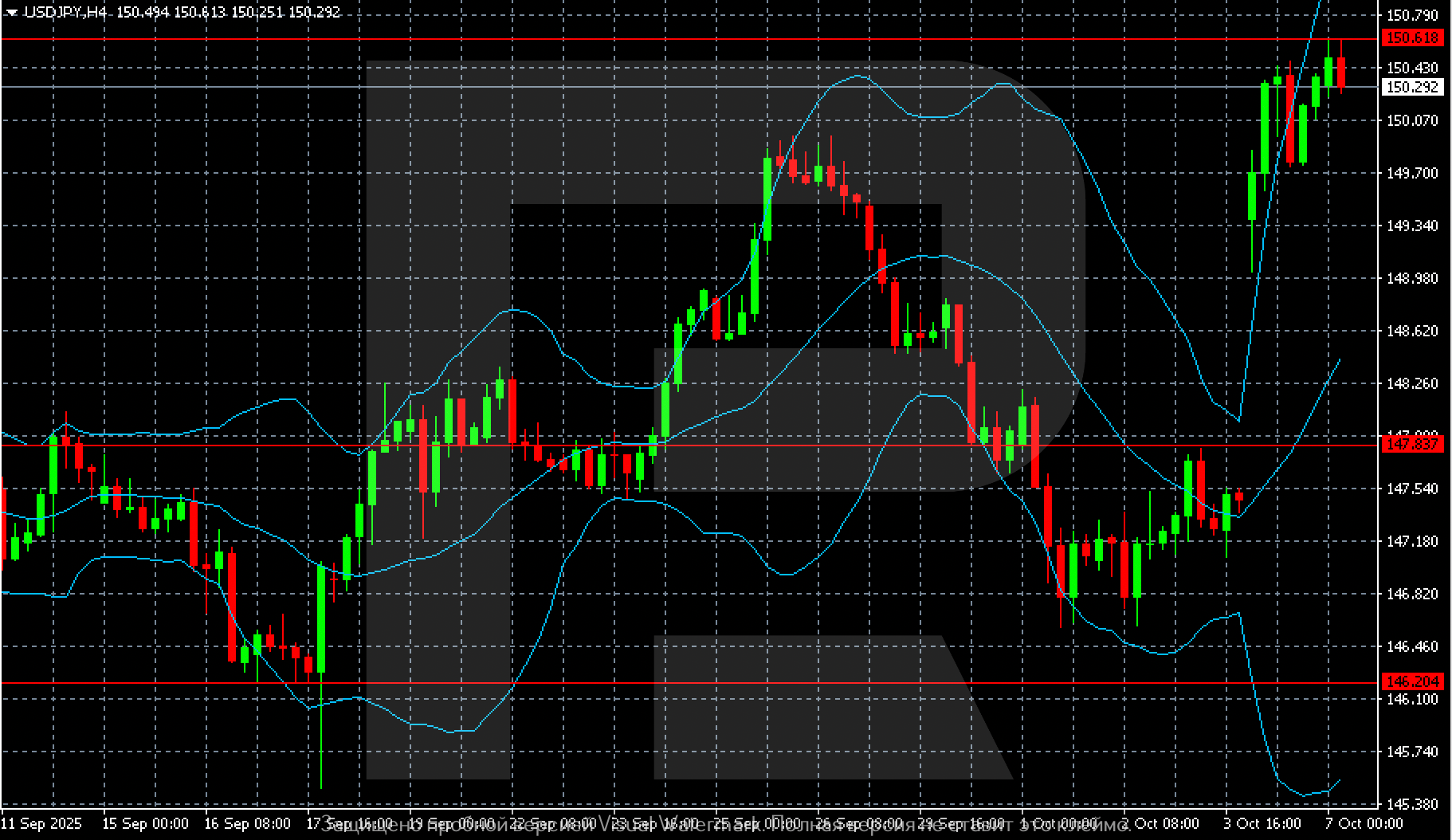

The USDJPY H4 chart shows a sharp upward move that pushed the pair to a local high near 150.79, the strongest level in over two months. After breaking above the key resistance level around 147.83, the pair accelerated higher and consolidated above 150.00.

The Bollinger Bands indicator shows a widening range, reflecting increased volatility. The price is moving along the upper band, signalling the dominance of buyers. The nearest support zone is now at 150.00, with the next one lower at 147.80.

From a technical perspective, upside potential remains as long as the pair holds above 150.00. A breakout above 150.80 would open the way towards the next target at 151.30. A decline below 149.50 could trigger a correction towards 147.80.

Summary

The USDJPY pair strengthened, supported by both the US government shutdown and domestic developments in Japan. The USDJPY forecast for today, 7 October 2025, suggests continued upside movement towards 150.80 and 151.30.

Open Account