Amid positive US economic data, the USDJPY rate may climb to 157.00. Discover more in our analysis for 16 January 2025.

USDJPY forecast: key trading points

- US industrial production: previously at -0.1%, projected at 0.3%

- US manufacturing production: previously at 0.2%, projected at 0.2%

- USDJPY forecast for 17 January 2025: 157.00 and 155.10

Fundamental analysis

Fundamental analysis for 17 January 2025 indicates that the USDJPY pair has formed a downward wave and tested the 155.10 support level, which marked a monthly low. This was driven by weaker-than-expected US economic data and rising confidence in an imminent BoJ interest rate hike.

Markets estimate the likelihood of a 25-basis-point rate hike at 79%, supported by Japan’s stable annual wholesale inflation of 3.8% in December.

Today, US industrial production data will be released. The forecast for 17 January 2025 suggests the indicator could enter positive territory, coming in at 0.3%, up from the previous -0.1%. Growth in industrial production would support the case for a stronger US dollar.

US manufacturing production for December is forecast to remain at the November level of 0.2%. If the actual data aligns with this projection, it may be considered a positive factor for the USD.

USDJPY technical analysis

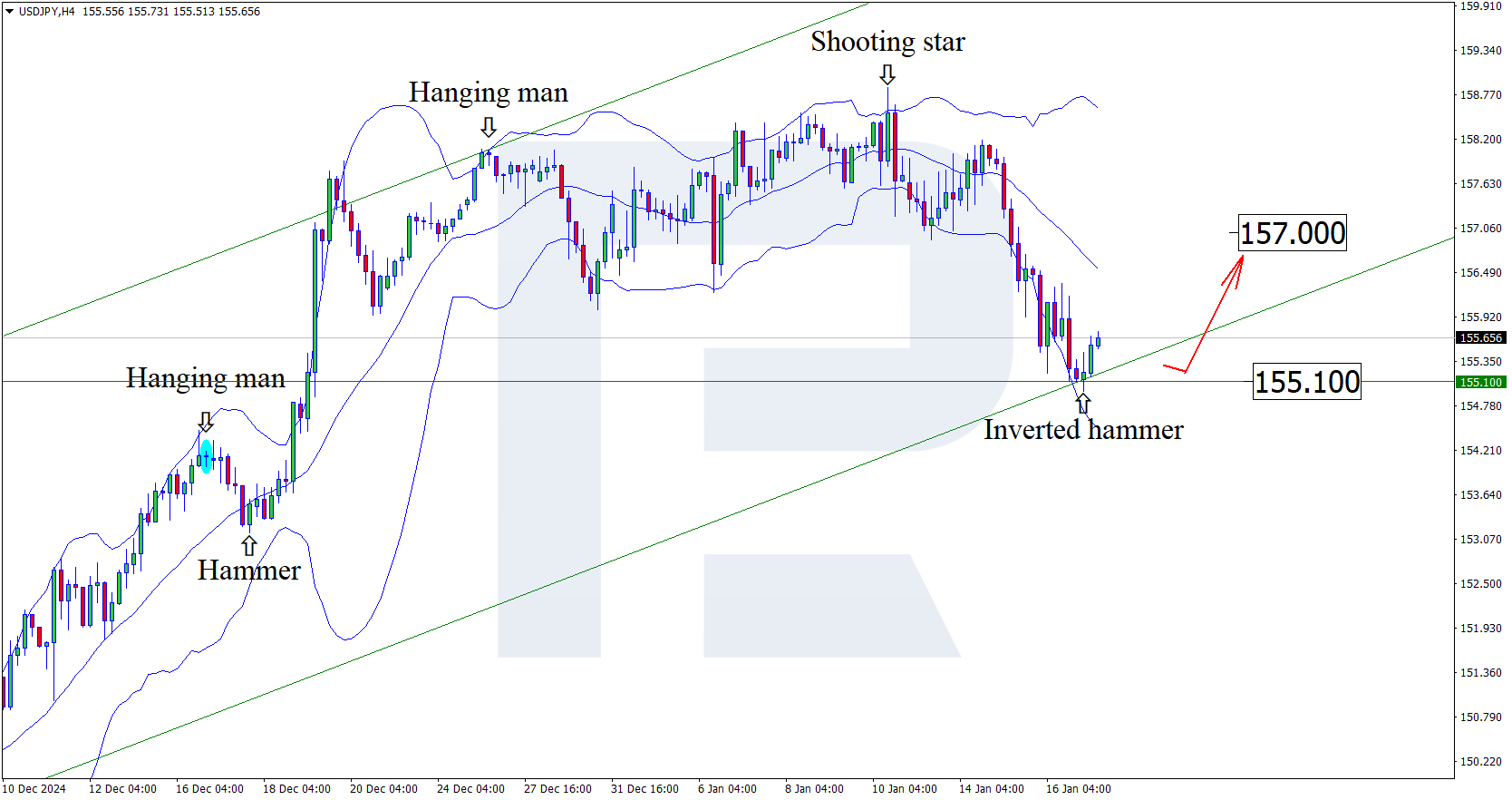

After testing the lower Bollinger band, the USDJPY price formed an Inverted Hammer reversal pattern on the H4 chart. At this stage, it maintains an upward trajectory following the signal from this pattern. Given that the quotes have rebounded from the support level and remain within an ascending channel, the uptrend will likely persist.

The growth target is the 157.00 resistance level. A breakout above this level would pave the way for a more substantial upward wave.

However, an alternative scenario is possible: the price could correct towards 155.10 before continuing its upward momentum.

Summary

With the USDJPY technical analysis, expectations of a BoJ interest rate decision suggest the continuation of the uptrend, potentially reaching new all-time highs.