The USDJPY pair is hovering near 142.76 on Thursday. The market is once again seeking safe-haven assets, which supports the yen. Find out more in our analysis for 24 April 2025.

USDJPY forecast: key trading points

- The USDJPY pair halted its two-day rally and may move lower

- Investors are returning to safe havens as the US reiterates its unchanged trade stance

- USDJPY forecast for 24 April 2025: 142.00

Fundamental analysis

The USDJPY rate stabilised around 142.76 on Thursday.

The two-day rally has paused as investors shifted back to safe-haven assets amid renewed trade uncertainty. Market sentiment changed following reports that the Trump administration is considering lowering tariffs on Chinese imports as part of potential negotiations. China also expressed readiness for dialogue but conditioned it on the US ending its ongoing threats.

However, US Treasury Secretary Scott Bessent dampened optimism, stating that formal talks had not yet begun, and there was no proposal from the US to unilaterally reduce tariffs.

Caution is now paramount. The US told the Japanese trade delegation that Tokyo would not receive any special treatment under Washington’s current tariff framework. Thus, the US has ignored Japan’s requests to reconsider its policy.

The USDJPY forecast is negative.

USDJPY technical analysis

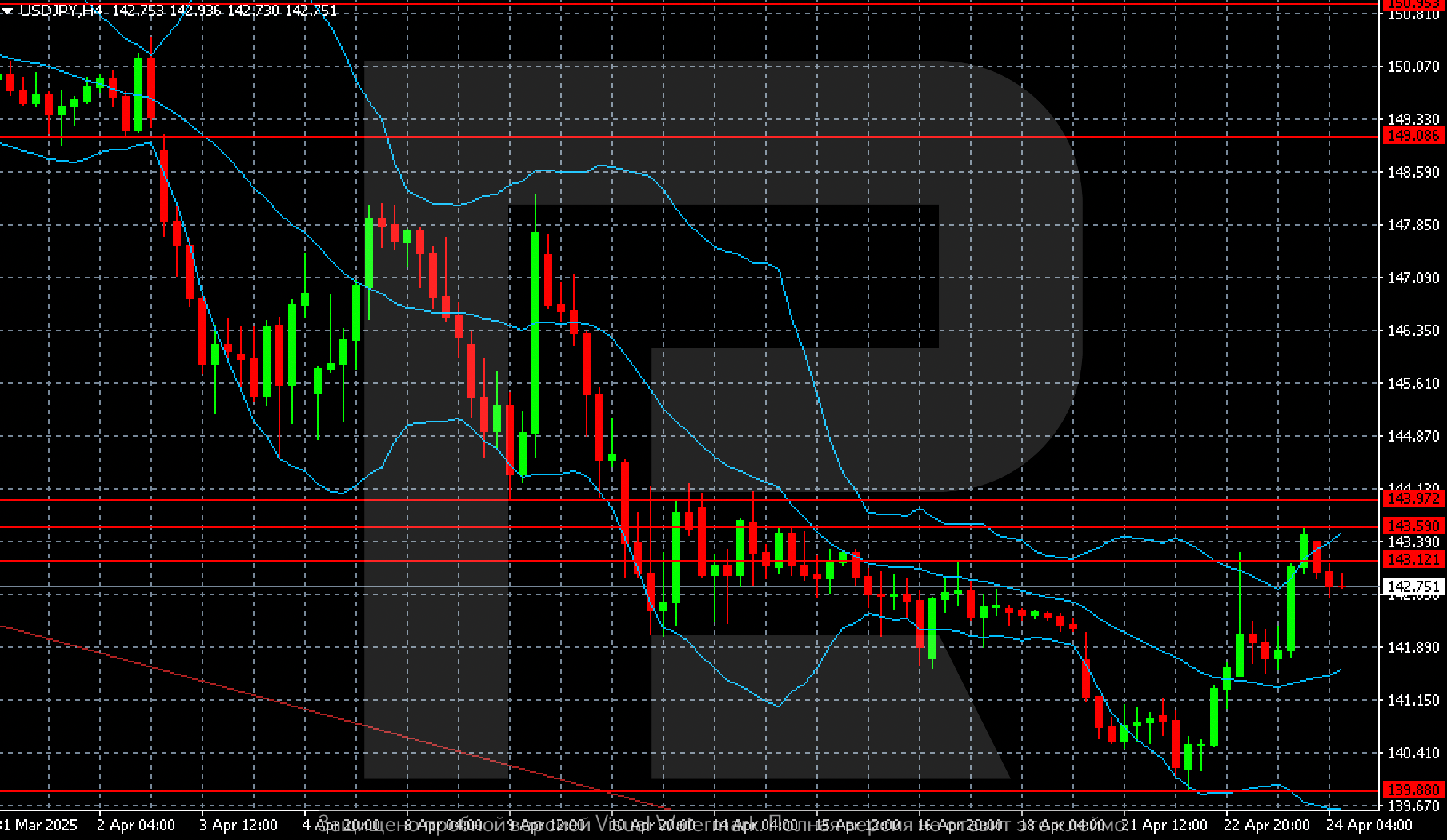

On the H4 chart, the USDJPY pair shows potential for a decline towards 142.00 from the current 142.75.

Strategically, the pair may form a sideways channel between 139.88 and 143.59.

Summary

After two strong sessions, the USDJPY pair began to decline. The Japanese yen has great chances to strengthen again. The USDJPY forecast for 24 April 2025 expects a bearish wave towards 142.00.