Brent prices are hovering around 64.85 USD on Tuesday as market uncertainty and risk sentiment dominate. Discover more in our analysis for 22 April 2025.

Brent forecast: key trading points

- Brent enters a sideways channel due to expected OPEC+ supply growth and Fed-related uncertainty

- A potential US-Iran deal could increase global oil supply, weighing on prices

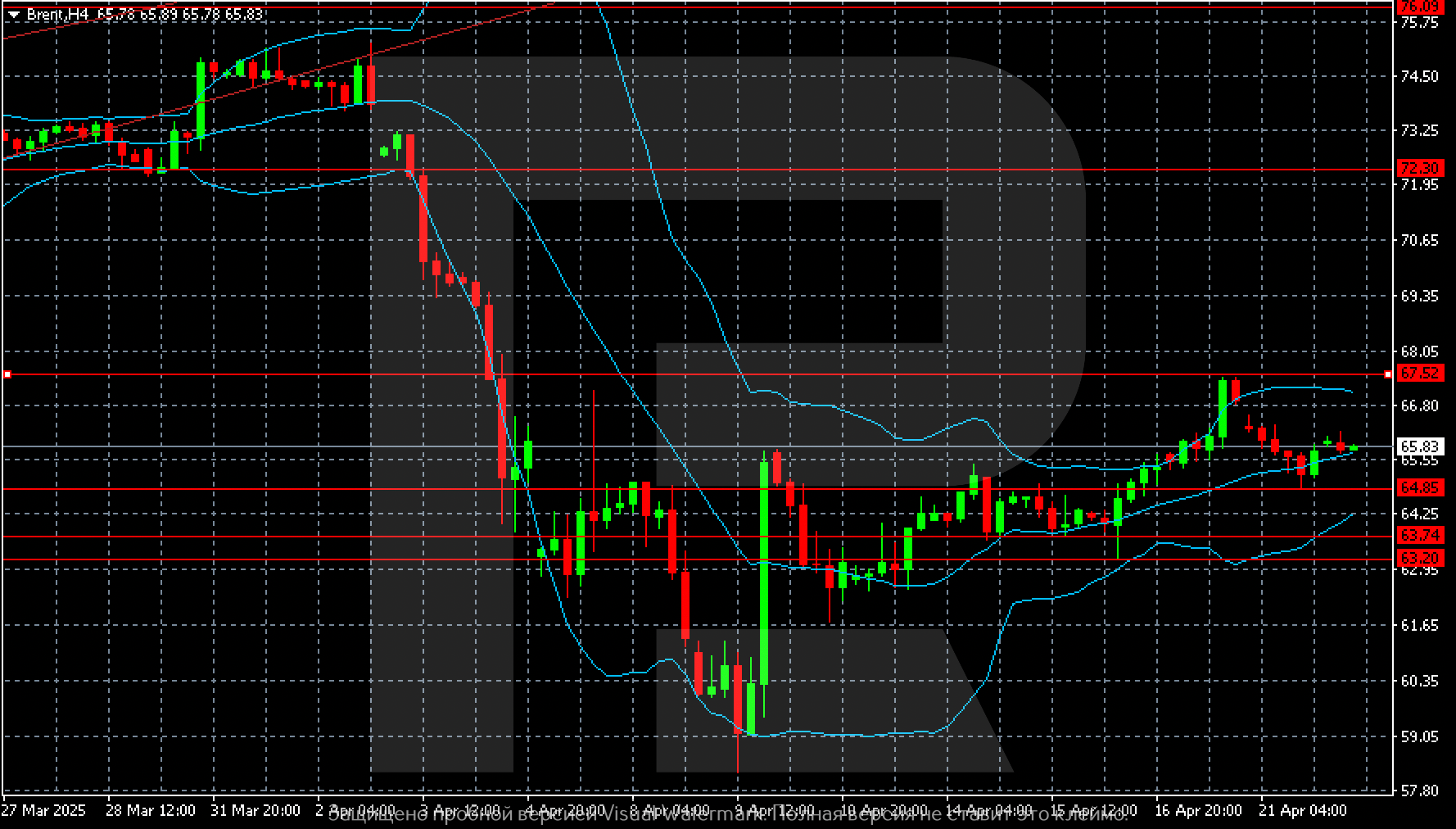

- Brent forecast for 22 April 2025: 63.20-67.52

Fundamental analysis

Brent quotes stabilised near 64.85 USD after falling by nearly 2% at the start of the week. Tuesday’s partial recovery has seen prices regain roughly 1% of that decline.

Investor focus remains on the possible return of Iranian crude to global markets. Negotiations between the US and Iran are reportedly progressing, raising the likelihood of a new deal, a bearish factor for oil due to potential oversupply.

Caution also stems from uncertainty caused by high US tariffs and duties. There are also doubts about the future Federal Reserve monetary policy. All these factors may negatively affect the global economy and reduce oil demand. According to the latest surveys, the likelihood of a US recession within a year is estimated at almost 50%, which is a very high expectation.

Meanwhile, OPEC+ still plans to increase output by 411 thousand barrels per day in May. Although some of that increase could be offset by production cuts among over-quota members, the general trend is negative.

The Brent forecast is neutral.

Brent technical analysis

The H4 chart shows Brent consolidating within a defined sideways channel between 63.20 and 67.52 USD. The lack of fresh drivers and recent technical correction have pushed the market into a flat range.

A breakout below the 64.85 level could trigger a move towards the channel’s lower boundary at 63.20. Conversely, if bulls manage to push prices above 66.00, the next target would be 67.52.

Summary

Brent has recovered slightly after Monday’s drop and is now stabilising. However, external risks remain high. The forecast for Brent for today, 22 April 2025, expects the sideways trading to remain between 63.20 and 67.52 USD.