The USDJPY rate continues to decline in anticipation of the Federal Reserve’s interest rate decision, with the target at 152.88. Find out more in our analysis for 18 December 2024.

USDJPY forecast: key trading points

- Japan’s exports in November: previously at 3.1%, currently at 3.8%

- The US Federal Reserve interest rate decision: previously at 4.75%, currently at 4.5%

- USDJPY forecast for 18 December 2024: 152.92

Fundamental analysis

Fundamental analysis for 18 December 2024 takes into account that Japan’s actual exports rose to 3.8% from the previous reading. For Japan, with its export-oriented economy, this is a positive factor that offers hope for improved economic conditions in the future. At the same time, other fundamentals also exceeded forecasts, increasing the yen’s chances of strengthening temporarily against the US dollar.

The US Federal Reserve will meet today to decide on interest rate changes. The USDJPY forecast for today, 18 December 2024, suggests that the rate may be lowered again, this time to 4.5%. However, the final decision will only be available after the official announcement. Until then, market participants will speculate, relying on indirect data, which creates market uncertainty and increases volatility in US dollar-related instruments.

USDJPY technical analysis

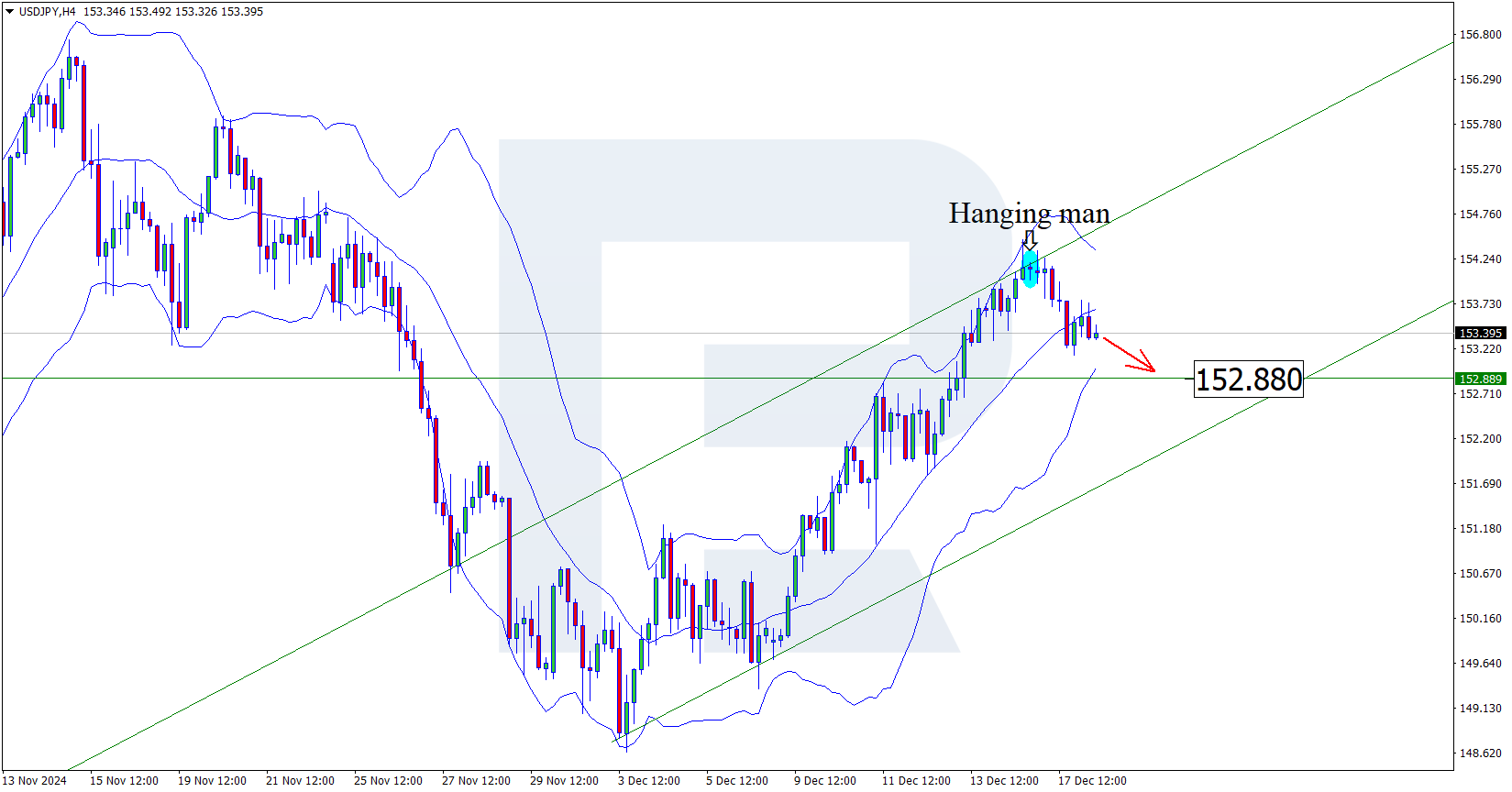

The H4 chart shows that the price formed a hanging man reversal pattern after consolidating at the Bollinger upper band. The price is declining as part of a reversal pattern signal. Since the quotes have also rebounded from the upper boundary of an ascending channel, a further decline appears likely.

At this stage, the 152.88 support level could be the key target. A breakout below this level could lead to a further price decline to the lower boundary of an ascending channel.

However, another scenario is possible: the price might rebound from the 152.88 level. In this case, it could maintain its upward momentum, potentially reaching new highs.

Summary

Combined with the USDJPY technical analysis, Japan’s positive news landscape and expectations of the Federal Reserve’s interest rate decision point towards a further decline to the 152.88 level.