The USDJPY pair declined to 147.50. A narrow sideways range ahead of the interest rate decision feels very comfortable for the market. Find more details in our analysis for 15 September 2025.

USDJPY forecast: key trading points

- The USDJPY pair is awaiting the Bank of Japan’s rate decision this week

- The day will likely be low-volatility due to a holiday in Japan

- USDJPY forecast for 15 September 2025: 147.40 or 148.20

Fundamental analysis

On Monday, the USDJPY rate slipped to 147.50. The Japanese yen partially recouped last week’s losses as markets look ahead to the Bank of Japan’s meeting.

The regulator is expected to keep the rate at 0.5%, weighing domestic risks and the impact of global factors, including US tariffs.

Investors are also focused on fresh trade data, where weak export and import dynamics are anticipated, along with inflation figures. The core CPI is expected to slow to 2.7%, the lowest since November 2024.

Externally, attention remains on the Federal Reserve meeting. The market has almost fully priced in a 25-basis-point rate cut this week. This is consistent with signals of easing inflation and a weaker US labour market.

Trading activity in Japan may remain subdued due to the national holiday.

The USDJPY forecast is cautious.

USDJPY technical analysis

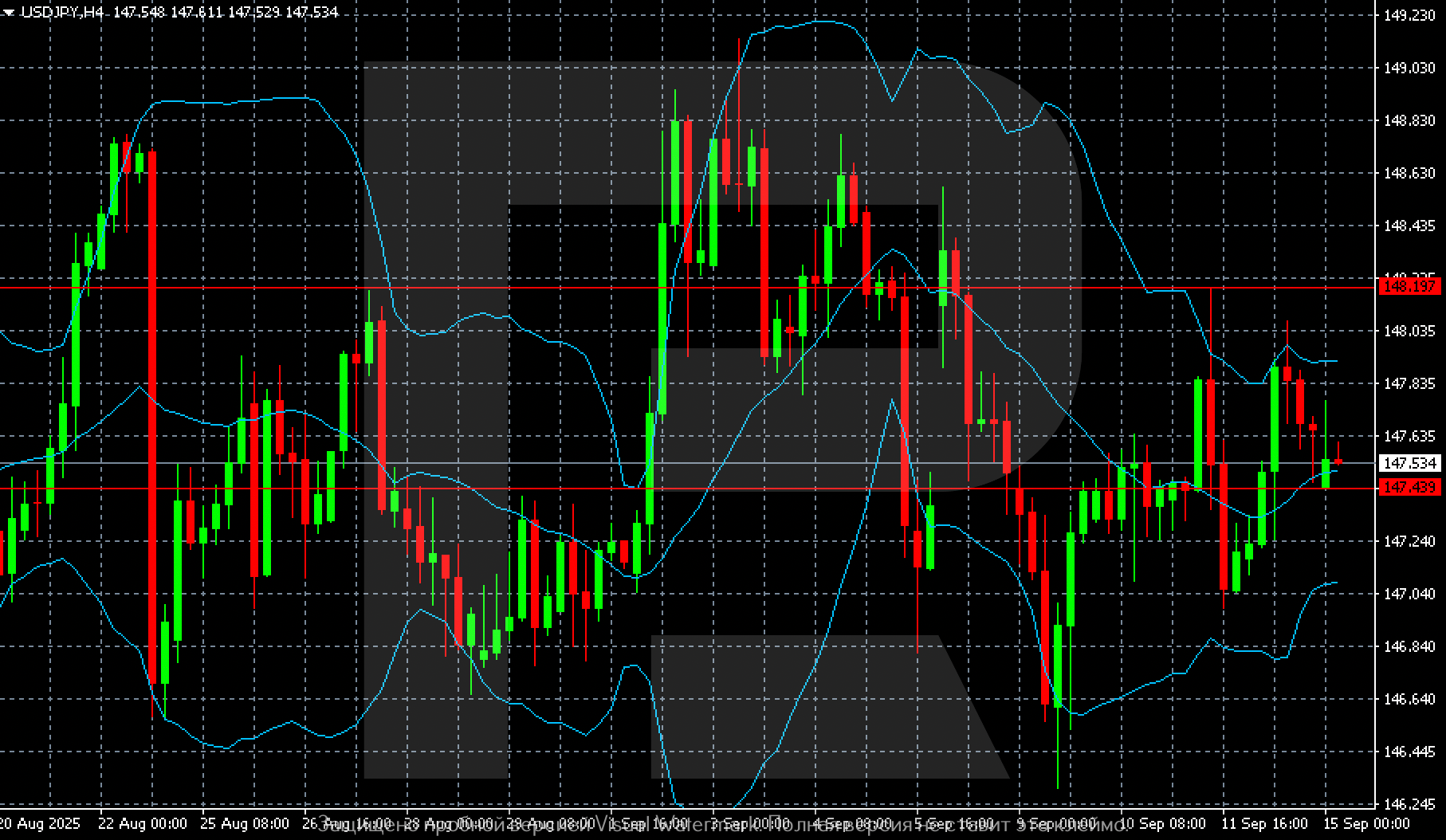

On the H4 chart, the USDJPY pair is consolidating around 147.50 in mid-September, remaining in a narrow range after a period of heightened volatility earlier in the month. Upward impulses have repeatedly stalled at the 148.20 resistance level, which remains the key barrier for buyers. The support level is forming around 147.40; a breakout below it would open the way towards levels around 146.60.

Bollinger Bands are narrowing, signalling a phase of fading volatility and preparation for a new move. The price is currently hovering near the middle line of the indicator, confirming the balance of power between sellers and buyers.

Thus, the 147.40–148.20 corridor remains the operative range. A breakout beyond it will signal the development of a stronger trend: an upside breakout would add pressure on the yen, while consolidation below 147.40 would confirm the downside scenario.

Summary

The USDJPY pair remains in a narrow range ahead of this week’s key events. The USDJPY forecast for today, 15 September 2025, suggests the sideways channel will persist.

Open Account