The USDJPY pair fell to the 140.00 area amid rising trade tensions and Trump’s clash with the Fed’s chair. Find more details in our analysis for 22 April 2025.

USDJPY forecast: key trading points

- Market focus: Trump pushes to remove Federal Reserve Chairman Jerome Powell over delayed rate cuts

- Current trend: trending downwards

- USDJPY forecast for 22 April 2025: 140.50 and 139.58

Fundamental analysis

The USDJPY rate continues its decline, now trading around the 140.00 level amid continued USD weakness, supported by Trump’s threats to remove Federal Reserve Chairman Jerome Powell. Investors are turning to safe-haven assets amid global trade tensions and the possible negative impact of new tariffs on the US economy.

Looking ahead, market attention is shifting to the Bank of Japan monetary policy meeting next week. While no change to the benchmark interest rate of 0.5% is expected, the BoJ may lower its economic growth outlook, reflecting the impact of US trade measures on Japan’s export-driven economy.

USDJPY technical analysis

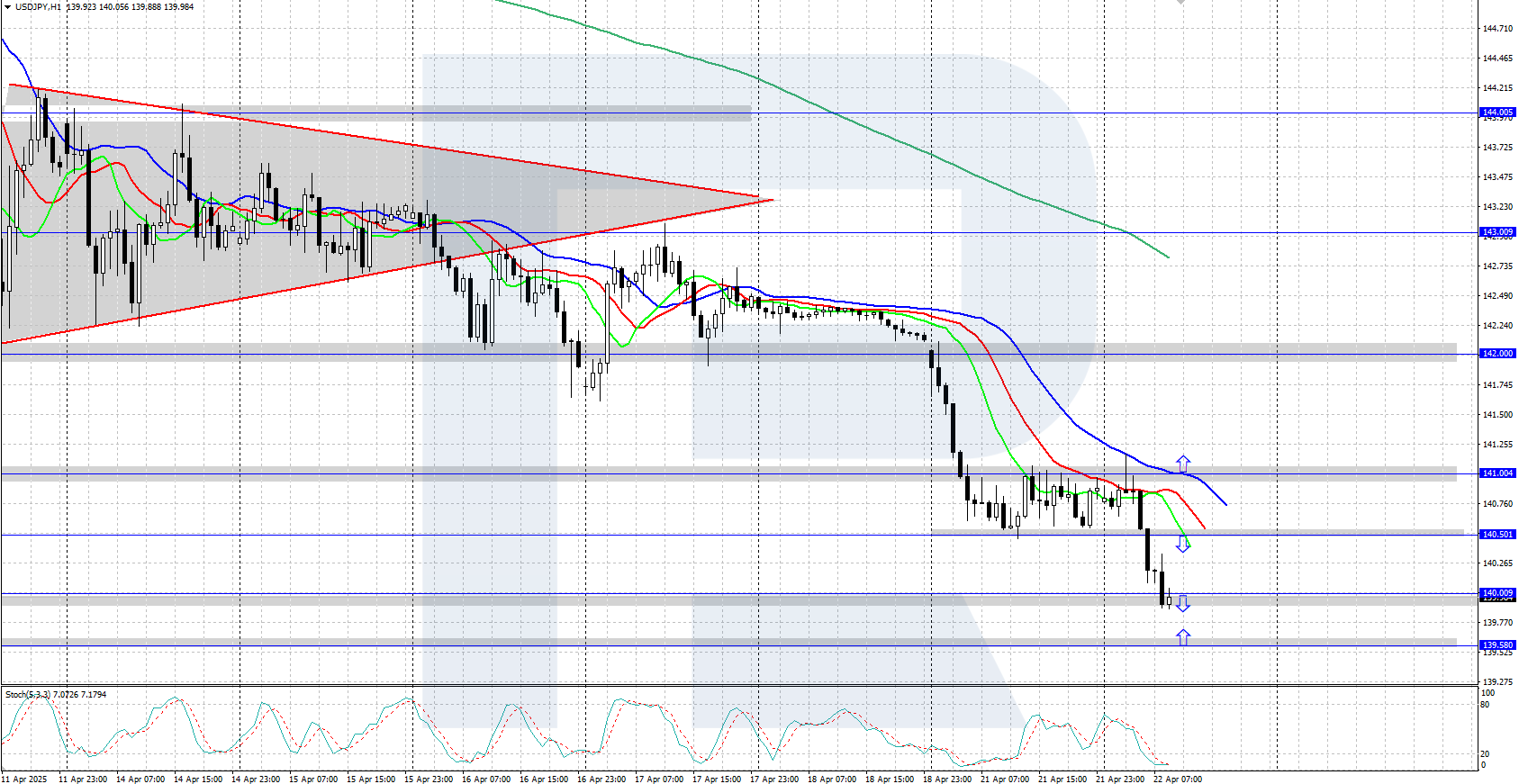

The USDJPY pair continues to trade in a bearish trend, falling to seven-month lows. The Alligator indicator confirms the sustained downward momentum, with the key support level currently at last year’s low of 139.58.

The USDJPY forecast for today suggests that the pair could plunge to 139.58 if bears retain the initiative. However, an upward correction is possible if bulls regain control and push the price above the 141.00 level.

Summary

The USDJPY pair dipped to the 140.00 area amid continued dollar weakness. Market participants are awaiting the results of next week’s Bank of Japan meeting.