The USDJPY rate rose slightly on Wednesday but remains below the resistance level. Find out more in our analysis for 16 October 2024.

USDJPY forecast: key trading points

- Seiji Adachi’s speech did not significantly impact the volatility of the USDJPY pair

- According to the BoJ official, interest rate hikes should be gradual to avoid the risk of deflation

- Japan’s machinery orders fell by 1.9% in August

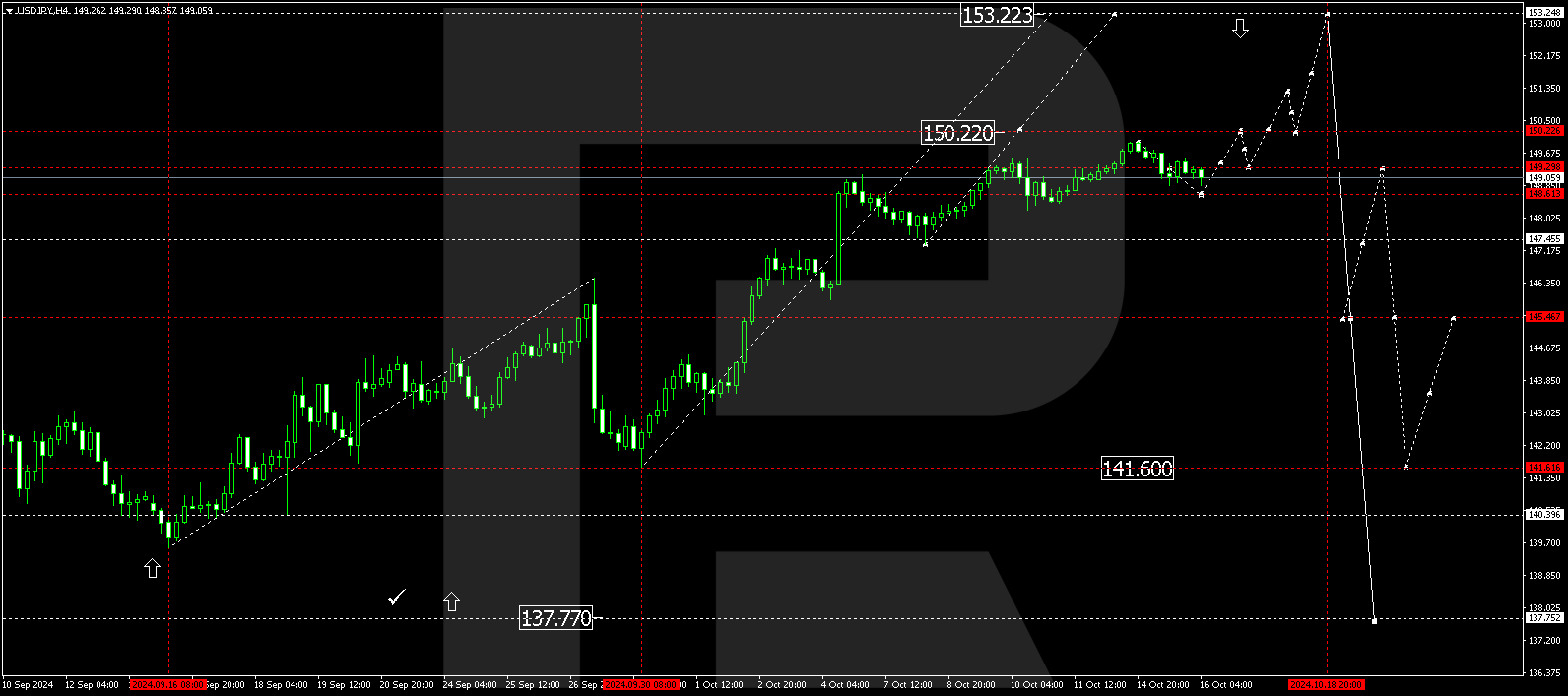

- USDJPY forecast for 16 October 2024: 150.22, 151.30, and 153.22

Fundamental analysis

The USDJPY rate continues to test the 149.45 resistance level. However, buyers have yet to secure a position above it. The speech by BoJ official Seiji Adachi, which could have shed light on the BoJ’s future monetary policy moves, did not significantly impact the currency pair’s movements.

In his speech, Adachi said that the interest rate should be raised gradually to avoid the risk of deflation. He noted that the Japanese economy has already created conditions for normalising monetary policy, but slowing global demand requires a thorough assessment. The regulator’s official also emphasised that it is necessary to maintain a loose financial policy until inflation reaches a stable level.

Meanwhile, machinery orders in Japan decreased by 1.9% in August 2024, although analysts expected a 1.5% increase. This represents the fifth contraction this year. Orders declined by 3.4% year-on-year, significantly contrasting with the 8.7% growth in July. Therefore, this data within today’s USDJPY forecast may exert additional pressure on the yen.

USDJPY technical analysis

The USDJPY H4 chart shows that the market continues to develop a narrow consolidation range around 149.30, which could extend down to 148.61 today, 16 October 2024. A breakout above the range will open the potential for a growth wave towards 150.22 and potentially further towards 151.30. With a downward breakout, a correction in the USDJPY rate could follow, targeting 147.50 (testing from above). Subsequently, a growth wave is expected to develop, aiming for 151.30 and potentially continuing the trend towards 153.22 as the local target.

Summary

The current economic data from Japan, including a decline in machinery orders and a cautious BoJ stance on interest rate hikes, is exerting pressure on the yen, potentially leading to a breakout above the crucial resistance at 149.45. Technical indicators in today’s USDJPY forecast suggest further growth to the 150.22, 151.30, and 153.22 levels.