The USDJPY pair is trading lower, slipping toward the 152.00 mark amid the signing of a new trade agreement between the United States and Japan and growing expectations of a Federal Reserve rate cut. Details — in our analysis for 28 October 2025.

USDJPY forecast: key trading points

- Market focus: traders await interest rate decisions from the Fed and the Bank of Japan.

- Current trend: short-term downward correction.

- USDJPY forecast for 28 October 2025: 151.00 or 153.00.

Fundamental analysis

The USDJPY pair continues to decline after U.S. Treasury Secretary Scott Bessent urged Japan to pursue a “responsible monetary policy,” criticizing the Bank of Japan’s slow pace of rate hikes during discussions with Japanese Finance Minister Katsuyama about exchange rate volatility.

The Bank of Japan is expected to keep rates unchanged this week, though policymakers are reportedly considering conditions for resuming rate hikes as tariff-related risks ease.

Meanwhile, U.S. President Donald Trump pledged to strengthen U.S.–Japan relations and praised Prime Minister Sanae Takaichi’s plans to increase defense spending during their meeting in Tokyo, where both leaders signed a new trade agreement.

Tomorrow, market attention will turn to the Federal Reserve’s interest rate decision. Investors are almost certain that the Fed will cut rates by 25 basis points following last week’s weaker-than-expected U.S. inflation report.

USDJPY technical analysis

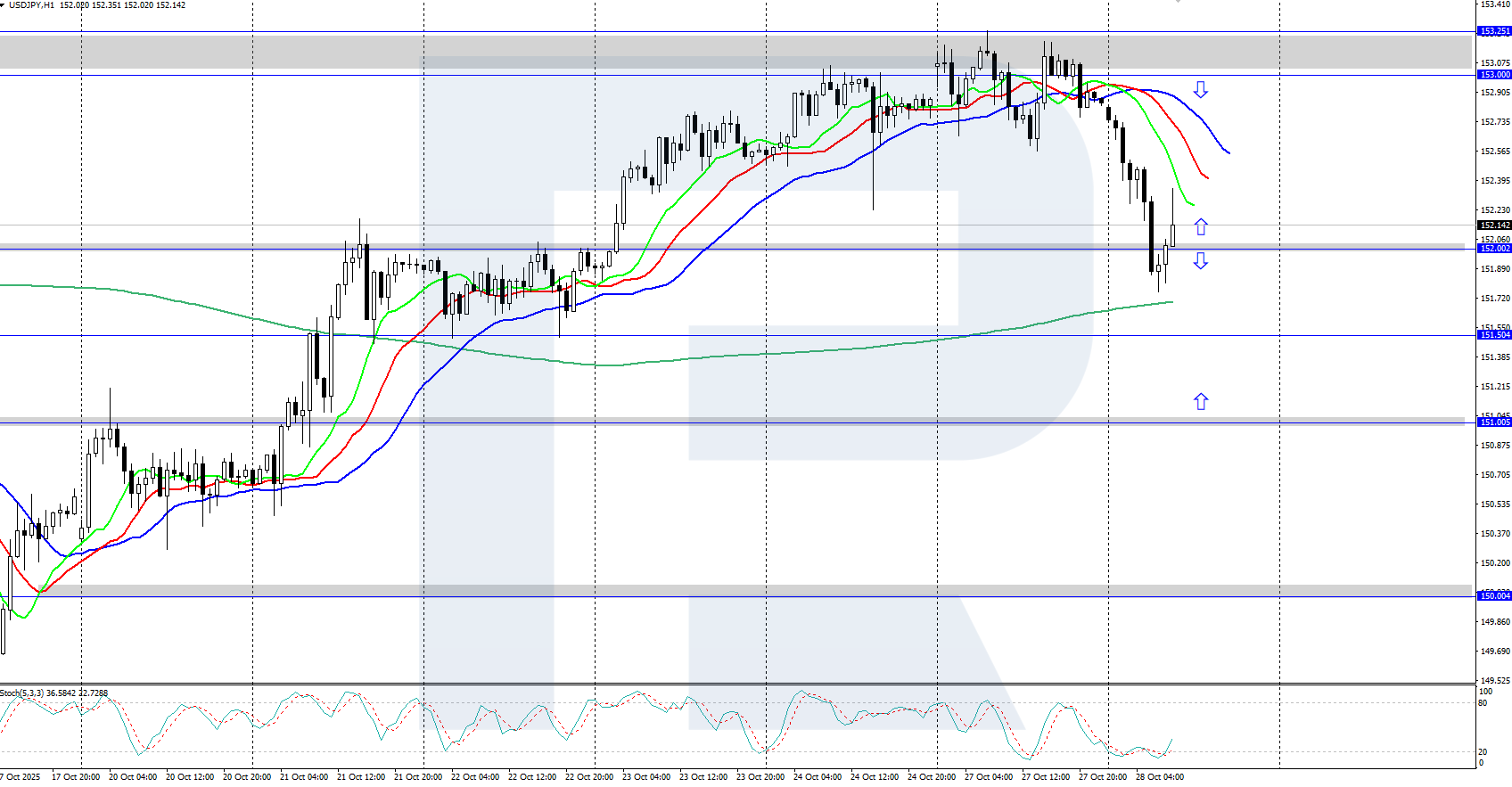

USDJPY remains under pressure within a short-term downward correction. The Alligator indicator has turned lower, confirming the current bearish bias. The nearest support level lies at 151.00, while resistance is located at 152.00.

Today’s forecast suggests that if bears maintain control, the pair could extend its decline toward 151.00. Conversely, a rebound and sustained move above 152.00 would indicate renewed bullish momentum and could push prices back up toward 153.00.

Summary

USDJPY has pulled back to the 152.00 area as markets await the Fed’s rate decision on Wednesday. A confirmed rate cut could fuel further weakness in the dollar, keeping the pair under pressure in the near term.

Open Account