The USDJPY rate is recovering after falling for two days. Discover more in our analysis for 28 November 2024.

USDJPY forecast: key trading points

- The Japanese yen has strengthened by over 2.6% in the past two days due to expectations of a monetary policy tightening by the BoJ

- The Bank of Japan’s chief hinted at the likelihood of a December interest rate hike to support the yen

- Market expectations of a 25-basis-point rate hike in Japan stand at 60%

- Analysts expect Tokyo’s core CPI to rise to 2.3% in October

- USDJPY forecast for 28 November 2024: 152.90

Fundamental analysis

The USDJPY rate rises following the bears’ failure to secure a position below the 151.25 support level. The Japanese yen has strengthened by more than 2.6% in the past two days due to expectations that the BoJ may raise the interest rate as early as next month. The US dollar is under additional pressure from a potential Federal Reserve rate cut in December. In addition, key US inflation data aligned with market expectations, signalling no changes in the Fed’s monetary policy.

BoJ Governor Kazuo Ueda had earlier referred to the likelihood of a December interest rate hike, citing the need to support the yen. Market players expect a 25-basis-point rate hike in Japan with a 60% probability, well above the 50% recorded a week ago. Most analysts share these expectations.

Investors are also eagerly awaiting Friday’s release of Japan’s inflation data, which may affect the BoJ’s further actions. Tokyo's core CPI is projected to rise to 2.3% in October from 1.8%, heightening expectations of monetary policy tightening. Against this backdrop, today’s USDJPY forecast shows that the Japanese yen will likely strengthen further.

USDJPY technical analysis

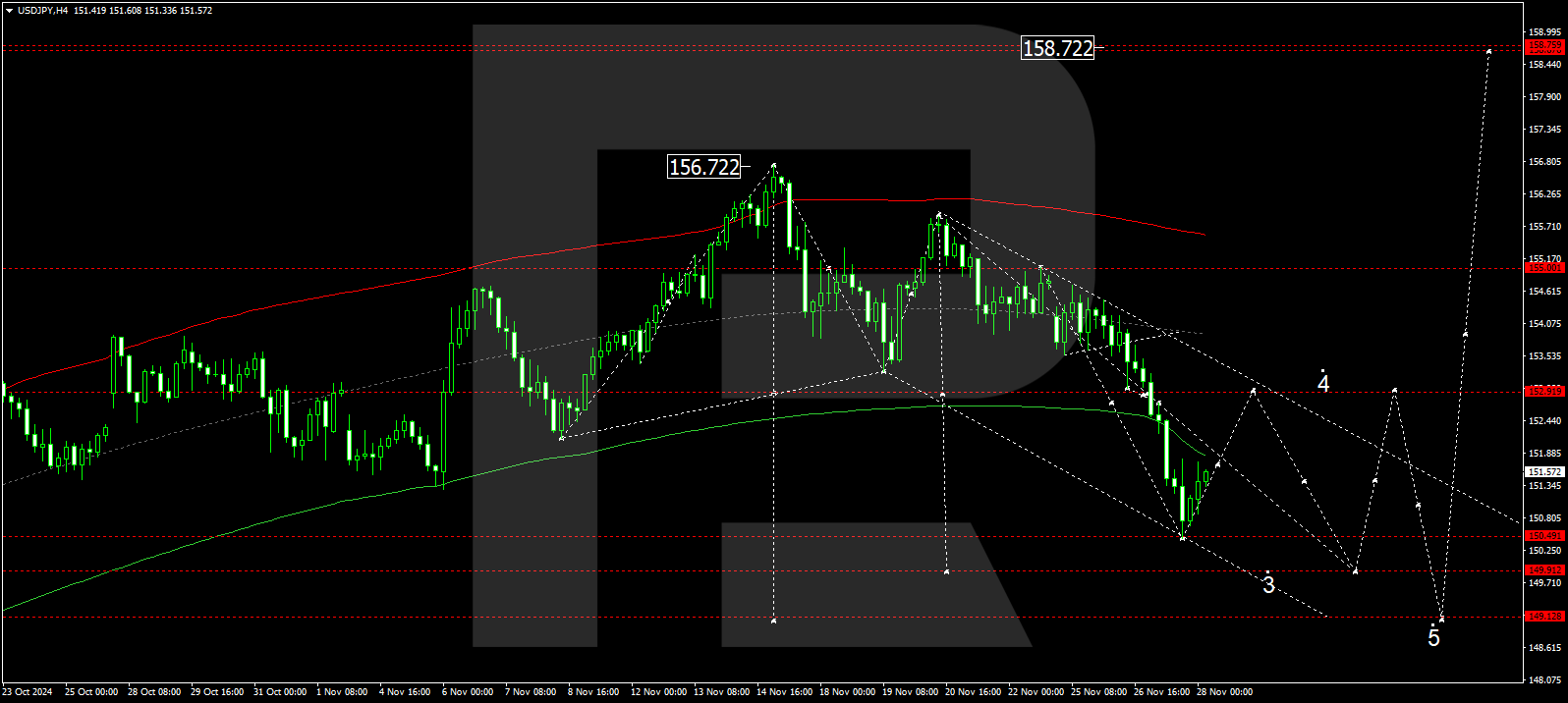

The USDJPY H4 chart indicates that the market has completed a downward wave to the 150.50 level and is now forming a consolidation range above it. The market could break above this level today, 28 November 2024, aiming for 152.90. With a downward breakout, the price is expected to plunge to the local target of 149.90. The market continues to develop a corrective wave. After reaching the local target, the price might rise to 152.50 (testing from below). Subsequently, the wave could extend to 149.12.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.90, technically support this scenario for the USDJPY rate. The market is forming the second half of the third downward wave. Today, the market is at the lower boundary of a price envelope, creating a consolidation range. An upward breakout could drive the price to the envelope’s central line. With a breakout below the range, the price could decline to the envelope’s lower boundary at 149.12 before rising to its upper boundary at 152.90.

Summary

Expectations of a BoJ interest rate hike and the likelihood of Federal Reserve monetary policy easing add to pressure on the US dollar. The Japanese yen may continue to strengthen if Tokyo’s inflation meets forecasts. Technical indicators for today’s USDJPY forecast suggest potential growth to the 152.90 level.