The USDJPY rate declined towards 145.00 after US President Donald Trump announced a ceasefire agreement between Israel and Iran. Find out more in our analysis for 24 June 2025.

USDJPY forecast: key trading points

- Market focus: Trump announced a truce between Israel and Iran

- Current trend: moving downwards

- USDJPY forecast for 24 June 2025: 145.00 and 145.77

Fundamental analysis

The Japanese yen strengthened against the US dollar on Tuesday, rebounding from multi-week lows as the US dollar weakened following President Donald Trump’s announcement of a ceasefire in the local conflict between Israel and Iran, which he called a "12-day war".

Domestically, investors remain focused on potential moves from the Bank of Japan. At its June meeting, the central bank kept its key rate at 0.5% but signalled openness to further rate hikes, citing persistently high inflation in the country.

USDJPY technical analysis

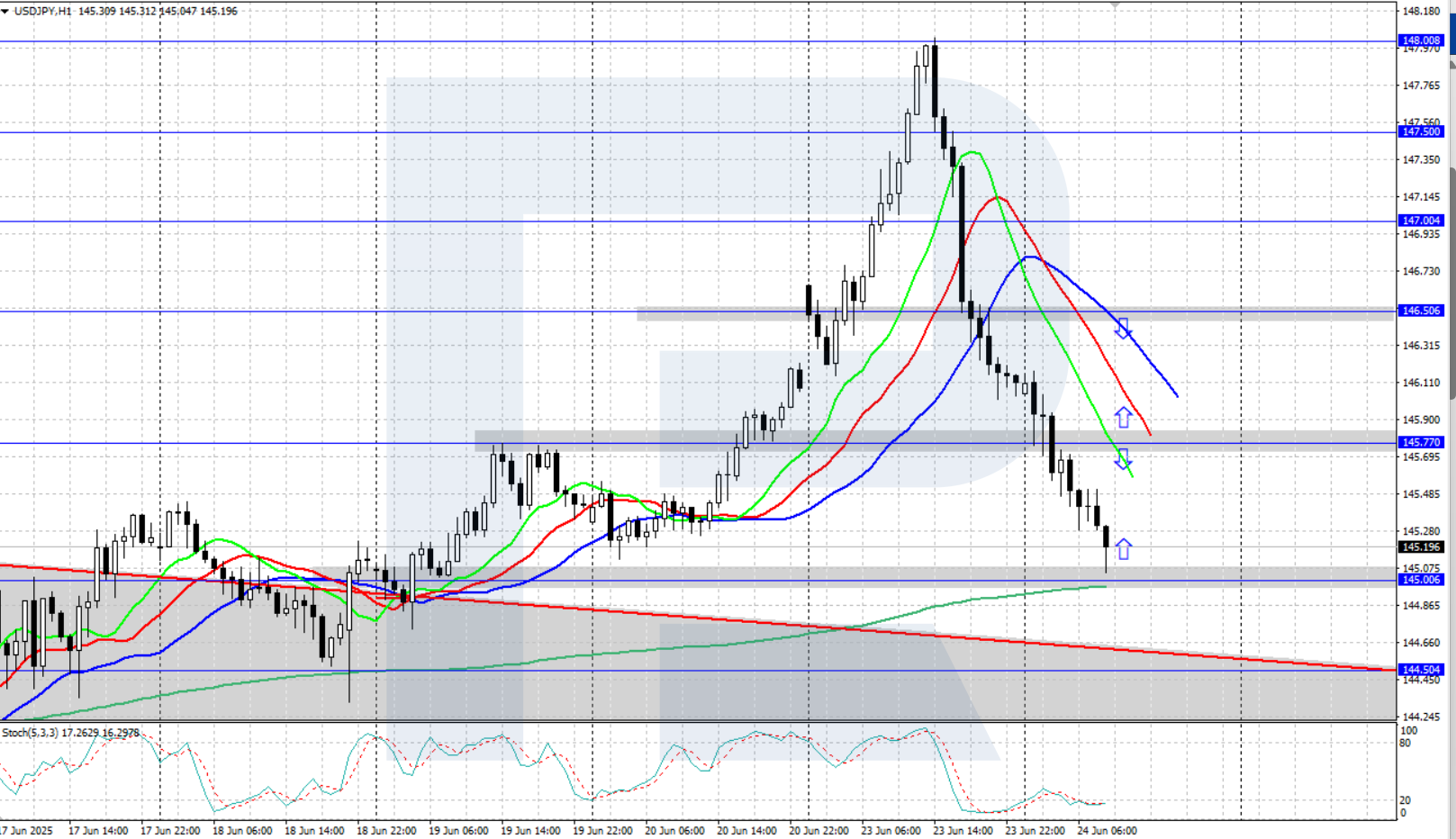

On the H4 chart, the USDJPY pair is heading lower, having reversed from the local daily high at 148.00. The Alligator indicator is moving downwards, confirming the current bearish momentum. The local support level lies at 145.00.

Today’s USDJPY forecast suggests the pair could continue falling towards the 145.00 support level if bears keep control. However, a bullish correction would become possible if buyers push the price back above 145.77, which could open the path for a rise towards the 146.50 resistance level.

Summary

The USDJPY pair has sharply dropped to the 145.00 area amid signs of easing geopolitical tensions in the Middle East. Investors are now watching for the Bank of Japan’s next move on interest rate policy.